[ad_1]

Analysts in an ET NOW survey had projected the number at Rs 1.9 billion rupees.

The increase in provisions and contingencies abolished the lender’s bottom line. The figure increased by 185 percent year-on-year (year-on-year) to Rs 7,730.02 crore during the quarter under review.

However, the quality of the lender’s assets improved with the percentage of gross non-productive assets (GNPA) reaching 4.86 percent against 5.26 percent in the previous year. The figure stood at 5 percent in the previous quarter ended December 31, 2019.

The percentage of net NPA improved to 1.56 percent from 2.06 percent in Q4FY19. The figures stood at 2.09 percent in the December quarter of fiscal year 20.

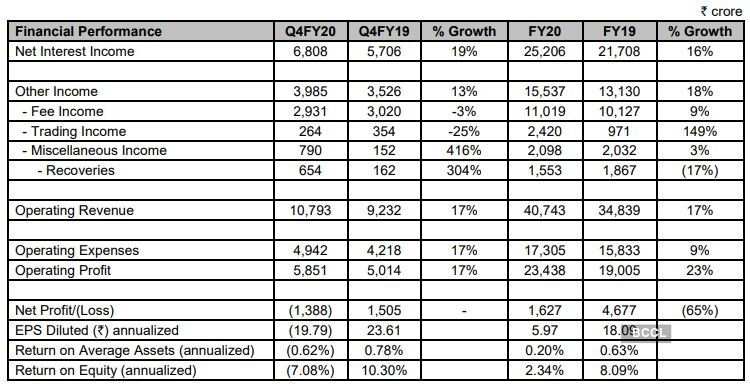

Net interest income increased 19 percent, year-over-year, to Rs 6,808 million, with net interest margins reaching 3.55 percent. Operating profit increased 17% yoy to Rs 5,851 million.

“During the quarter, the bank has provided provisions of Rs 7.73 billion, including Rs 3 billion related to Covid-19. The general additional provisions maintained by the bank for various contingencies, together with the standard asset provisions, translate into a standard asset coverage of 1.3 percent as of March 31, 2020, ”said Axis Bank.

Overall, the provision coverage ratio (PCR) improved to 69 percent as of March 31 compared to 60 percent for Q3FY20 and 62 percent for Q4FY19.

The bank’s balance sheet grew 14% yoy (YoY) and stood at Rs 9.15 lakh crore as of March 31. Total deposits in quarterly terms increased 19% and 17% YoY.

Axis Bank recognized slips of Rs 3,920 million in Q4FY20 against Rs 3,012 million in rupees last year.

In another update, the bank’s board has approved borrowing funds in Indian or foreign currency in the amount of Rs 35,000 crore.

[ad_2]