Updated: September 21, 2020 8:35:13 am

FinCEN’s files contain a 20-page “intelligence assessment” on the mirror network and list 54 shell companies that they say moved billions of dollars annually from Russia through European stock markets to other jurisdictions starting in 2011.

FinCEN’s files contain a 20-page “intelligence assessment” on the mirror network and list 54 shell companies that they say moved billions of dollars annually from Russia through European stock markets to other jurisdictions starting in 2011.

The Financial Crimes Enforcement Network (FinCEN), the US regulatory agency for enforcing money laundering laws, has uncovered a transaction network of a burgeoning money laundering network led by Pakistani national Altaf Khanani, who is also said to have been a key funder for fugitive terrorists Dawood Ibrahim, Suspicious Activity Reports (SARs) filed by Standard Chartered Bank, New York, and investigated by reveal The Indian Express.

These SARs detail the transactions of the Khanani Money Laundering Organization (MLO) and the Al Zarooni Exchange. For decades, Khanani and his MLO moved an estimated $ 14 billion to $ 16 billion annually for drug cartels and terrorist organizations such as al-Qaeda, Hezbollah, and the Taliban.

Read also | FinCEN Archives – One More Veil Lifted: Suspicious Indian Banking Transactions Red Flagged to US Top Regulator

On September 11, 2015, Khanani was arrested at the Panama airport following a transcontinental sting operation and incarcerated in a Miami prison. His detention ended in July 2020 and he was to be turned over to U.S. immigration authorities for deportation. It is unclear whether he has been deported to Pakistan or the United Arab Emirates.

Khanani’s relationship with Dawood Ibrahim was documented by the U.S. Office of Foreign Assets Control (OFAC) when it issued the sanctions notice against him after his arrest.

Issued on December 11, 2015, the notice read: “Khanani MLO exploits its relationships with financial institutions to funnel billions of dollars around the world on behalf of terrorists, drug traffickers and criminal organizations … Altaf Khanani, the director of Khanani MLO, and Al Zarooni Exchange have been involved in the movement of funds for the Taliban, and Altaf Khanani is known to have had relationships with Lashkar-e-Tayiba, Dawood Ibrahim, al-Qaida and Jaish-e-Mohammed. “

Khanani’s arrest was seen as a breakthrough by Indian intelligence agencies given the connection to Dawood Ibrahim and the fact that Lashkar-e-Toiba and Jaish-e-Mohammed had been specifically mentioned by OFAC as terrorist organizations funded by he.

Read also | FinCEN Archives: Bank Reported Fraud, UK Link of IPL Team Sponsor

Incidentally, one year after the original sanction notice, OFAC, on October 10, 2016, sanctioned another list of individuals and entities for their ties to Khanani MLO. The individuals included members of the Khanani family, most operating out of Pakistan, and various entities that “support” the money laundering ring.

Headquarters of FinCEN, America’s leading financial watchdog, in Virginia. (Source: Scilla Alecci / ICIJ)

Headquarters of FinCEN, America’s leading financial watchdog, in Virginia. (Source: Scilla Alecci / ICIJ)

The list of entities is led by Dubai-based Mazaka General Trading LLC, and four years after the sanctions were imposed, the FinCEN Archives expose the extent of the Khanani MLO’s financial infiltration through this company, as well. as well as others related to the aforementioned. as “Moscow Red Mirror”.

Mirror trade is an “informal value transfer mechanism through which an individual or company buys securities in one jurisdiction and sells them in another without financial gain, thus concealing the original source and final destination of the funds.”

Read also | FinCEN Archives – Revealed: How Jindal Steel sent funds overseas and obtained them in the same period

FinCEN’s archives contain a 20-page “intelligence assessment” on the mirror network and list 54 shell companies that they say moved billions of dollars annually from Russia through European stock markets to other jurisdictions starting in 2011.

FinCEN’s intelligence report says that Mazaka General Trading LLC received $ 49.78 million from five Moscow Mirror Network entities between March 2013 and October 2016. Mazaka also received funding from Singapore-based Ask Trading PTE , through mirror operations.

Significantly, OFAC sanctioned Mazaka for having “materially aided, sponsored, or supported the Khanani Money Laundering Organization, which launders illicit funds for terrorists, drug traffickers and criminal organizations …”

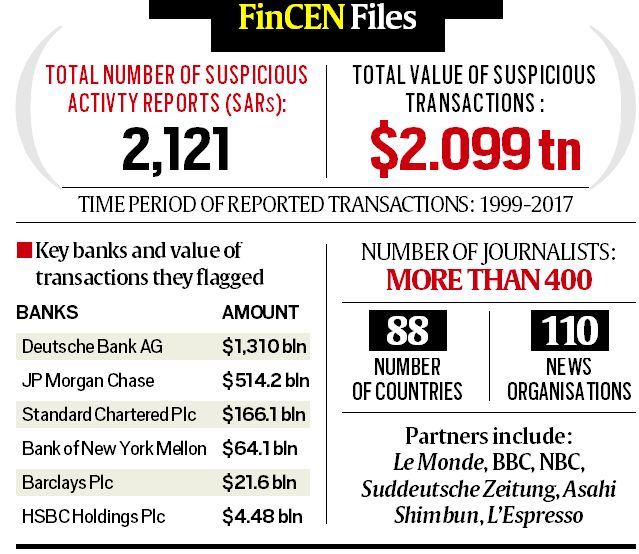

Read also | Swiss Leaks, Panama Papers, now SAR: Bank Reports Alerting Law Enforcement

This is also where ties with India emerged in the running of the Altaf Khanani laundering operation. In addition to JP Morgan Chase Bank (New York) and United Overseas Bank (Singapore), the records show the Dubai branch of the Bank of Baroda that was being used by Mazaka General Trading LLC for transactions with Ask Trading PTE.

In addition to this, a scrutiny of Mazaka General Trading’s transactions shows that it dealt with a New Delhi-based company, Rangoli International Pvt Limited. This company, dedicated to the wholesale trade and export of clothing, was created in 2009.

FinCEN files have around 70 transactions listed for Rangoli International, mostly with entities based in the UAE and remittances are sent through various Indian banks: the National Bank of Punjab, the Central Bank of India, the Oriental Commerce Bank, the Corporation Bank, the Vijaya Bank and Bank of Maharashtra.

There are 17 originators of these transactions for a total of $ 10.65 million. Among them is a transaction dated June 18, 2014 with Mazaka General Trading for $ 136,254 sent through the National Bank of Punjab.

Registrar of Companies (RoC) records show that Rangoli International witnessed a sharp deterioration and decline in profitability in the year ending March 2014 and incurred a loss of Rs 74.87 crore on sales revenue of Rs 339.19 crore. The company has not held an annual shareholders’ meeting since 2015, the year in which it also presented its latest balance sheet.

Several banks have issued alerts on Rangoli’s default. The Bank of Maharashtra listed Rangoli as intentional defaulters in February 2020. The Union Bank of India issued a real estate electronic auction notice in July 2020 for partial debt recovery. The Corporation Bank published a public notice for the auction of the company’s real estate for loan recovery in October 2019. The Punjab National Bank included the company in electronic auctions of mortgaged properties in November 2019 and April 2016. Allahabad Bank listed the company as one of its Top 50 Doubtful Assets in March 2015.

When contacted, Mel Black, Altaf Khanani’s lawyer, told the ICIJ media partner Süddeutsche Zeitung: “Mr. Khanani pleaded guilty and served a long sentence, during which his brother died and was separated from his family. You are in poor health. He is financially destitute and his ability to earn money is destroyed by an OFAC designation being blocked and his accounts being frozen. You have not been involved in any commercial activity of any kind for five years. He hopes to move on in a simple, law-abiding life. “

When asked for their comments, Luv Bhardwaj, Managing Director of Rangoli International, said: “To the so-called ‘around 70 transactions relating to Rangoli International from the years 2013-2014’ that you refer to in your inquiry, for which we have no data because answering anyway would be a paradox. “

“We have been in the business of exporting ready-made garments and receiving payments for the proceeds from the sale of our exported products is as routine as possible … In your specific inquiry of a receipt of June 18, 2014 in our account of the National Bank of Punjab, we would like to formally confirm that our bank account (more specifically, that of National Bank of Punjab) has no receipts as of the mentioned date you mention … However, we have received a remittance of USD 1.36,280 on June 20, 2014 and that corresponds to our bill … to M / s Mideast Star Impex FZE. The shipment containing ready-made garments was shipped after customs clearance on 9/17/13. Our bank has received this remittance; to which it has recognized the Value Date as June 16, 2014. After adjusting to our LC limit, it credited the balance to our account on June 20, 2014, ”said Bhardwaj.

“We do not have business operations or relationships with the mentioned Mr. Mazaka General Trading and / or Mr. Altaf Khanani, nor do we know each other,” he said.

📣 The Indian Express is now on Telegram. Click here to join our channel (@indianexpress) and stay updated with the latest headlines

For the latest news exclusive to Express, download the Indian Express app.

.