[ad_1]

The measures, announced as part of the government’s Rs 20 lakh crore economic stimulus package, aim to increase available cash and ease liquidity pressure facing people due to the ongoing national blockade to combat the spread of the deadly pandemic of coronavirus.

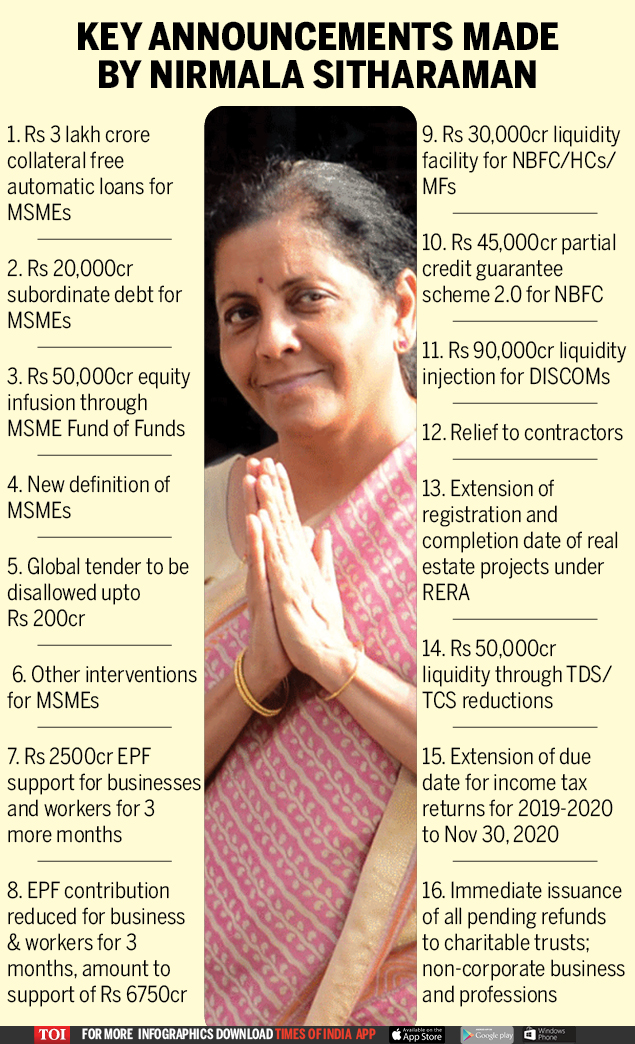

Here are the key announcements made by Finance Minister Nirmala Sitharaman:

* Extension of the due date to file tax returns

The due date for filing all income tax returns for the 2019-20 fiscal year has been extended from July 31 and October 30, 2020 to November 30, 2020.

Additionally, all test dates that expired on September 30, 2020 were extended to December 31, 2020, and those that were blocked on March 31, 2021 were extended until September 30, 2021.

* Reduction in the TDS / TCS rate for non-salary payments

Deducted tax rates at source (TDS) for specific non-salaried payments made to residents and tax collection rates at source (TCS) for specified receipts have been reduced by 25% from existing rates. This will apply to all types of transactions, including contract payment, professional fees, interest, rentals, dividends, commissions, brokerage, etc., will be eligible for this reduced TDS rate.

“This reduction would release almost Rs 50 billion rupees into the hands of people who would otherwise have paid it as TDS,” Sitharaman said.

The reduction will be applicable for the remaining part of the financial period 2020-21, that is, from May 14, 2020 to March 31, 2021.

* EPF support for companies, workers

For all companies, the legal obligation to pay 12 percent of the basic salary as part of the employer to the contribution of the employee provident fund (EPF) has been reduced to 10 percent to increase its liquidity. This scheme will provide liquidity up to Rs 6.75 crore to employers and employees for three months.

Under the Pradhan Mantri Garib Kalyan Package (PMGKP), payment of 12 percent of employer contributions and 12 percent of employees was made into the EPF accounts of eligible establishments, providing wages for the months of March, April and May 2020. This support has been extended for another 3 months until June, July and August 2020.

* Fast pending funds processing

The income tax department will accelerate the processing of pending refunds to charitable trusts, LLP, non-corporate companies and proprietary companies, among others.

Sitharaman also said that the income tax department has already authorized refunds worth Rs 18 billion, where the amount owed was up to Rs 5 lakh.

* Payment of the Vivad se Vishwas Plan

The Vivad Se Vishwas scheme for the direct resolution of tax disputes has been extended for six months until December 31, 2020.

On video: FM Sitharaman in the economic package of Rs 20 lakh crore from the Center: key points

.

[ad_2]