[ad_1]

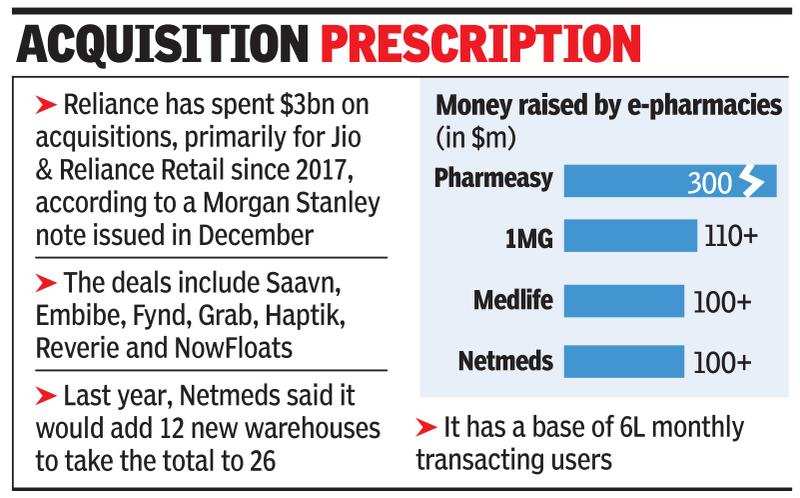

Netmeds, which began operating in 2015, has to date announced three rounds of financing totaling approximately $ 100 million. The company was founded by Pradeep Dadha, whose family was one of the first Sun Pharmaceuticals distributors. The distribution business was later acquired by Sun Pharma. In addition to Dadha’s family office, Netmeds’ sponsors include healthcare investor OrbiMed, investment bank MAPE Advisory, the Asia Fund System and Daun Penh Cambodia Group, based in Singapore.

“As a politician, we do not comment on media speculation and rumors. Our company is evaluating various opportunities on an ongoing basis, ”said a Reliance spokesperson, adding that it will inform the exchanges according to Sebi of any developments.

“It would not be productive to comment on media speculation at this stage,” Dadha said in an email response, adding that Netmeds has partnered with Reliance Retail to supply essential products such as groceries to its customers.

The talks between Reliance and Netmeds, which also had talks with Walmart-owned Flipkart, had taken place before the coronavirus closed, the sources said. This will be Reliance’s second major move in the pharmaceuticals sector, as last year it acquired 82% in Bengaluru-based C-Square Info Solutions, which manufactures software for distributors, retailers and sales force in the pharmaceuticals sector for a total of Rs 82 crore. Some of the company’s clients include Apollo Pharmacy, Adcock Ingram, and other players.

The development comes as Reliance is boosting its online to offline (O2O) trading business, first with groceries with the link between Reliance Retail and WhatsApp last month. That deal came after WhatsApp’s parent company Facebook agreed to invest $ 5.7 billion for a 9.99% stake in Jio Platforms, Reliance’s telecoms and digital services business.

Netmeds generates 90% of its revenue from prescription and over-the-counter medications. This is similar to other drug delivery platforms such as 1MG, Medlife, and Pharmeasy, which generate 80-90% of their revenue from drug sales, focused on chronic customers who make repeat purchases regularly. Last year Netmeds announced it would add a dozen new warehouses to bring the total to 26 as it expanded across India. A RedSeer report in February said it has a 6 lakh user base for monthly transactions.

According to the RedSeer report, a market research company, the e-pharma industry, which includes consulting and diagnostics, costs around $ 1.2 billion. This is expected to reach approximately $ 16 billion in five years. Although more than 4 million households have already opted to buy drugs online, this space has become one of the few beneficiaries of the virus outbreak as more consumers choose to buy drugs online.

In mid-March, e-pharmacy platforms experienced a sharp increase in mask and disinfectant sales. 1MG Co-Founder and CEO Prashant Tandon said sales of these products increased 10-20 times before the virus outbreak. “Order volumes are even higher than before Covid-19. But in the future, we are looking at supply problems and labor shortages to meet growing demand, ”said the CEO of another e-pharma platform. Typically, consumers on average transact 1.5-2 times from these companies, while the average purchase size is Rs 1,400-1,700.