It wasn’t such a great start to the new year. S&P 500 SPX,

Fell 1.5% to start the trading year 2021, the worst single-day decline since October 28.

Maybe one day represents the trend. “2020 bought the rumor, and 2021 will sell the news,” wrote Kirk Spano, author of the Pte newsletter for Fundamental Trends.

He says it takes time for stocks to get valuation, even for zero interest rates. “Starting a company today is literally cheaper than buying a company. All of this could explain to SPAC, ‘he says, adding to last year’s demand for additional special-purpose acquisitions.

“Imagine a world without COVID-19 and huge Fed liquidity injections. 2020 could very well be a chopped year. Now, the sudden valuation is even higher and the economy has suffered a permanent loss that requires a longer reconstruction period, ”he says.

The Spaniards are told that the S&P 500 will reach as high as 500 chop, which is called a “shiny round numbered, budget,” – but the index will also fall to, 000,000 or less. In addition to consolidation, markets also need to isolate struggling zombies, companies that cannot meet their debt-service costs profitably, which account for 40% of the S&P 500.

The Georgia Senate membership could lead to an early decline if Democrats succeed, as investors start raising prices in taxes on the rich. But, he says, increased investment in infrastructure, education and health care will exacerbate that situation in the economy and stocks.

It is also called Bitcoin BTCUSD,

Treasury Secretary nominee Janet Yellen is sensitive to stricter regulation. “I don’t think governments and central banks will destroy Bitcoin, or can, and can, but they make life much, much harder and at a lower price,” he says. There is also competition from the digital dollar, the euro and the yen, which will have the support of the central bank. (Late Monday, the currency pt controller said Fis said U.S. institutions could use so-called stablecoins for payment activities and participate as nodes in the blockchain.)

Humming

Georgia holds its run-up elections for two Senate seats, the result of which is the U.S. Determines the control of the Senate. Analysts warn that nearby races will not be called for days.

U.S. And as the coronavirus situation in Europe continues to worsen, the UK is now closed by mid-February and Germany is expected to close by the end of January. As it appears mostly every day in the last three months, the U.S. set a record for hospital admissions at 128,210, according to the Covid-19 tracking project. As of Monday, the U.S. had 4.56 million inoculations, according to the Centers for Disease Control and Prevention, or 22% of those infected with the disease.

German biotechnology company Biotech BNTX,

Its partner U.S. Drug company Pfizer PFE,

There is no evidence that a delay in the second inoculation of their coronavirus vaccine will be effective even after three weeks, a step the UK has taken and Germany is considering, but the U.S. Is resistant to the Food and Drug Administration. There are also concerns that the so-called South African vaccine will not be effective.

Intercontinental Exchange ICE unit, New York Stock Exchange,

China Mobile reversed its decision to liquidate three Chinese telecommunications companies, including CHL.

Micron Technology MU,

The rise came as the microchip maker received a double upgrade from Citi ahead of its quarterly results.

The Institute for Supply Management publishes its December Manufacturing Report at 10 a.m. Eastern Purti. Loretta Mest, president of the Cleveland Federal Reserve, said there was no need to change monetary policy once markets closed.

Markets

U.S. Stock Futures ES00,

NQ00,

Flowed low. Gold GCF 21,

Rose, like oil futures CL.1,

US Dollar Ler DXY,

Went to the bottom, and yielded on the 10-year Treasury TMUBMUSD10Y,

Was 0.93%.

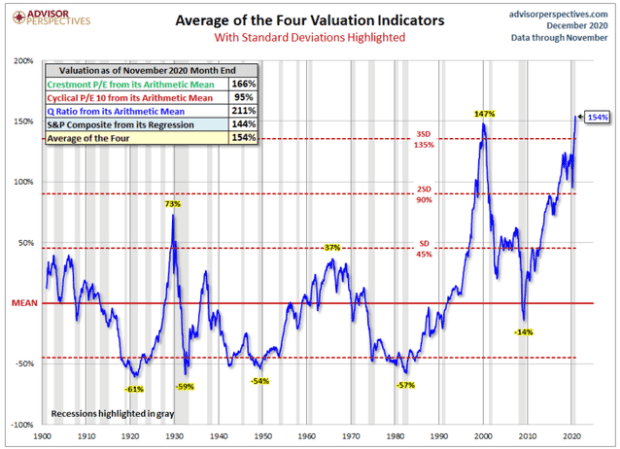

Chart

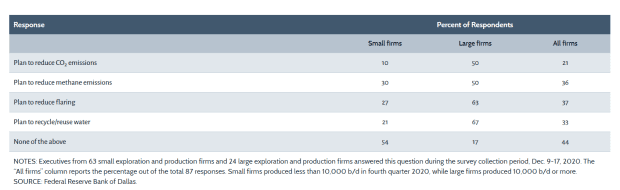

The Dallas Fed surveyed oil and gas companies in its territory on a variety of topics, including what they expect by the end of the year (between $ 45 and $ 55), including oil prices and their capital spending plans. The lack of environmental efforts despite pressure from investors in the sector is a taboo. Even in the largest companies – which produce at least 10,000 barrels a day – only half have plans to reduce carbon dioxide emissions.

A separate report from Bank of America found that institutional investors thought the oil-gas sector had the greatest opportunity for improvement in environmental, social and governance issues.

Reads randomly

Why Queen Elizabeth II always leaves the festive decorations of the Twelfth Night.

Where you can get a 20-year fixed-rate mortgage with 0% interest rate.

If you are reading this newsletter, chances are You are sitting down.

Need to know the initial start and update to the initial bell, but sign up here to deliver once to your email book. The emailed version will be sent out at about 7:30 p.m.

Want more for the next day? Sign up for Baron Daly, A morning briefing for investors, featuring exclusive comments from the authors of Baron and Marquette..

.