You will necessarily need a FASTag for your car if you are on a road trip and crossing the toll plazas on Indian National Roads, as of January 1. This confirmation comes from the Union Minister of Transport for Road, Highways and MSMEs, Nitin Gadkari, who has said that FASTags would be mandatory to pay at toll plazas and would allow contactless and electronic payments for toll payments. We have been seeing a push from the government which also tried to make this mandatory late last year and then extended that deadline until early 2020. Right now, several banks are issuing FASTags including HDFC Bank, Axis Bank, ICICI Bank , Kotak Bank, Paytm Payments Bank, and IDFC First Bank, to name a few. It is also worth noting that the FASTag payment option is enabled at more than 720 toll plazas on Indian national highways.

But what exactly is a FASTag? NETC, or National Electronic Toll Collection FASTag, works with electronic payment systems that have been developed by the National Payments Corporation of India (NPCI) and uses RFID technology to automatically collect payments without the vehicle having to stop or you. have to pay in cash. A FASTag is a sticker that is attached to your car’s windshield, from the inside. This is radio frequency identification (RFID) enabled via barcode and is linked to your vehicle registration details. That information is stored in the barcode itself. When you drive through any toll plaza on any Indian national highway, there will be dedicated lanes that will have FASTag readers installed on the roof; and when your vehicle passes under them, your vehicle’s RFID code will be detected, processed and the necessary toll amount calculated. deducted from prepaid balance. All this without you having to stop, interact with a human being at a toll plaza and have to pay in cash.

What is the advantage of a FASTag? In accordance with the 2008 National Road Tax (Rate Determination and Collection) Rules, there are lanes in toll plazas reserved exclusively for FASTag users. You enter that lane, the rooftop readers detect the FASTag, the payment goes smoothly, and you’re on your way. The process is so fast that you don’t need to stop. The government’s push towards automated digital payments at toll plazas across India has several fronts. An advantage is the reduction of cash handling by the concessionaire and the authorities that administer the toll plazas to allow greater transparency in the system. It is also expected to reduce the rush and wait times at toll plazas, which are often due to cash charges, people trying to find the exact change, or sometimes even discussions about the exact amount of the toll. And lastly, the less time you spend in a toll plaza, the less fuel you waste just sitting there in a queue and that reduces pollution too.

How can I buy a FASTag? You have multiple options here. If you need to buy a FASTag for your car, you can buy one at certain toll plazas across India, taking your ID and vehicle registration documents with you. This is a mandatory KYC process. Or, and this could perhaps be simpler as well, you could buy one on Amazon.in or approach certain banks, including payment banks, to get these FASTags. Banks that currently offer FASTags include HDFC Bank, ICICI Bank, State Bank of India, Kotak Bank, Axis Bank, and Paytm Payments Bank, to name a few.

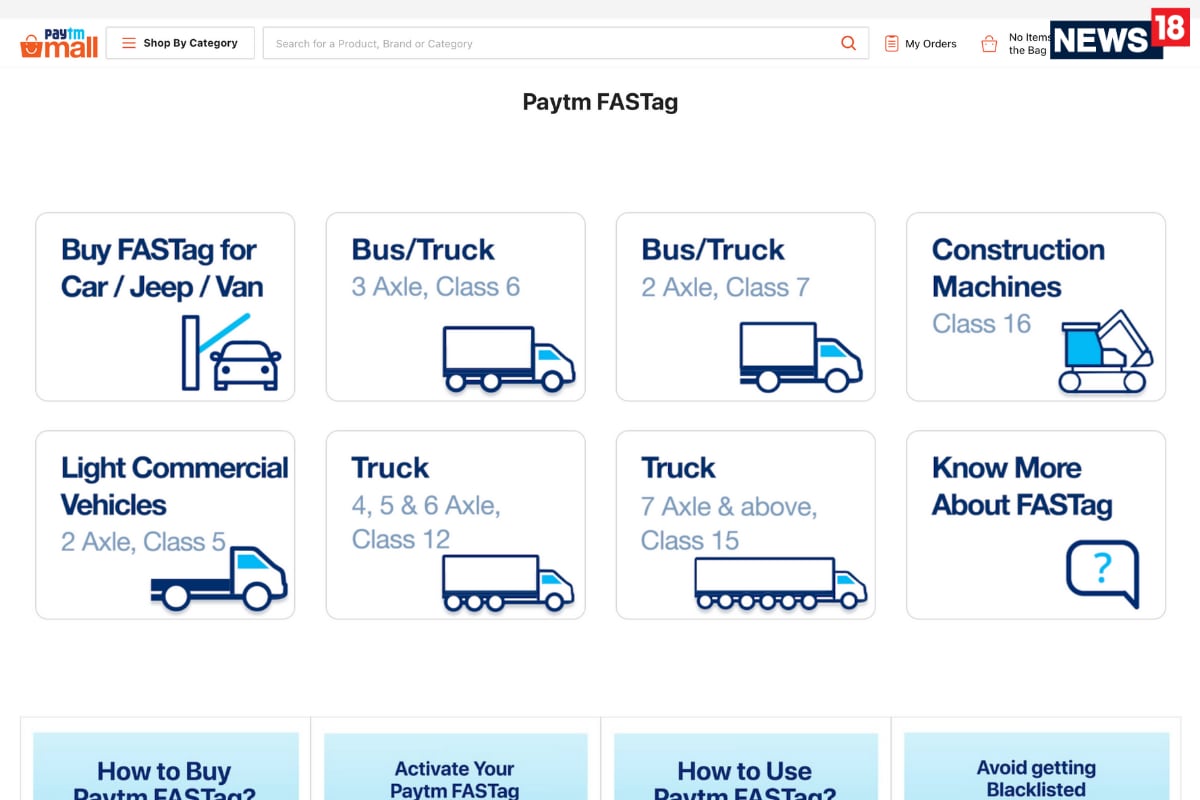

What is the cost of buying a FASTag? The cost of buying a FASTag depends on two things. First, the kind of vehicle you are buying it for: a car, jeep or truck, or a bus or truck, light commercial vehicles, construction machines, etc. Second, the bank where you are buying the FASTag will have its own policies regarding the issuance of fees and security deposits. Right now, for example, you can buy a FASTag for a Paytm car for Rs 500; this includes a refundable security deposit of Rs 250 and the minimum balance threshold of Rs 150 that must be maintained. If you buy it from ICICI Bank, you will pay a tag issuing fee of Rs 99.12 plus Rs 200 as a deposit amount and Rs 200 as a minimum balance. There are small price differences, but in most cases, banks also combine some offers or rebates with the purchase of a new FASTag.

How can I recharge a FASTag? Very simple, there are two options for you. First is to use the FASTag wallet created by the issuing bank and recharge it through Internet banking, credit or debit cards or UPI, depending on the options offered by the bank. Second, you have mobile wallet apps like Paytm and PhonePe that allow you to top up just about any FASTag from the issuing bank. The last option is much simpler and more intuitive, because the quality of the wallet options currently offered by most banks is not really up to par.

What is the validity of FASTag? A FASTag is valid for a period of 5 years from the date of issue. The recharge you carry out for the FASTag account has no validity and may remain active in the wallet for the entire duration of FASTag.

.