[ad_1]

Distribution companies and generators are pinning hopes on the Rs 90 billion rupee liquidity infusion package from the Center, but it may take two to three weeks for approval and an additional two weeks to raise funds and implement it.

Electricity distribution companies have been unable to collect more than 20-25% of bills, which authorities say would be further reduced in the prolonged blockade.

State officials said collections were expected to drop further as the blockade has been extended and industrial users are holding cash in uncertain times.

The blockade has reduced energy demand by 20-30%, particularly by high-paying industrial and commercial consumers.

Discounts have extended due dates for payment of electricity bills, and most have waived or deferred payment of fixed charges by residential and industrial consumers. States are concerned that energy producers, especially liquid power-deprived private power plants, may lose bank guarantees or letters of credit from inconvenience or begin to regulate energy supply. Distribution companies have paid negligible amounts of payments to some energy projects.

The total accounts receivable from the states to the power plants amounts to Rs 92,887 million, according to government data. Of this, past due accounts receivable is Rs 80,818 crore, mainly from Uttar Pradesh, Rajasthan, Tamil Nadu, Telengana and Andhra Pradesh.

Most states have asked the Center to streamline the loan package to help companies meet payments from power plants. But a senior government official told ET that the package was under discussion while the Center is exploring the availability of low-cost funds for the scheme.

The purchase cost of energy is approximately 80% of the total cost of the discoms. In Tamil Nadu, an executive said peak demand for electricity has fallen by 30%, while consumers in the industrial category are seeking exemption from fixed costs.

Energy officials said Andhra Pradesh has not seen such a deep financial crisis in 50 years and called on the Union ministry to provide special assistance to close the revenue gap that is occurring: Its electricity consumption fell by 20% and revenue collection by 80%. The state expects a drop of Rs 2.5 billion in revenue collections from April to June. The daily collections of Rajasthan distribution companies have decreased to Rs 30-40 crore from Rs 150-200 crore before, but they maintain a constant supply of energy.

Authorities said Uttar Pradesh is trying to encourage digital payments, but collections have not been recovered.

The CEO of the Association of Energy Producers, Ashok Khurana, said: “With the increase in accounts receivable and without liquidity support in sight, many plants may have to close due to lack of resources.”

The credit rating agency ICRA has said that the blockade has also negatively affected income and cash collection for public energy distribution services, especially given the decrease in consumption of high-cost industrial and commercial consumers and the possible delays in collecting cash from other consumer segments.

This is likely to increase the level of book loss for India-wide discomforts by Rs 200 billion in fiscal year 2013, with further downside risks stemming from any extension in the lockout period and any delayed issuance of inadequate tariff orders or tariffs approved by the state electricity regulatory commissions, ICRA said.

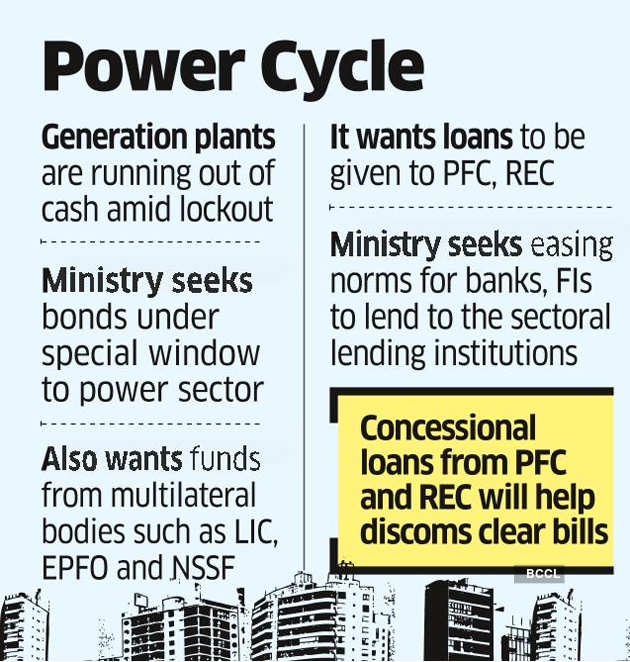

ET reported on April 29 that the government is seeking to arrange low-cost financing for its Rs 90,000 crore liquidity infusion plan to avoid blackouts as power generation plants are running out of cash amid a national blockade. The energy ministry has sought bonds under a special window for the sector in addition to funds from multilateral agencies and institutions such as LIC, EPFO and NSSF for the scheme.

The loans are sought to be available to Power Finance Corp (PFC) and REC Ltd, the two sectoral lending institutions in India’s electricity sector, for concessional loans to state-owned electricity distribution companies to help them settle bills. of energy generating companies.

The Ministry of Energy has also sought to relax the exposure rules for banks and financial institutions to lend to the state-owned PFC and its subsidiary REC Ltd.

[ad_2]