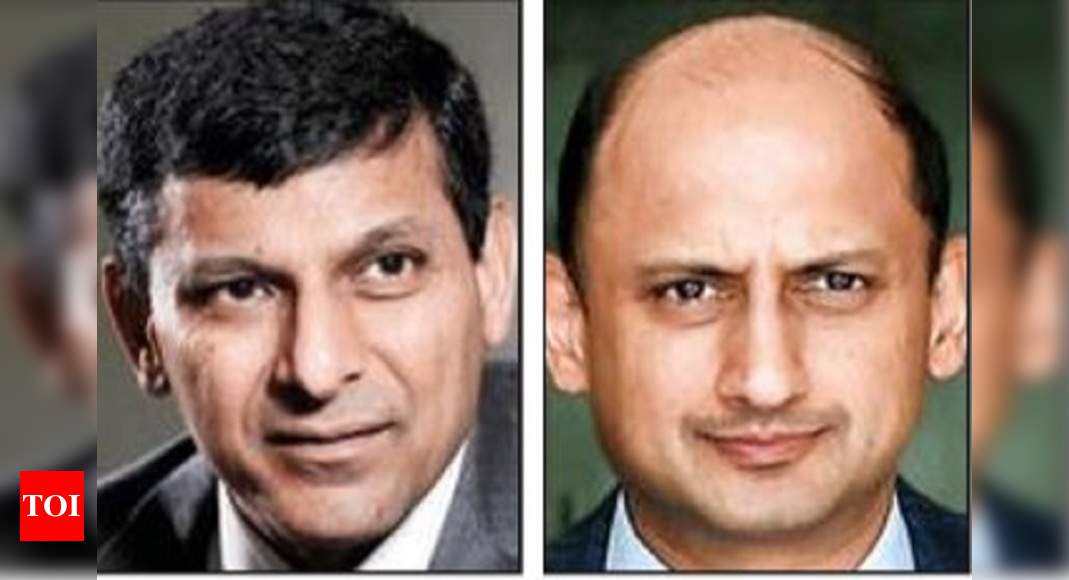

MUMBAI: Former Central Bankers Raghuram rajan and Viral Acharya have written a document in banking sector reforms where they have called for the ‘reprivatization’ of some public sector banks and the dismantling of the department of financial services.

Calling for a reduction of the government stake below 50%, the document says that the “ reprivatization ” of selected PSBs can be undertaken as part of a carefully calibrated strategy, attracting private investors who have both financial and financial experience. technological experience, but corporate companies. they should avoid acquiring significant stakes, given their natural conflicts of interest.

Other suggestions include a proposal made earlier during Rajan’s tenure at RBI for ‘wholesale banks’ that only lend to businesses and the creation of a bad bank They will take care of bad loans from existing lenders.

Most of the proposed reforms have been carried out in the past by various committees, including the PJ Nayak committee on banking reforms. The newspaper “Indian Banks: Time to reform?” has the strongest words for the bureaucrats in the finance ministry, particularly the financial services department that oversees all state financial institutions.

“Today, your job is to affirm the government’s will over public sector banks and seek to affect banking regulation through the RBI Board seat that was assigned to the DFS Secretary in 2012. A key marker of PSB Bank The boards of directors have sufficient independence if the department is eliminated and if its officers are reassigned more productively to other locations, ”the newspaper said.

Rajan, who was hired as RBI Governor by the UPA government in 2013, is currently at the Booth School of Business at the University of Chicago, while Acharya, who was appointed in 2017 under the Narendra modi government, is currently at the NYU Stern School of Business. Noting that the government has been forced to invest Rs 4 crore in public sector banks since 2010, the document says that credit to GDP remains low by global standards and bad loans remain high.

The research article aims to advise the government to seize the opportunity for reform brought on by the economic crisis that has reduced the government’s ability to continue injecting capital into public sector banks. According to the authors, it examines what is holding back Indian banking and suggests a variety of implementable reforms that could allow banking activity to grow significantly without periodic boom-bust cycles.

.