[ad_1]

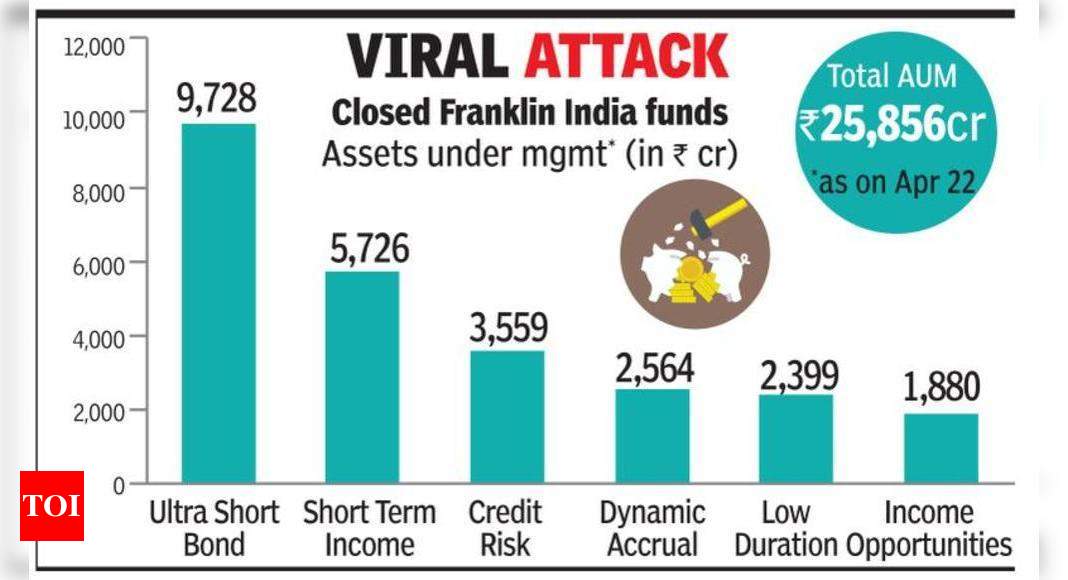

MUMBAI: Franklin Templeton Mutual Fund, one of the leading fund houses in India, has decided to close six of its debt funds, which currently manage almost Rs 25.9 billion rupees in total. The move is due to liquidity problems in the bond market caused by problems related to Covid. This is the first time such an incident has occurred in India.

The funds close is effective on Friday. As a result, all systematic investment plans (SIP), systematic retirement plans (SWP), systematic transfer plans (STP), and all redemptions and entries will stop. The funds are Low Duration Fund, Dynamic Accumulation Fund, Credit Risk Fund, Short Term Income Plan, Ultra Short Bond Fund and Income Opportunities Fund.

Sanjay Sapre, President of Franklin Templeton – India, said that the assets of these six funds will be turned over to an administrator. He added that existing investors can wait a phased payment until all assets are liquidated. The fund house has not given any specific timeline for paying investors in the funds.

“What it means is that people won’t get their money now. Investors will raise money as maturities occur in the portfolios. There is no need to overreact at this time, “said financial adviser Surya Bhatia.

Sapre said the problems were first faced in the Indian debt market in September 2018 after the IL&FS crisis began. Then, current developments related to the pandemic significantly increased illiquidity, which in turn led to the fund house’s decision to terminate the schemes. In the past few weeks, the fund house had been in contact with market regulator Sebi, bank regulator RBI and the government, and talks continued with them, Sapre said.

“The decision to liquidate these funds was extremely difficult, but we believe that it is necessary to protect the value for our investors and we present the only viable means to ensure an orderly realization of the assets of the portfolio. Significantly reduced liquidity in the Indian bond markets for most debt securities and unprecedented levels of redemptions after the Covid-19 outbreak and blockade have forced us to make this decision, ”Sapre said.

In India, as of March 31, Franklin Templeton MF was managing assets worth around Rs 1.16 lakh crore. Globally, its parent managed almost $ 700 billion, that is, nearly 54 rupees rupees at Thursday’s exchange rate. A statement from the fund house said the details of the liquidation process will be communicated to existing investors in these funds, who will continue to publish their net asset values daily. Investors will not be charged any management fees on these funds in the future.

[ad_2]

The funds close is effective on Friday. As a result, all systematic investment plans (SIP), systematic retirement plans (SWP), systematic transfer plans (STP), and all redemptions and entries will stop. The funds are Low Duration Fund, Dynamic Accumulation Fund, Credit Risk Fund, Short Term Income Plan, Ultra Short Bond Fund and Income Opportunities Fund.

Sanjay Sapre, President of Franklin Templeton – India, said that the assets of these six funds will be turned over to an administrator. He added that existing investors can wait a phased payment until all assets are liquidated. The fund house has not given any specific timeline for paying investors in the funds.

“What it means is that people won’t get their money now. Investors will raise money as maturities occur in the portfolios. There is no need to overreact at this time, “said financial adviser Surya Bhatia.

Sapre said the problems were first faced in the Indian debt market in September 2018 after the IL&FS crisis began. Then, current developments related to the pandemic significantly increased illiquidity, which in turn led to the fund house’s decision to terminate the schemes. In the past few weeks, the fund house had been in contact with market regulator Sebi, bank regulator RBI and the government, and talks continued with them, Sapre said.

“The decision to liquidate these funds was extremely difficult, but we believe that it is necessary to protect the value for our investors and we present the only viable means to ensure an orderly realization of the assets of the portfolio. Significantly reduced liquidity in the Indian bond markets for most debt securities and unprecedented levels of redemptions after the Covid-19 outbreak and blockade have forced us to make this decision, ”Sapre said.

In India, as of March 31, Franklin Templeton MF was managing assets worth around Rs 1.16 lakh crore. Globally, its parent managed almost $ 700 billion, that is, nearly 54 rupees rupees at Thursday’s exchange rate. A statement from the fund house said the details of the liquidation process will be communicated to existing investors in these funds, who will continue to publish their net asset values daily. Investors will not be charged any management fees on these funds in the future.