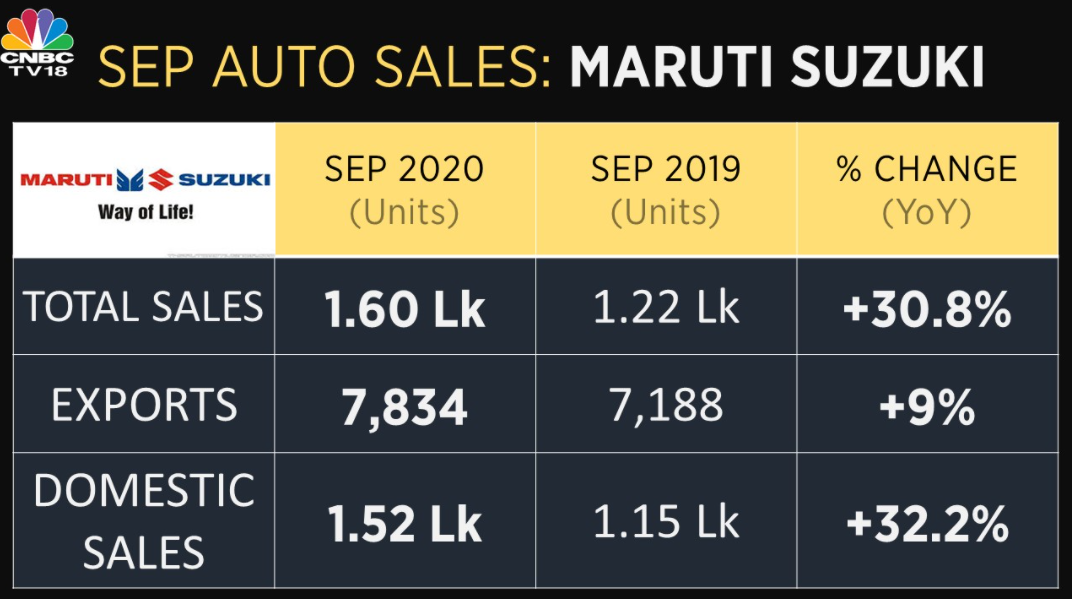

Maruti’s total sales increase 31% and exports 9% in the month of September year-on-year

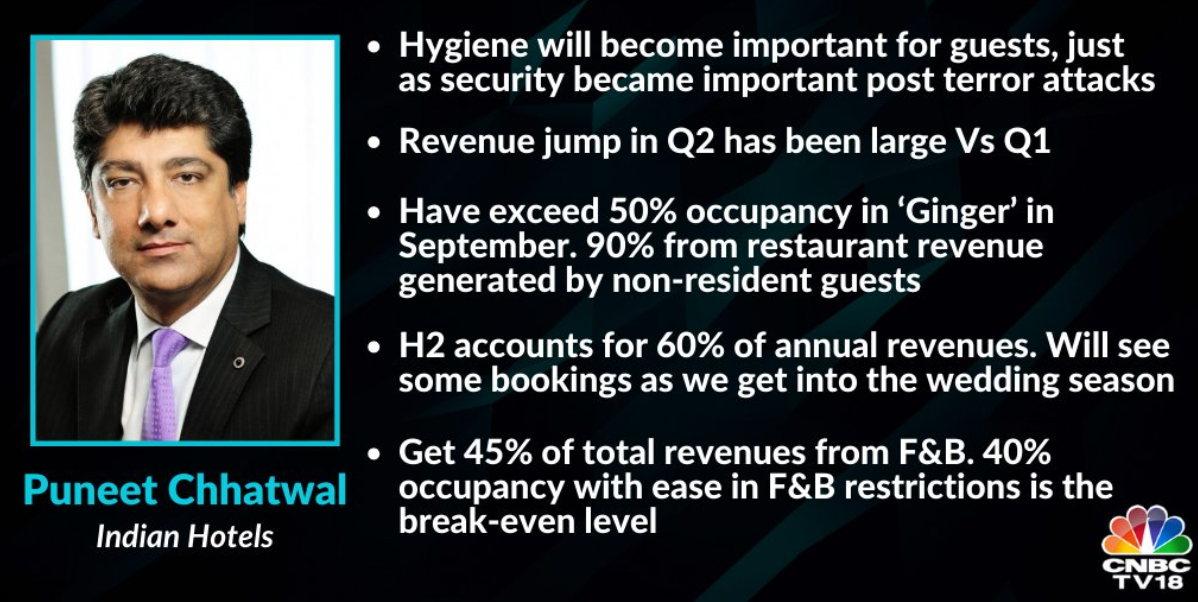

Puneet Chhatwal of Indian Hotels says that he will co see some reservations as we head into the wedding season.

Chemcon Specialty Chemicals debuts with a strong 115% premium over the issue price

Chemcon Specialty Chemicals debuted on the stock exchanges with a strong 115 percent listing at Rs 730.95 on the BSE, above its issue price of Rs 340. The shares were up as much as 118 percent of their issue price, to Rs 743.80 . The specialty chemicals maker’s IPO was signed 149 times on its last day of bidding (September 23). The funds raised from the new issuance will be used to meet the working capital requirement, CAPEX towards the expansion of the manufacturing plant and general corporate purposes.

CAMS is trading at Rs 1,527 versus the issue price of 1,340 on the BSE

Computer Age Management Services (CAMS) shares were trading at Rs 1,518 versus the issue price of Rs 1,340 on the BSE. CAMS ‘initial public offering (IPO) was fully subscribed on the second day of the bidding process and was subscribed almost 47 times. The public issue of Rs 2,244 million received equity share offerings of Rs 1.38 million versus the equity offering size of Rs 1.28 million. The portion reserved for retail investors was subscribed 1.7 times, while the reserved category of the non-institutional investor segment received a subscription of 32.3 percent. The price band was a fixed price band of Rs 1,229-1,230 per share.

Bajaj Auto September Auto Sales | The company’s total sales in September 2020 increased 10 percent to 4.41 lakh units from 4.02 lakh units, year-over-year. Total sales were up 24 percent, month-on-month. Domestic sales rose 6 percent to 2.28 lakh units from 2.15 lakh units, while exports grew 14 percent to 2.12 lakh units versus 1.86 lakh units, year-over-year. Two-wheelers sales increased 20 percent to 4.04 lakh units from 3.36 lakh units, while three-wheelers sales decreased 44 percent to 36,455 units from 65,305 units, year-over-year.

Technical view | We are at a foothold, trading above 11,350. It is imperative for markets to close above this level for the bulls to take over. From here, we can achieve 11,600 and then 11,800. If we can’t close past 11,350 marks and make a U-turn, we could go down to 10,700-10,800, he said. Manish Hathiramani, Technical Analyst and Property Index Trader, Deen Dayal Investments

Microfinance firms look attractive, says HDFC Securities

Despite being a risky business, microfinance companies have attracted investors over the years due to their rapid growth and high profitability rates. The potential for higher business growth due to a lack of penetration, wide spreads leading to high RoAE and cheap valuations have made MFIs a better investment option, analysts said. In the past two years, while overall credit growth has slowed considerably, microcredit growth has fared better. Currently, active microcredit borrowers are only 4.3 percent of the population. Ten states in India account for more than 80 percent of outstanding microloans and the average outstanding per borrower is around Rs 39,300. More here

Opening bell: Sensex opens 400 points higher, Nifty above 11,350; finance, auto stock surge

Indian indices opened higher on Thursday after the gains of their Asian peers led mainly by banking and automobiles. At 9:18 a.m., the Sensex climbed 391 points to 38,458 while the Nifty climbed 108 points to 11,355. The broader markets were also positive during the day with the Nifty Midcap and Nifty Smallcap indices rising 0.9 percent and 1.4 percent, respectively. All sectors also witnessed purchases in the morning deals. Nifty Bank increased more than 1.5 percent, while Nifty Fin Servcies and Nifty IT also increased more than 1 percent each. The auto and metals indices gained 0.9 percent in trade. In the Nifty5- index, Bajaj Auto, IndusInd Bank, Adani Ports, Tata Motors and Tata Steel, while ONGC, Eicher Motors, Nestlé and GAIL were the only stocks in the red.

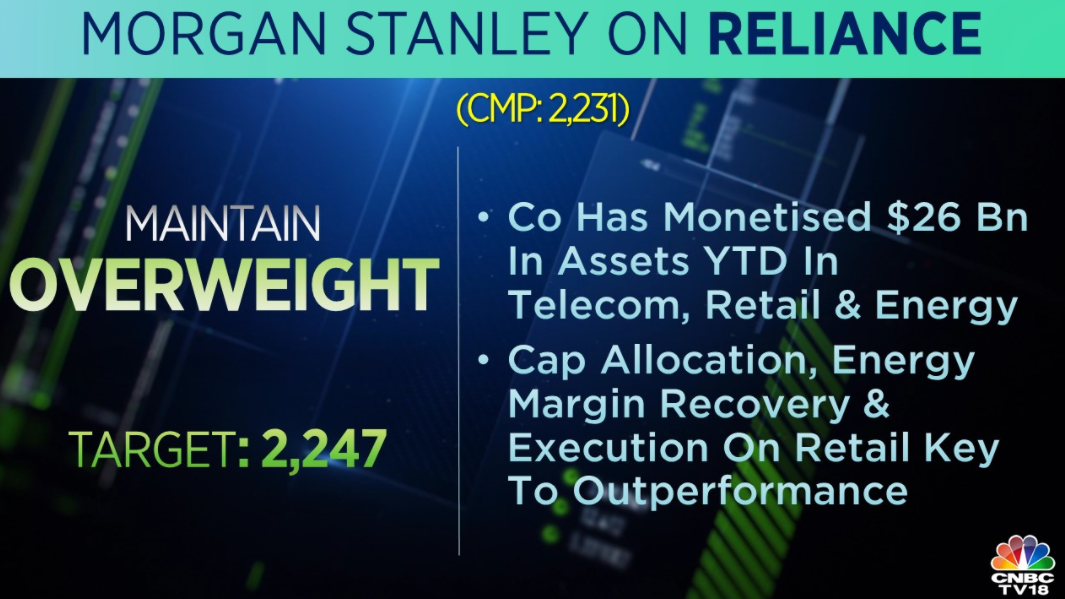

Morgan Stanley is OVERWEIGHT in Reliance Ind, target of Rs 2,247 / share

Voda Idea AGM: KM Birla says fundraising of Rs 25K cr is enough for now

Debt-laden telecommunications operator Vodafone Idea Ltd (VIL) held its annual general meeting on September 30 to, among other things, seek shareholder approval to raise a previous borrowing limit of Rs 25,000 crore to 1 lakh crore of rupees. At the meeting, shareholders questioned the company’s decision to spend money on IPL’s rebranding and marketing, even as it has been incurring losses. Vodafone Idea, renamed Vi (read ‘we’) on September 7. Chairman Kumar Mangalam Birla, whose Aditya Birla Group is a joint promoter of VIL together with Vodafone Plc, said that rates remain the lowest in India, while data consumption in the country is the highest in the world. Here are the key takeaways from the AGM

Reduction in the price of domestic gas by 25%, negative for ONGC, PETRÓLEO; positive for end users

The domestic natural gas price for the second half of the 2020-21 fiscal year was reduced by 25.1 percent to $ 1.79 per MMBTU compared to the previous price of $ 2.39 per MMBTU. The maximum price for deepwater natural gas is set at $ 4.06 per MMBTU for the period beginning October 1 through March 31, which was previously $ 5.61 per MMBTU. The sharp cut in the national price of natural gas is due to a cut in global prices, also affected by the coronavirus pandemic, which has reduced demand while production is higher. The impact of the price cut will affect companies such as ONGC and Oil India, which are engaged in the exploration and production of 80 percent of the nationally produced natural gas in India. The measure will affect both the performance and the profitability of the companies, since crude prices have not recovered from their lows. More here

Here are some global signals for today.

Silver Lake Co-Investors to Invest an Additional Rs 1,875 Crore in Reliance Retail

Reliance Industries said in a filing to the exchanges that Silver Lake co-investors will invest an additional Rs 1,875 crore in Reliance Retail Ventures, a subsidiary of Reliance Industries. This brings the aggregate investment of Silver Lake and its co-investors in RRVL to Rs 9,375 crore, which will translate into a 2.13% equity stake in RRVL on a fully diluted basis. This is the private equity firm’s second investment in Reliance Retail, which has already bought a 1.75 percent stake. Along with this, Silver Lake has also invested 2.08 percent in Jio Platforms, having invested Rs 10,202 crore in two tranches.

Brookfield REIT Files Documents with Sebi for OPI

Global investment firm Brookfield Asset Management has submitted draft documents to market regulator Sebi for the initial public issuance of its real estate investment trust (REIT). This would be the third REIT offering in the country after the Embassy Office Parks REIT and the Mindspace REIT. The initial public offering consists of units of Brookfield India Real Estate Trust (Brookfield REIT) comprising a new issuance totaling up to Rs 3,800 crore and an additional component for an offer to sell, according to preliminary documents filed with Sebi. Sources in commercial banking said that the REIT is fully sponsored by Brookfield and that the company is set to raise up to USD 600 million (around Rs 4,440 crore). More here

ONLY IN: Reliance Ind receives a subscription amount of Rs 1,894.50 Cr from Intel Cap and Rs 730 cr from Qualcomm for Jio platforms

First, here is a quick update on what happened in the markets on Wednesday

India’s benchmark stock indices Sensex and Nifty ended Wednesday’s volatile session unchanged, as gains in consumer goods, pharmaceuticals and IT stocks were offset by the sale of PSU metals and banks in medium of mixed global signals. The Sensex closed 94.71 points or 0.25 percent higher at 38,067.93 while the Nifty closed at 11,226.50, a marginal increase of 4.10 points or 0.04 percent. The broader indices underperformed the benchmark indices, as the Nifty Smallcap and Nifty Midcap indices finished lower.

Welcome to the CNBC-TV18 Market Live blog

Good morning readers! I am Pranati Deva, the market table of CNBC-TV18. Welcome to our market blog, where we provide live news coverage of the latest events in the stock market, business and the economy. We’ll also get instant reactions and guests from our stellar lineup of TV guests and editors, researchers, and internal reporters. If you are an investor, we wish you a great trading day. Good luck!