The finance minister’s letter to the states comes four days after the GST Council meeting failed to reach consensus on the deadlock on the Center’s proposal that states borrow against future GST collections to make up the deficit.

“We have now resolved some key aspects of the special window. Based on suggestions from many states, it has now been decided that the central government will initially receive the amount and then consecutively pass it on to the states as loans. This will allow for ease of coordination and simplicity. on indebtedness, in addition to guaranteeing a favorable interest rate “, reads the letter to which PTI had access.

Therefore, he said, the amount of resources available to the state is adequate to cover the full amount of compensation that would have been payable this year. Interest and principal will be covered with future income from the tax.

States that objected to the Center’s earlier stance also welcomed Thursday’s decision of a loan of Rs 1,10,208 crore from the Government of India to cover the GST revenue collection shortfall.

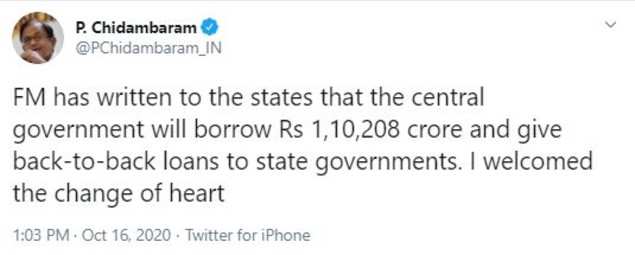

Welcoming the measure, leader of Congress and former Minister of Finance P Chidambaram on Friday he said the Center has taken the “right first step” and should now work to restore trust with them.

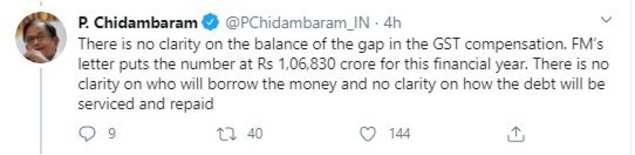

“FM has written to the states that the central government will borrow Rs 1,10,208 crore and make consecutive loans to the state governments. I appreciate the change of mind. There is no clarity on the balance of the gap in the GST. FM’s letter states the number at Rs 1,06,830 crore for this financial year, “Chidambaram said in a series of tweets.

There is no clarity on who will borrow the money and how the debt will be repaid and repaid. States are opposed to borrowing on their own, he said.

“The states are right. There is no difference between the first amount and the second amount. The Center must resolve the deadlock immediately by offering the same terms for Rs 1.06.830 crore that it now offers for Rs 1.10.208 crore. Having taken the Right one. first step, I urge the PM and the FM to also take the second step and restore trust between the Center and the states, ”he said.

A slowdown in the economy since last fiscal year has resulted in a drop in the collections of the Goods and Services Tax (GST), altering the budgets of states that had waived their right to collect local taxes such as sales tax. or VAT when the GST was introduced in July 2017.

The four-page letter signed by Sitharaman thanked the states for constructive cooperation in finding a solution to the GST compensation problem.

Noting that the current financial year is unprecedented in terms of severe impact on revenues due to the pandemic, he said that “the Union government has also been severely affected by falling revenues and the higher level of spending required to meet essential aid and recovery and state government needs. ”

It is in this context that the GST offset problem is being resolved, the letter said.

He said that “long-term macroeconomic stability is the responsibility of the Center, but it is also in the interest of the states that are partners in our cooperative federalism system. The genuine opinion of the central government on this macroeconomic issue is that borrowing from the books of the Center will not be optimal for the national interest. ”

The amount of resources available to the state is adequate to cover the full amount of compensation that would have been paid this year, he added.

.