[ad_1]

The | New Delhi |

Updated: May 13, 2020 6:16:18 am

Prime Minister Narendra Modi on Tuesday announced “Aatmanirbhar” aid packages for the poor amid the shutdown

Prime Minister Narendra Modi on Tuesday announced “Aatmanirbhar” aid packages for the poor amid the shutdown

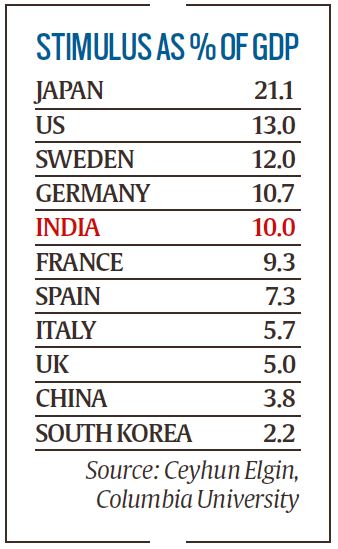

The 20 lakh rupee rupee package announced by Prime Minister Narendra Modi sounds big, but it will only burn a small hole in government finances. A large part, or as much as Rs 8.04 lakh crore, is the additional liquidity injected into the system by the Reserve Bank of India through various measures in

Add to this the Rs 1.7 lakh crore tax package announced by Finance Minister Nirmala Sitharaman on March 27. The balance of the economic package, the details of which are not yet known, stands at Rs 10.26 lakh crore. The Finance Minister is expected to announce the details as soon as possible as this influences the bond markets.

Sources familiar with the discussions within the government said that fiscal spending cannot be more than Rs 4.2 lakh crore during the year, taking as a reference the revised loan schedule announced just three days ago. “On May 9, the government revised its estimated market loans to Rs 12 lakh crore from Rs 7.8 lakh crore as announced in the 2020-21 Budget … In a way, this places a limit on the size of the fiscal package at 2.1 percent of GDP (Rs 4.2 lakh crore), “said the source.

The RBI statement in the loan schedule said the review had been necessary due to the Covid-19 pandemic.

In other words, the cash that the government could afford, given this limit, to extend to the poor, vulnerable and migrant workers, may be limited to Rs 4.2 lakh crore. But if this is taken advantage of in an innovative way, the multiplier impact on the economy could be significant, particularly when the Indian economy would have lost almost 47 days of production throughout the year. Most global financial services research houses have estimated the Indian economy to contract 0.4 percent in 2020-21.

The sources said that the money left after making cash transfers to those most in need is likely to be used in a way that produces maximum profits. “For example, if the government accepts the first 10 percent loss in the event of default by companies in specific sectors, it will incentivize banks to lend much more. The big problem today is banks’ risk aversion to extend credit, “said another source. This may not involve making a large allocation in the Budget, but it will go a long way in providing credit to the companies most affected by the pandemic.

Similarly, the MSME package devised by MSME Minister Nitin Gadkari, for example, involves the government to secure a revolving fund of Rs 1 lakh crore created by banks and financial institutions. “The government simply provides a guarantee to the fund … it is a type of insurance, which does not imply a big departure from the Budget,” the source said. While the Rs 1 lakh crore helps the government show a great economic package, the real cost to the treasury is likely to be a couple of billions of rupees.

In addition, the government can also recapitalize banks, aiding their capital adequacy. “Once again, we only have to account for the interest to be paid on the recapitalization bonds, which is also not equivalent to a substantial exit,” said a government official, who did not want to be quoted.

The government, the authorities explained, cannot really afford much encouragement. “It is intended to provide relief and remove the patient from the ICU … There is no fiscal space to substantially increase spending,” said the official.

Even in the first fiscal package on March 27, immediate money transfers would total only Rs 61.38 billion rupees in the next three months: Women account holders Jan Dhan – Rs 10 billion rupees; widows, elderly and disabled – Rs 3,000 crore ’farmers – Rs 17,380 crore; and construction and construction workers: Rs 31 billion from the Welfare Fund.

The rupee of 17,380 rupees to be delivered to farmers was not an additionality, but was already budgeted for 2020-21. The government only advanced the payment of the first tranche of Rs 2,000 (of the Rs 6,000 budgeted per farmer per year under the PM KISAN scheme). Similarly, money for construction workers did not require the government to borrow more.

📣 The Indian Express is now on Telegram. Click here to join our channel (@indianexpress) and stay updated with the latest headlines

For the latest news from India, download the Indian Express app.

© The Indian Express (P) Ltd

.

[ad_2]