[ad_1]

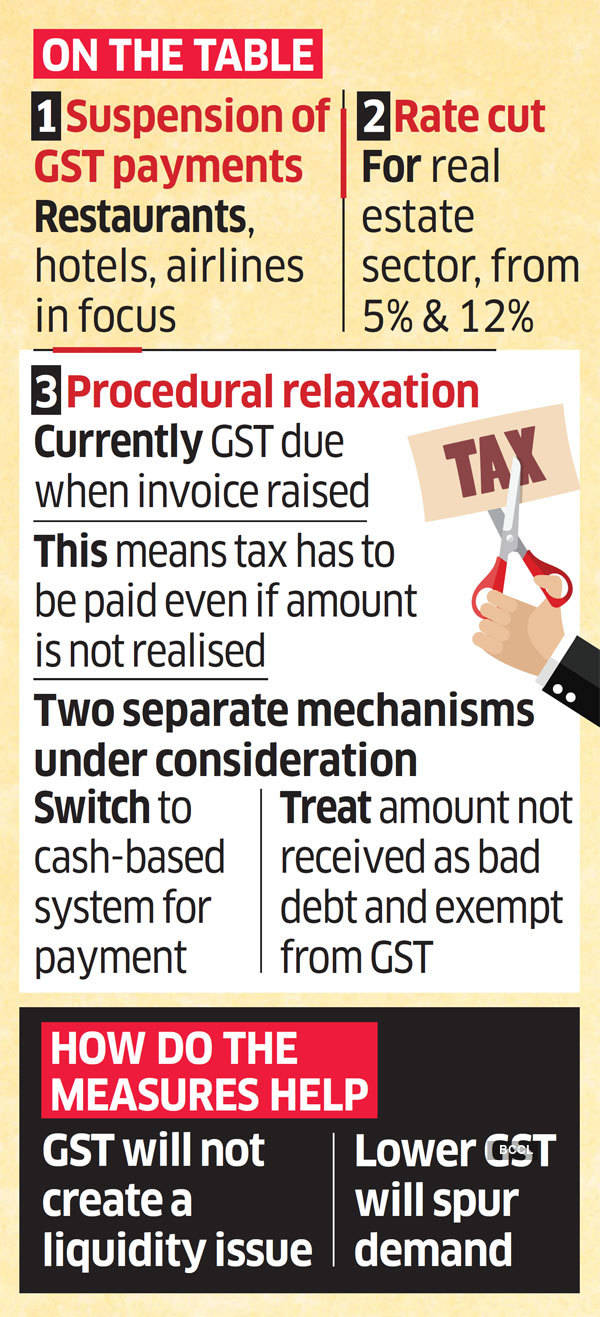

Other proposals include a change to a cash-based principle of collecting taxes from the current bill-based system and providing GST relief on sales for which payment is not received due to blocking by treating those as bad debts.

These measures are expected to ease liquidity pressure on companies that are short on cash, the people quoted above said. The GST Council will make a final decision on the proposals, which is the highest decision-making body of the tax.

“It is thought that for these service sectors, the government should at least save its dues,” a government official told ET.

The government may also consider exempting them from other legal charges for some time.

Although there has been a demand for a full GST exemption, the government is circling to see that suspending the tax will work better, the official said. Exempting a tax sector would mean breaking the credit chain, leading to more problems in the future.

Need for liquidity

A cash-based system will mean that companies pay GST when they get the money and not when the bill goes up, ensuring they don’t have to pay the tax out of pocket and squeeze out of working capital. This is more relevant for services where payment is received late after invoices are generated.

Most service providers face delays in customer payments, but face GST obligations. Another option is to exempt them from GST, treating them as bad debts.

“The idea is to provide some help to companies to overcome this crisis,” said a second official, adding that states are expected to support the move in light of the unprecedented economic situation.

Tax experts said liquidity is one of the immediate needs of the industry.

“Right now, the industry needs more liquidity and therefore postponement of GST payment for the next few months (interest free) should be considered,” said Pratik Jain, national leader, indirect tax, PwC.

While providing a selective exemption is an option, it often creates complications as entry credit is blocked, in addition to facing the rigors of anti-profit provisions, he said.

“Since the tax point at GST is effectively the billing problem, providers pay GST to the government before they actually collect it from customers,” said Bipin Sapra, an EY partner, endorsing a cash-based system.

[ad_2]