[ad_1]

But analysts said Nifty’s failure to maintain initial earnings may not be a good sign. “Technically, the bearish island reversal that formed on May 4 is still intact and the up and down gaps are not filled. As long as the last gap down of this pattern remains open at the 9,730 level, the negative impact of this pattern cannot be ruled out, ”says Nagaraj Shetti of HDFC Securities.

Shrikant Chouhan of Kotak Securities technically said that the market has entered a new trading range. “But the trend will hinge on announcements of the tax package to come in the coming days, and therefore operators should adjust their positions accordingly,” he said.

BSE Sensex ended Wednesday’s session 637 points, or 2.03 percent, higher at 32,008.61, while Nifty passed the 9,400 mark but failed to maintain it and ended at 9,383, an increase of 187 points, or 2.03 percent.

With that said, here is a look at what some of the key indicators suggest for Thursday’s market action:

US stocks fall on Powell’s bleak outlook

The S&P 500 and Dow fell on Wednesday when Federal Reserve Chairman Jerome Powell warned of a prolonged period of weak growth and stagnant income, while also rejecting speculation about negative interest rates. At 8:00 p.m. (IST), the Dow Jones Industrial Average fell 161.70 points, or 0.68 percent, to 23,603.08, the S&P 500 fell 9.76 points, or 0.34 percent, to 2,860.36. The Nasdaq Composite rose 33.91 points, or 0.38 percent, to 9,036.46.

European stocks fall on virus fears

European stocks fell on Wednesday as investors feared a resurgence in COVID-19 cases would nullify hopes of a rapid recovery in the global economy, while mounting tensions between the United States and China also affected sentiment. The pan-European STOXX 600 index fell 1.4 percent, with banks showing a drag after a series of negative updates. Auto, travel and leisure manufacturers, and oil and gas also dragged the leading index lower.

Tech charts show a witty negative outlook

Nifty formed a ‘Bearish Belt Hold’ pattern on Wednesday as it was unable to maintain its opening gains and closed near the day’s low. Analysts are not convinced of Wednesday’s earnings. They say that the prevailing trend is still negative. In the next two trading sessions, if the index does not exceed Wednesday’s high of 9,585, it will initially slide to the recent low of 9,043, they said.

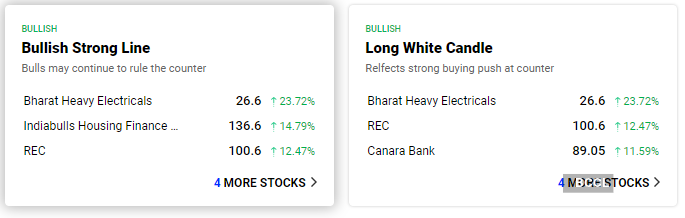

Take a look at the candle formations in the latest trading sessions

Options point to a wide range for Nifty

Option data indicated that Nifty’s immediate trading range ranges from 9,000 to 9,700 levels. India VIX rose 1.65 percent to the 38.83 level. Overall, increased volatility could continue to keep Nifty on a roller coaster ride in a broader trading band.

Stocks showing bullish bias

The Moving Average Convergence Divergence (MACD) indicator showed a bullish trading setup on the counters of Tata Power, Arvind, NMDC, SJVN, BEML, IRCTC, Aditya Birla Capital, Godrej Consumer Products, Hindustan Copper, Indian on Wednesday. Energy Exchange, Heidelberg Cement, Ircon International, Phillips Carbon, GIC Housing, Prakash Industries and Minda Industries, among others. The MACD is known for signaling trend reversals in traded stocks or indices. It is the difference between the exponential moving averages of 26 and 12 days.

Stocks indicating weakness ahead

The MACD showed bearish signs on the counters of Karur Vysya Bank, JK Paper, Reliance Capital, Future Enterprises, Fineotex Chemical, IndiaMART InterMESH, Va Tech Wabag, GM Breweries, Goodluck India, Ansal Properties, 5Paisa Capital, Timken India, Sanofi India, Digicontent, Arshiya, Grindwell Norton, Mindteck (India), Axles Automotive, Hester Biosciences, Pearl Polymers, Remsons Industries, Dhunseri Investments, SKIL Infrastructure, GB Global, Precot Meridian, Palred Technologies, Premier Polyfilm and Consolidated Finvest. The bearish crossover in the MACD on these counters indicates that they have just started their downward journey.

Most active stocks in terms of value

RIL (Rs 4539.32 crore), ICICI Bank (Rs 2478.04 crore), HDFC Bank (Rs 2080.60 crore), Bajaj Finance (Rs 2053.98 crore), Axis Bank (Rs 1971.04 crore), Maruti Suzuki (Rs 1697.01 crore), HUL (Rs Rs 1,696.72 million), Kotak Bank (Rs 1,425.32 crore), SBI (Rs 1,422.37 crore) and Vedanta (Rs 1,334.72 crore) were among the most active stocks on Dalal Street on Wednesday in value terms. Greater activity in an accountant in terms of value can help identify the accountants with the highest volumes of business on the day.

Most active stocks in terms of volume

Vodafone Idea (Shares traded: Rs 44.29 million), BHEL (Shares traded: Rs 30.97 million), Vedanta (Shares traded: Rs 14.58 million), SBI (Shares traded: Rs 8.17 million), ICICI Bank (Shares traded : Rs 7.28 million), Tata Motors (Shares traded: Rs 6.81 million, IDFC First Bank (Shares traded: Rs 6.29 million), Bank of Baroda (Shares traded: Rs 5.76 million), Indiabulls Housing Finance (Shares traded : Rs 5.38 million) and Tata Power (Shares traded: Rs 5.36 million) were among the most traded shares in the session.

Podcast: Can Nifty sustain stimulus-driven earnings?

The NSE barometer formed a ‘Bearish Belt Hold’ as the 50-pack index was unable to maintain its opening gains and closed near the day’s low. Analysts are not convinced of Wednedsay’s earnings. They see the prevailing trend as negative. “In the next two trading sessions, if the index does not exceed Wedensday’s high of 9,585, it will initially slide to the recent low of 9,043. A move beyond the level may extend the rally to the 9,700 level, where there appears to be a confluence. of resistance points, “said Mazhar Mohammad, chief strategist at Chartviewindia.in.

Shares seeing purchase interest

Ruchi Soya Industries, Alchemist, Mittal LifeStyle, Universus Photo Imagings and Bharti Airtel witnessed strong buying interest from market participants as they climbed their new 52-week highs on Wednesday, indicating bullish sentiment.

Actions witnessing selling pressure

Kajaria Ceramic, Delta Manufacturing, Magma Fincorp, Seya Industries, Wonderla Holidays, and Praxis Home Retail witnessed strong selling pressure in Wednesday’s session and hit their 52-week lows, indicating bearish sentiment at these counters.

Sentiment meter favors bulls

In general, the breadth of the market remained in favor of the bulls. Up to 403 shares in the BSE 500 index settled the day in green, while 95 settled the day in red.

.

[ad_2]