Updated: November 30, 2020 2:10:17 pm

People load sacks of cement onto a truck outside a warehouse in Calcutta’s Chitpur area (Photographer: Arko Datto / Bloomberg)

People load sacks of cement onto a truck outside a warehouse in Calcutta’s Chitpur area (Photographer: Arko Datto / Bloomberg)

According to official data released last Friday, India’s gross domestic product (GDP) contracted 7.5% during the quarters of July, August and September. This means that in the second quarter of 2020-21 India produced 7.5% less goods and services compared to what India produced in the second quarter of 2019-20.

In the process, the Indian economy has formally entered a technical recession because, along with the contraction of nearly 24% in the first quarter, India has had two consecutive quarters in which the rate of GDP growth has slowed.

However, the 7.5% drop data has been met with general applause. That’s counterintuitive, but not without justification. For one thing, the 7.5% figure is decidedly lower than most street estimates.

Furthermore, this sharper-than-expected economic “recovery”, so to speak, has substantially changed the way the Indian economy is viewed. The 23.9% drop in GDP in the first quarter was one of the worst among the world’s major economies. But the 7.5% contraction is better than the world average. According to an analysis by the State Bank of India research team, 49 countries have reported GDP data for the July-September quarter. The average decline for these 49 countries is 12.4%. In comparison, 7.5% of India looks much better. In the previous quarter, that is, April, May, June, the average of these 49 economies was minus 5.6%, while India contracted almost 24%.

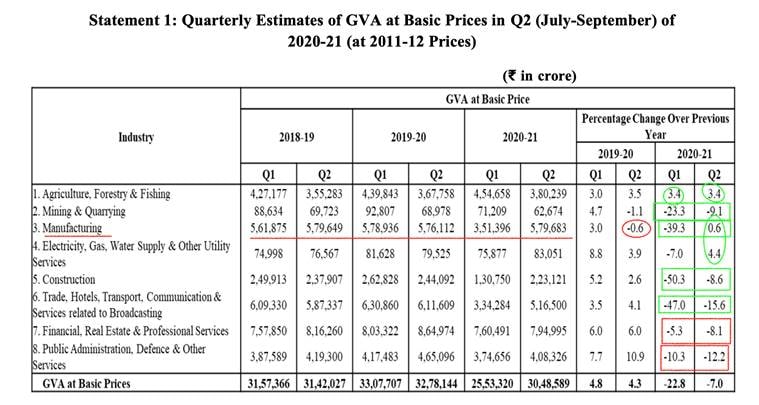

The second conclusion is that the economic recovery is fairly broad based. To understand this, one must look at gross value added (GVA) data rather than GDP data. The GVA data provide a measure of national income by looking at the value added by different sectors of the economy in that quarter. If you want to compare which parts of the economy improved production and revenue from quarter to quarter, GVA is more suitable.

Look at the last two columns of Statement 1 (from the government press release) alongside. They show the percentage variation of the GVA of each sector with respect to the same quarter of the last fiscal year (2019-20).

Opinion | With better-than-expected second-quarter figures, the economy could deliver a positive surprise

Statement 1: Quarterly estimates of GVA at basic prices in the second quarter

Statement 1: Quarterly estimates of GVA at basic prices in the second quarter

First, compared to a single sector that added positive value in the first quarter, three sectors added positive value in the second quarter. These were agriculture, manufacturing, and utilities (highlighted in green circles).

Additionally, in three of the remaining five sectors, the rate of decline slowed, highlighted in green boxes.

The third conclusion is in the form of a warning. The most surprising aspect of the second quarter data is the positive growth, albeit a meager 0.6%, recorded by India’s manufacturing industry. Part of this can be explained by a weak base – see minus 0.6% in Q2 2019-20.

But even so, most analysts are amazed at how India’s manufacturing companies managed to add value in such difficult times. Especially since other markers of said industrial activity performed quite badly during the same period.

The Industrial Production Index, for example, is highly correlated – almost 0.90 – with the GVA of the manufacturing sector, and yet “this correlation collapsed in the second quarter when the manufacturing IIP decreased by 6.7% (average of July / August / September) while the manufacturing GVA grew 0.6% ”, affirms an SBI research report.

“We believe a possible reason for this could be the stellar corporate GVA numbers in the second quarter due to a massive cost purge. In addition, we observe that small companies, with a turnover of up to 500 million rupees, are more aggressive in reducing costs, showing a reduction in the cost of employees by 10-12%, ”he further states.

In other words, companies increased their revenue not by selling more, but by relentlessly shedding employees. This, in turn, could undermine future demand.

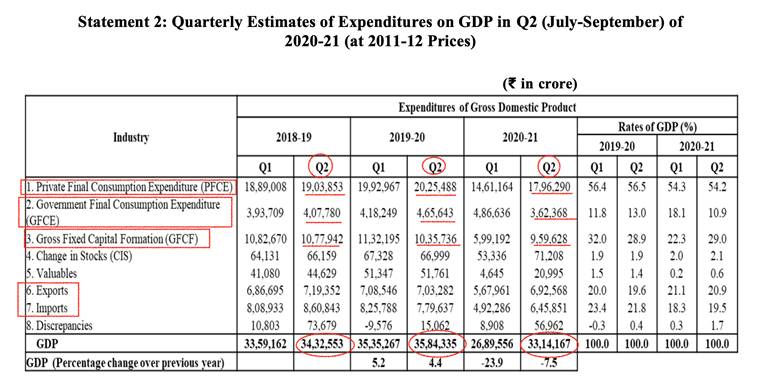

Speaking of lack of demand leads us to the fourth conclusion. If we turn to the GDP data (see Statement 2), which measures national income from the perspective of who demanded (spent) how much in a particular quarter, we find that all the growth engines were running well below normal.

Don’t miss Explained | Term insurance: dividing your plan can optimize both coverage and cost

Statement 2: Quarterly estimates if spending on GDP in the second quarter

Statement 2: Quarterly estimates if spending on GDP in the second quarter

All four engines are highlighted in red boxes. The PFCE refers to what you and I spend on our consumption and this is the engine in greatest demand. This expenditure of Rs 17.96 lakh crore was reduced by 11% in the second quarter compared to the second quarter of 2019-20. The GFCF refers to the demand generated by the investments made in the economy by companies / companies, both large and small. This component is the second largest growth engine and, at Rs 9.59 lakh crore, it was 7% less than in Q2 2019-20.

Both exports and imports have declined but imports have declined relatively more than exports and, as such, net exports have improved marginally. But while this provides a boost to aggregate demand in a relative sense, such a steep drop in import demand does not bode well for a growing economy like India.

However, the worst news is that the GFCE or government spending in the second quarter was reduced by more than 22% compared to the same quarter of the last financial year. This underscores the point that various critics have made in the past: that the government is not spending enough to fuel economic recovery.

As a result, real GDP for the second quarter in absolute terms is lower than two years ago.

However, the second quarter GDP data, which is the last release of its kind before the Union budget is released on February 1, points to a trend where India is likely to witness a rate of Positive growth in “nominal” GDP already in the third quarter, which is Ongoing.

That brings us to the fifth key takeaway from this round of GDP data: the importance of nominal GDP, especially from the point of view of India’s next budget.

Let me explain.

Throughout this analysis, we have talked about real GDP (and GVA). In other words, GDP calculated at constant prices (that is, the prices that prevailed in 2011-12). Or, more simply, GDP once the effect of inflation has been removed.

Removing the effect of inflation from “nominal” GDP helps provide the “real” picture of an economy. For example, if prices increased 10% from year to year, even without any increase in the total number of things produced in an economy, the nominal GDP growth rate would be 10%. But the nominal growth rate hides the fact that not a single real thing was added in the second year.

But there is a crucial aspect in which nominal GDP trumps real GDP: in the real world we inhabit, what we observe is nominal GDP (that is, GDP calculated at current prices). The so-called “real” GDP is derived data. It is determined by taking the growth rate of nominal GDP and subtracting the inflation rate. So if the observed nominal GDP is 12% and the inflation rate is 4%, economists quickly derive the growth rate of “real” GDP as 8%.

More importantly, when the government makes its Budget for next year, as it is already happening, it bases all its calculations – its projected tax collections, its expenditures, its deficits – on nominal GDP.

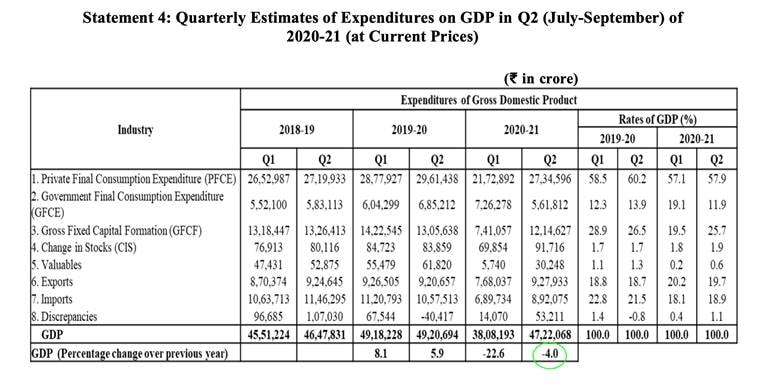

Statement 4 of the government press release shows the absolute level and growth rate of nominal GDP. As you can see, the nominal GDP growth rate was just minus 4% in the second quarter. Together with an inflation rate (called the GDP deflator) of 3.5%, we obtain a real GDP growth rate of minus 7.5%.

Don’t miss Explained | Moratorium on Lakshmi Vilas Bank: What does it mean for depositors, financial sector?

Statement 4 of the government press release shows the absolute level and growth rate of nominal GDP.

Statement 4 of the government press release shows the absolute level and growth rate of nominal GDP.

Most experts now expect that for the fourth quarter, the nominal GDP growth rate will rebound so far that even after subtracting the inflation rate, India would record positive real growth at least in the fourth quarter.

But it is important to note that Finance Minister Nirmala Sitharaman, as well as her predecessor, Piyush Goyal, repeatedly erred in their assumption of nominal GDP growth. This has resulted in massive variance between budget estimates and revised estimates, or poor “fiscal targeting.”

The robustness of the Ministry of Finance’s assessment of India’s nominal GDP growth rate in 2021-22 is critical to the credibility of the upcoming budget figures.

Stay safe.

Udit

Don’t miss Explained | What is driving concerns about the growth of the Indian economy?

© IE Online Media Services Pvt Ltd

.