In its affidavit, the Finance Ministry said the government has decided to uphold its tradition of taking small borrowers and shouldering the burden that arises from such a waiver of interest on interest, or compound interest, for banks.

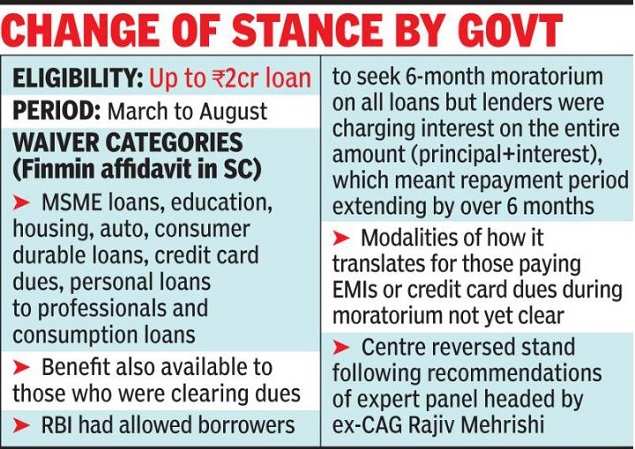

“This category of borrowers, in which case compound interest will not apply, would be MSME loans and personal loans up to Rs 2 million from the following category: MSME loans, education loans, housing loans, consumer durable loans , credit card fees, auto loans, personal loans to professionals and consumer loans, ”the ministry said.

The reserve Bank of India had allowed borrowers to request a six-month moratorium on all loans, but banks and home finance companies were charging interest on the full amount, principal and interest liability, resulting in a period of repayment that spanned more than six months. The liability was higher for recent loans, as the interest component is generally charged up front. In addition, there was a large increase in the liabilities of credit cards, which come with high interest rates.

The bankers said that the total interest cost of the interest exemption, if the benefit were restricted to only these categories, would be around Rs 5,000 crore-Rs 6,000 crore. However, if the scheme were extended to all borrowers, the total cost of the waiver would be between Rs 10 billion and Rs 15 billion. Bankers expect the government to compensate interest exemption since it is a measure of social welfare.

The modalities of how the benefit would flow to those who were paying their EMI or credit card fees during the moratorium period were not immediately known.

The Center has changed position following the recommendations of a committee of experts headed by the former Comptroller and Auditor General Rajiv mehrishi. Previously, the Center and the RBI had argued against the waiver of interest on interest on the grounds that it would go against the interests of other stakeholders, especially depositors, and would be unfair to those who paid their fees.

A bench of judges Ashok Bhushan, RS Reddy and MR Shah had insisted that the government “consider and reconsider” its decision not to waive interest.

However, he appeared to accept the government’s decision not to give up interest entirely.

The Center said that waiving interest on interest for all categories of borrowers would result in a very substantial and significant financial burden for various categories of banks, making it impossible for them to bear the financial burden. As this would also affect the interest of depositors, the government decided not to give it up for large borrowers.

“The government has therefore decided that the relief from the compound interest exemption during the six-month moratorium period will be limited to the most vulnerable category of borrowers,” the ministry said. This would mean loans of up to Rs 2 crore.

The RBI and the Center had previously argued that the moratorium was simply deferring loan installments until a future date and that it did not mean waiving either interest on the amount owed during the six-month period or interest earned during the period of director.

He had said that the borrowers understood the difference between the waiver of the interest on the loan and the deferral of the payment of the installments of that loan and, therefore, “the majority of the borrowers in fact have not benefited from the moratorium.”

“If the government considered the exemption of interest on all types of loan advances to all categories of borrowers corresponding to the six-month period for which the moratorium, that is, the deferral of payment of installments, was available in the relevant RBI circulars, the estimated amount exempted would be more than Rs 6 lakh crore, “the ministry said.

He said that if banks were to bear the burden, a substantial portion of his net worth would disappear, rendering most banks unviable. “This was one of the main reasons why the interest exemption was not even contemplated and only the payment of installments was postponed,” he said.

More than half of the State Bank of IndiaNet worth would disappear if interest were waived for six months, the government said.

.