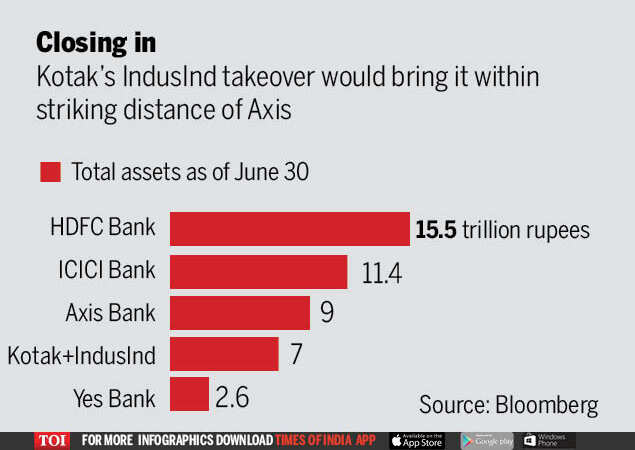

In what could be the country’s largest banking deal, Kotak Mahindra, backed by Asia’s richest banker, Uday Kotak, is exploring an acquisition of its smaller rival, people with knowledge of the matter said this week. A combination would boost its assets to Rs 7 lakh crore ($ 950 billion) and consolidate Kotak’s position as India’s fourth-largest private bank, closing the gap with Axis Bank Ltd.

“Kotak has always found it difficult to build scale organically,” according to a report from analysts at Macquarie Capital Securities, led by Suresh Ganapathy. “The acquisition of IndusInd Bank would result in an increase in Kotak’s asset portfolio, loan portfolio and branch network by 85%, 94% and over 100%, giving it huge benefits of scale / size”.

Talking about the merger and unexpected earnings growth from Kotak has already pushed the lender ahead of rival ICICI Bank Ltd to become India’s second-largest market value. The shares are up 15% this week, bringing the bank’s market capitalization to about Rs 3.1 crore. If the deal is carried out through an exchange of shares at the current IndusInd price, Kotak’s market value will skyrocket by approximately Rs 46,450 crore, putting it well ahead of its rival ICICI.

A spokesperson for Kotak declined to comment on the acquisition plans, while a representative for IndusInd denied the report.

India’s nearly $ 2 trillion financial sector, home to more than 20 private sector banks and more than 10 state lenders, is struggling to contain the fallout from the coronavirus pandemic which is expected to reduce the economy to the maximum in four decades. Banks entered the year already weakened by a two-year-old shadow loan crisis that had eroded capital.

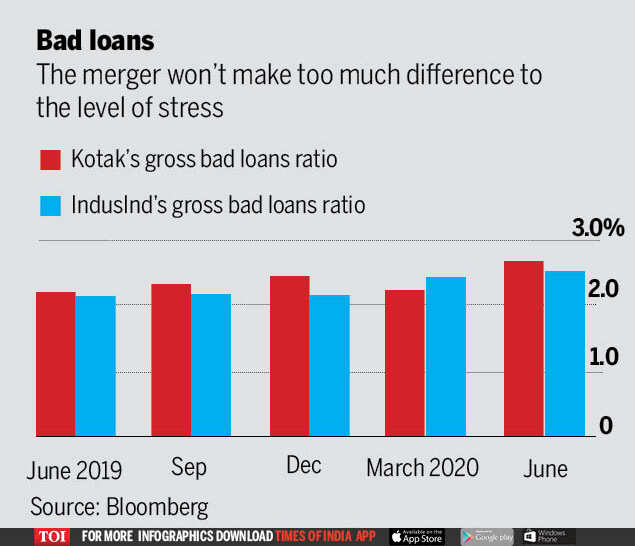

The South Asian nation’s bad loan rate, already the worst among major countries, will worsen further and could rise to 12.5% in March, hampering any hope for an early recovery. Given that Kotak and IndusInd face similar debt ratios on their loan books, a deal is unlikely to hit lenders bad debt too much.

Kotak’s “excess capital, healthy balance sheet, and conservative management could allow it to benefit from IndusInd’s well-diversified loan portfolio and low valuation of 1.1 times the forward spot price, if a potential risk occurs. acquisition of IndusInd, “said Bloomberg Intelligence Banking analyst Diksha Gera.

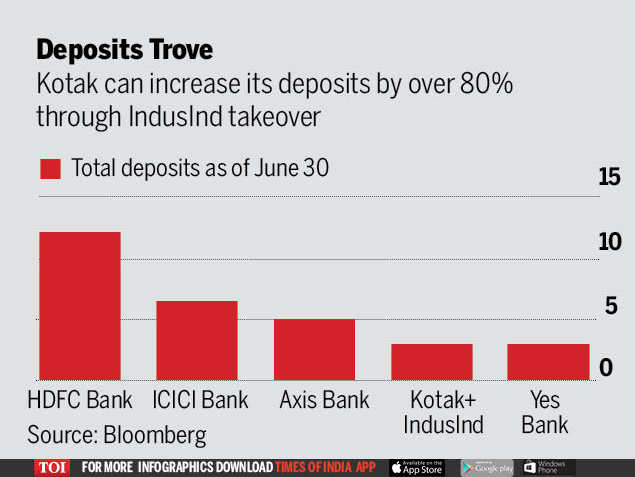

Banks face stiff competition for customer deposits, with more than 30 lenders serving some 57.4 crore of Indians who have access to basic savings accounts. The possible merger would increase Kotak’s deposits by 81% to Rs 4.7 lakh crore, still far behind HDFC Bank Ltd.

.