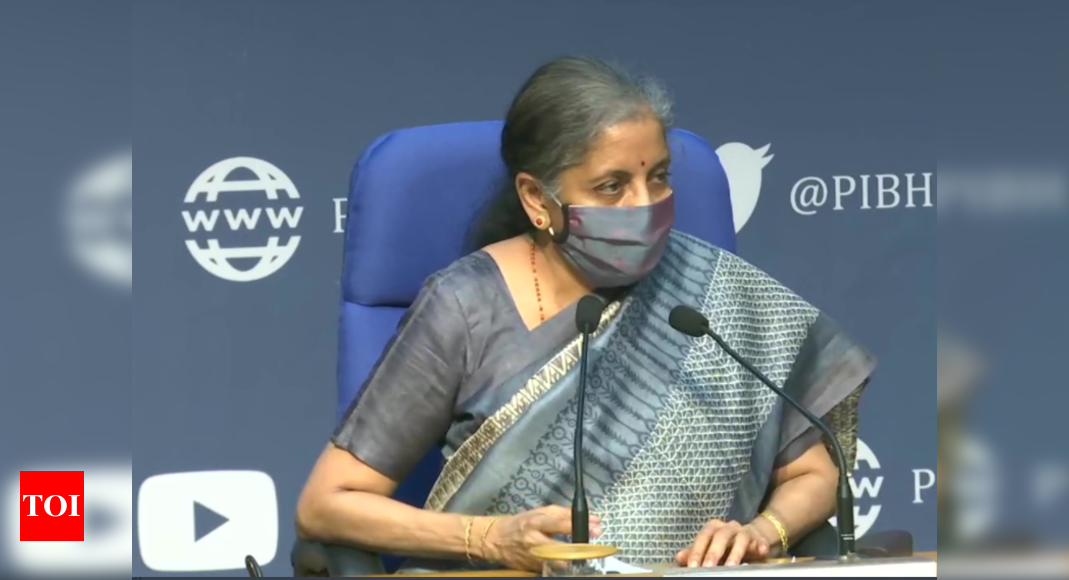

The Minister of Finance while addressing the media after the 42nd meeting of the GST Council stated that the amount of this year’s fee will be disbursed tonight.

The states’ compensation requirement between April and July stood at Rs 1.51 lakh crore.

The government will further extend a surcharge to taxes on luxury goods, including cars and tobacco products beyond 2022, as part of plans to help states repay loans raised to cover revenue shortfalls in the current fiscal year, Sitharaman said.

“The GST Council has approved extending the tax (surcharge) beyond five years,” Sitharaman added.

Under the GST structure, taxes are collected below 5, 12, 18 and 28 percent of slabs. In addition to the higher tax slab, a luxury, sin and demerit property tax is levied and the proceeds from these are used to compensate the states for any loss of income.

The surcharge on luxury items such as cars and tobacco products, which ranges from 12% to 200%, is part of the national goods and services tax (GST) introduced in 2017 and was due to expire in 2022.

Finance Secretary Ajay Bhushan Pandey said that as of January 1, taxpayers whose annual turnover is less than 5 million rupees will not be required to file monthly returns (GSTR-3B and GSTR-1). They will only file quarterly returns, he added.

The finance secretary stated that the council’s decision to make small taxpayers pay their returns quarterly instead of monthly will be a huge relief. The number of returns is reduced from 24 monthly returns to just 8 from next year, he added.

The finance secretary also said that the council has decided to exempt ISRO and Antrix satellite launch services.

The next meeting will be held on October 12 to continue deliberating on the compensation of states for the GST cessation deficit, Finance Minister Sitharaman concluded.

(With contributions from the agency)

.