[ad_1]

The | Mumbai

Updated: April 25, 2020 7:58:02 am

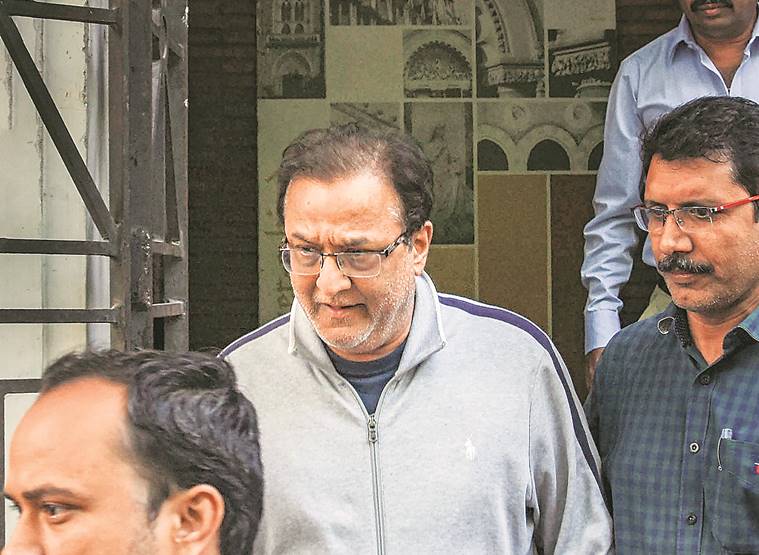

Cox & Kings CFO Anil Khandelwal (left) and Promoter Peter Kerkar. (File photo)

Cox & Kings CFO Anil Khandelwal (left) and Promoter Peter Kerkar. (File photo)

The series of indictments against Cox and Kings, such as reported on The Indian Express Friday, discovered in their forensic audit, relate to forgery of records, attempts to divert funds, false sale and default on debt. Add to this list: forgery, conflict of interest, and criminal conspiracy.

Part of the Yes Bank loan to the Cox and Kings subsidiary appears to have been diverted to a company led by the company’s top executives, including its internal auditor.

This firm, in turn, used that money to buy a stake in a government-sponsored financial institution, show records of an investigation by Yes Bank and the resolution professional appointed by the National Court of Company Law.

Cox and Kings was one of the main borrowers of Yes Bank when co-founder Rana Kapoor was in front of the bank. Yes, the Bank had an exposure of Rs 2.267 crore to Cox and Kings.

Records of the investigation, conducted after Kapoor’s departure from Yes Bank, show that a company promoted by Cox and Kings, Ezeego One Travel and Tours Ltd, allegedly “diverted” Rs.150 million of Rs 150 that it borrowed from Yes Bank. and invested it in Redkite Capital.

Cox and Kings was sent to bankruptcy court in October 2019, after he defaulted on payments.

Cox and Kings was sent to bankruptcy court in October 2019, after he defaulted on payments.

This was done in two tranches between January 2018 and March 2019 through non-convertible bonds (ENT).

Redkite Capital, created in 2010, is owned by four companies controlled by Anil Khandelwal, Chief Financial Officer (CFO) of Cox and Kings; his father, Om Prakash Khandelwal; Naresh Jain, the Cox and Kings internal auditor; and the Jain and Khandelwal family.

Redkite, according to records, used Ezeego’s Rs 150 crore raised to acquire a 32.81 percent controlling stake in a government-sponsored financial institution, the Tourism Finance Corporation of India (TFCI), between February and March 2019. after approval of the Reserve Bank of India (RBI).

The official RBI spokesman said the regulator does not comment on individual entities.

Probe records show Ezeego did not disclose its first investment of Rs 80 crore in Redkite Capital in January 2018, in its audited balance sheets for that financial year.

Significantly, the second investment tranche of Rs 70 crore was made by Ezeego on March 30, 2019, after it had defaulted on its loan payment obligation to Yes Bank.

Cox and Kings was one of Yes Bank’s main borrowers when co-founder Rana Kapoor was in charge of the bank.

Cox and Kings was one of Yes Bank’s main borrowers when co-founder Rana Kapoor was in charge of the bank.

The bank that has an exposure of Rs 945 crore to Ezeego denounced the company’s account as a fraud to the RBI in February 2020.

TFCI, a publicly traded non-bank financial company (NBFC), was created in 1988 by IFCI Ltd as an all-India financial institution to finance tourism projects following the recommendations of the National Tourism Committee created with the support of the Commission on Planning.

In addition to Redkite Capital, TFCI’s other shareholders include IFCI (0.67%), LIC (3.73%), Oriental Insurance Co Ltd (1.07%), Tamaka Capital (Mauritius) Ltd (3%), and Koppara Sajeeve Thomas (5%). The general public owns about 30.74 percent of TFCI.

Significantly, TFCI is also one of the Cox and Kings lenders.

The bankrupt travel company owes approximately Rs 100 million to TFCI, according to data obtained from the Business Registry (RoC).

This loan was made to Cox and Kings before Redkite Capital became TFCI’s majority shareholder.

Records show that Redkite, immediately after acquiring the majority stake in TFCI, promised TFCI shares (as collateral) to raise Rs 85 crore from lenders.

Yes, the Bank now alleged that Ezeego “indulged in a criminal conspiracy” with Redkite and other connected entities with “intent to mislead” the bank and “fraudulently” divert money lent to Ezeego.

In addition to this, Yes Bank alleged that Ezeego One diverted approximately Rs 85 million from a Rs 450 million term loan granted in June 2017 and filed a falsified end-use certificate with the bank.

Both Redkite Capital and Naresh Jain, in an email response, said they had received no communication from Yes Bank and were unaware of any allegations made by the bank.

“We vehemently deny the allegations. We have maintained high government standards in our transactions,” they said.

When contacted, a Yes Bank spokesperson declined to comment.

Detailed emails to Ezeego and Ajay Ajit Peter Kerkar, the promoter of Cox and Kings, received no response.

Emails to Anil Khandelwal went unanswered.

Cox and Kings was sent to bankruptcy court in October 2019, after he defaulted on payments. While the promoter group owns 12.20 percent of the company’s shares, the public owns the remaining 87.80 percent.

The travel and tour company owes Rs 5.5 billion rupees to banks and financial institutions.

Last month, Ajay Ajit Peter Kerkar was summoned for questioning by the Directorate of Execution (ED), in relation to the money laundering case against Kapoor.

Kapoor, currently housed in jail, is accused of taking bribes instead of making loans to various companies that have now defaulted on payments.

(Tomorrow: how the audit reports, the bank accounts were allegedly falsified)

📣 The Indian Express is now on Telegram. Click here to join our channel (@indianexpress) and stay updated with the latest headlines

For the latest business news, download the Indian Express app.

© The Indian Express (P) Ltd