For babus, it is a gift, as they could not have claimed LTC without going on a journey. In contrast, the private sector can pay taxes and take the LTA, which is part of the ‘cost to the company’.

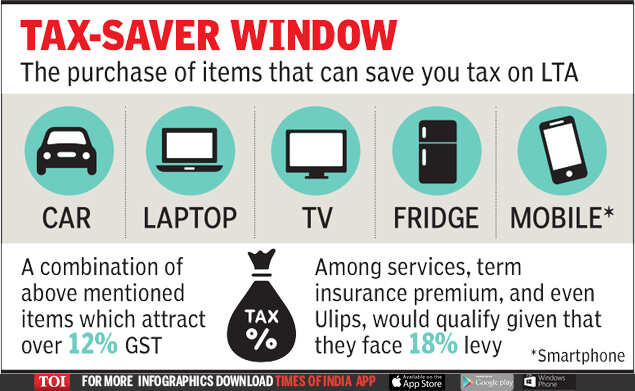

So, this is what’s on the table. If your LTA is Rs 1 lakh for the current financial year, you produce tickets to claim it as a tax-free allowance or pay a tax of Rs 30,000 on it. Now the government offers you a window where you can avoid paying Rs 30,000 without going on vacation to Goa or Kerala as long as you spend Rs 3 lakh to buy a car, laptop, TV, refrigerator, smartphones or a combination of these . items attracting more than 12% GST. Among services, the term insurance premium, and even Ulips, would qualify given that they face an 18% tax.

“For the private sector, LTC is generally one month’s base salary and to save taxes, you will have to spend three times the amount to buy the goods or services that attract at least 12% of GST. It can help those who already have the extra money and are required to purchase such goods or services, as they will save taxes and will not need to postpone their purchase decision. But for others, in the current situation of job uncertainty and / or salary increases, etc., it can be difficult to get them excited to buy, ”said Rahul Garg, Senior Tax Partner at PwC India.

Does it make sense to choose it? “You should not claim (opt for this) for the fun of claiming the 30,000 rupees. If you have expenses planned for the remaining six months of this year, then you can use them to your advantage, ”said financial advisor Surya Bhatia.

Homi Mistry, a partner at Deloitte, advises those seeking it to read the fine print. A big area of confusion is what happens to those who have opted for the new regime this year, where they can pay income tax at a lower rate, as long as they waive all exemptions, including LTA ones.

“We need to wait for the tax modifications that are proposed in the notification. We will have to see how the government aligns the new tax regime that does not allow the LTA exemption with the proposed amendment and also if there is a special window for private sector employees, “said Shalini Jain, tax partner at EY.

Similarly, it is unclear whether those who have already withdrawn their LTA entitlement for the year will now be eligible to take advantage of the waivers.

.