[ad_1]

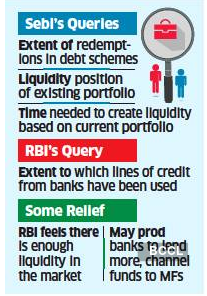

To encourage banks to lend more, the RBI can modify rules that limit the amount it absorbs from banks through the reverse repo window at, say, Rs 2 lakh crore or set a different amount, one person said. close to conversations. The RBI believes there is great liquidity, and banks park Rs 7 lakh crore with it through a reverse repository, the person added.

“RBI officials spoke to banks and fund managers over the weekend to determine readiness to deal with redemptions and liquidity positions,” said one person familiar with the discussions. “There is no liquidity problem for most funds. But one of the suggestions is to encourage banks to lend and buy bonds from companies with investment grade but not triple A. ”

“Credit funds” are a small part

The Securities and Exchange Board of India (Sebi) also sought details of the mutual funds on the extent of the repayments and the liquidity position of the portfolio of their debt plans, three people familiar with the matter said.

Franklin Templeton’s decision to eliminate all six debt schemes and suspend repayments indefinitely raised widespread concern that investors would withdraw from similar product categories across the industry. Sebi wants to know if the mutual funds would be in a position to handle the probable massive redemptions based on their current portfolios.

“The (market) regulator has asked if the funds are facing large repayments, how liquid are their debt fund portfolios and how many days it would take to liquidate the holdings,” said a senior industry official.

The corpus of debt mutual funds is estimated to be around Rs 12 lakh crore with investments ranging from overnight funds to long-term bond funds. Of this, the so-called credit funds, the family that Franklin Templeton froze, make up about Rs 55 billion, according to industry estimates.

An email inquiry to Sebi’s spokesperson on the matter went unanswered.

MFS NITI APPROACH, FINMIN

Mutual funds are also said to have knocked on the doors of Niti Aayog and the finance ministry for measures to contain the consequences. “The problem in the mutual fund industry is limited only to credit funds,” said the second person. “These constitute less than 5 percent of the total amount with debt schemes. So it’s not a big problem for the overall system from now on. ”

Fund houses are looking for a separate loan window, but the RBI believes there is enough liquidity and that it’s just about channeling it. “Already, the reverse repo rate has been reduced to 3.75 percent to make it unattractive for banks to park money with the RBI,” one person said. “That is the first step, and the second could come soon.”

On Friday, the mutual funds switched to cash by selling some highly-rated debt securities in anticipation of bailout pressure in the coming days. Risk aversion in the bond market led to yields expanding 20-30 basis points on Friday, which was higher than normal. Franklin Templeton was forced to stop the redemptions as he had run out of liquid papers after the big outings in the past two months.

The rest of the securities in their portfolios are mainly low-rated papers, which have few buyers in the current market. Industry officials said Franklin Templeton had also exhausted its debt limits with banks for these schemes.

Consultation on loans

RBI’s consultation with the mutual fund industry about their loans is to assess the amount of loans they have taken from banks. In a communication to mutual fund compliance officials on Sunday morning, the Mutual Fund Association of India (AMFI) said the RBI had sought details on the “lines of credit” used by asset management companies and the “lines not withdrawn” by March 31. and on April 24.

Inquiries emailed to RBI and AMFI went unanswered.

Mutual funds can borrow up to 20 percent of their assets from banks for six months to meet redemption and other payment demands. If a fund house has exhausted this limit, Sebi allows you to raise up to 40 percent based on merit.

In February and March, a handful of large mutual funds approached Sebi to improve the debt ceiling after strong outflows of various debt products after financial markets froze due to the Covid-19 pandemic.

Industry officials said these mutual funds, except for Franklin Templeton, did not need to use the higher limits after the RBI injected money into the system through long-term repos (LTRO) operations in March.

“Most of the funds have not used even the 20 percent limit. So there is comfort for now, ”said the CEO of a large fund.

Of the 42 mutual funds, four, including Franklin Templeton, had loans of about Rs 4,427 million as of April 23, according to an AMFI statement.

Assets under the mutual fund industry’s debt schemes were worth approximately Rs 10.3 lakh crore on March 31, 16 percent less than the previous month.

[ad_2]