[ad_1]

Would you ask for a loan? Use the Money Center calculator!

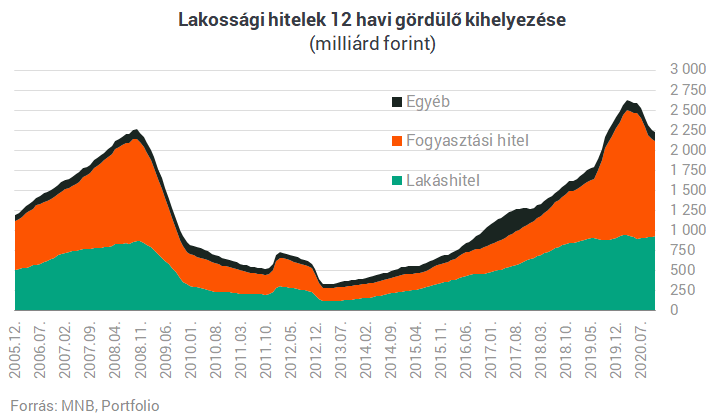

The Hungarian National Bank released the November credit and deposit statistics for the Hungarian banking sector this morning. According to the latest data, the outlook for the Hungarian retail loan market is confusing as

- in November, 11 percent more mortgage loanIt was picked up more than a year earlier, so in the first 11 months of 2020 there was a 2 percent annual increase in the amount of the new home loan contract despite the corona virus crisis.

- a personal loanon the other hand, they were 45% lower in November than a year earlier, so the first 11 months of the year saw a 40% drop in these types of loans

- a baby waiting for loanThe placement of these products was 19% less than a year earlier, so from July to November their placement was 38% less than a year earlier (the product did not exist in the first half of 2019), but at the end of November had a contract amount of HUF 1,044 billion and HUF 1,022 billion. the product.

Thus, the coronavirus crisis brought a strong setback in the consumer credit market at the same time as the lower behavior of consumption, while in housing credit we can only speak of a slowdown in growth. Before Christmas, the decree on the subsidized mortgage loan to reform announced by Viktor Orbán was also published, and the loan will be available in banks as of February 1. While our analysis suggests that this product will provide only a substantial installment advantage to low-income borrowers over renewal mortgages already on the market, it will undoubtedly provide an additional boost to home loan issuance.

Currently, second-hand homes make up the majority of new home loans, and it can also be said that loans with an interest period of 10 years dominate, their share exceeded 60% and the share of mortgage loans The floating rate fell below 1%.

What else is this article about?

- Credit market before the arrival of loans for subsidized interest renewals

- We haven’t seen anything like it in bank deposits in four years.

- Corporate loans played weaker

[ad_2]