[ad_1]

The economic affairs department of the finance ministry is studying options, including the possibility of ordering the “approval route” for Chinese foreign portfolio investment (FPI) as well. FPI investors generally buy smaller shares and keep shaking their investment. The government will initiate the steps in consultation with the market regulator. Sebi.

Read also: India changes FDI policy to block the threat of acquisitions of Chinese companies

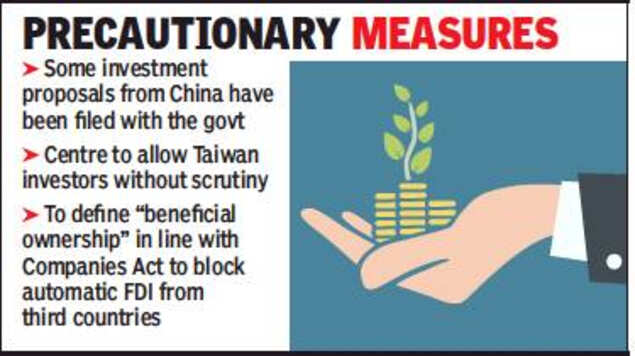

In contrast, FDI is a more stable and long-term source of financing, which the government had recently blocked for Chinese investors through the automatic route and ordered direct investment from countries that share a border with India only allowed with the previous government. approval. Although the move will leave Taiwan’s investment out of the loop, Hong Kong will be covered by the guidelines.

Sources said closing this gap was important as the government wanted to ensure that a group of investors blocked via the FDI route did not use the FPI option to obtain significant ownership in a company. In addition, the Department for the Promotion of Industry and Internal Trade (DPIIT) is seeking to define the “beneficial ownership” of the shares in accordance with the provisions of the Companies Law. Therefore, companies where Chinese citizens own more than 10% cannot escape prior government approval, even if the funds come from a third country like Singapore or the United States.

Under Indian law, there are two definitions of “beneficial owner” with the Money Laundering Prevention Law that is more liberal than the recently notified rules under the Companies Law. Participatory notes, often opaque, are one of the instruments in which the FPI policy must be observed. Amendments to the FDI rules were necessary out of fear among officials and companies about possible attempts by Chinese companies, sitting on piles of cash, of Indian entities where share prices had fallen after the coronavirus outbreak.

Several other countries, from Italy and Germany to Australia and Japan, have established detection mechanisms to block potential takeover bids by Chinese investors, many of whom are suspected to be widespread state weapons. Although Indian authorities started work months ago, People’s acquisition of more than 1% stake Bank of China at HDFC Bank it was seen as one of the triggers for accelerating FDI policy change last month.

.

[ad_2]