[ad_1]

Your work for many years

Economists have long been concerned with the question of what exactly determines the evolution of exchange rates. At first glance, the answer is simple: the demand for a given currency and the supply of the currency determine the equilibrium price of the currency. Of course, supply and demand can be more often interpreted using currency pairs, so we can know how much a unit currency (eg euro) is worth in another currency (eg forint). The challenge is to explore exactly what causes fluctuations in currency supply and demand.

Of course, it doesn’t matter how long we want to explain the phenomenon. It is important to separate the weakening of the forint this year from the long-term processes, since 2020 can be considered a year of crisis. Therefore, we must first examine what determines the evolution of the forint price in the medium and long term, and since we can explain the continuous trend of depreciation that has lasted for many years.

Inflationary effects

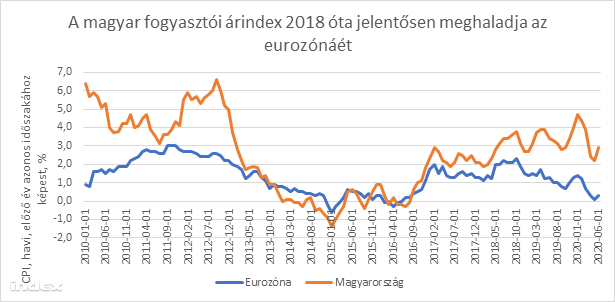

According to some ideas, the relative price of currencies (the exchange rate) Long-term it is determined by the different inflation rates in each exchange zone. The idea is also intuitive, nobody wants to have a currency that depreciates at a higher rate than other currencies. Projected to the Hungarian situation, we can say that if the price increase in Hungary significantly exceeds the price increase in the euro area in the long term, we can assume that the forint will weaken against the euro.

For most of the last ten years, price increases measured by the consumer price index have also been low, both domestically and globally. However, since 2018, a significant difference can be observed between Hungary and other countries in the euro area. While inflation in the euro area has been steadily declining to around 1% in early 2020, the value of the consumer price index in Hungary was around 4.5% in early 2020. The highest rate of price increase in Hungary can play an important role in weakening the forint.

The medium-term evolution of exchange rates can be explained by the so-called interest rate parity. The essence of the idea is that the evolution of currency prices is explained by the interest rates available in each currency zone and the difference between them. If higher interest rates are available in a given country, that country’s currency will strengthen (as long as the expected exchange rate is fixed). It is important to note that we are talking about real interest rates, so we must adjust to the effect of the increase in price levels.

Due to the loose monetary policy of recent years in Hungary, available returns were quite low. The Magyar Nemzeti Bank continually “injected” more money into the economy by lowering the base rate and through other instruments in its monetary policy toolbox, through which it achieved a continuous depreciation of the forint. The MNB, of course, opts for low interest rates to support economic growth, but one of the “by-products” of this is the forint exchange rate, which is continually weakening. The continued rise in inflation also lowers real interest rates, contributing to the depreciation of the forint.

Short term

In the short term, the evolution of exchange rates current account balance. For the sake of simplicity, consider only the external trade balance, which makes up the majority of the current account. The thing is very simple: as long as the value of the goods sold abroad exceeds the value of the goods bought abroad, the exchange rate of the forint strengthens. For example, if I sell abroad for 100 euros, but I only buy for 50 euros, I have 50 euros left, which I can exchange for forint to reinforce the forint exchange rate.

Hungary’s foreign trade balance has shown a continuous positive balance in recent years, except for one or two exceptional periods. It is worth seeing that the balance fell to a deficit of almost 200 billion HUF in April 2020, which coincides with reaching the all-time low for the forint. In the months after April, the foreign trade balance once again showed a positive balance, which will hopefully support the forint exchange rate in the coming months as well.

In the short term, the panic selling of forint assets can also affect the forint exchange rate. The phenomenon is explained by the fact that, in the event of a crisis, foreign investors will likely dispose of their Hungarian government securities, shares and investment shares earlier than their other safer assets (eg German government securities). Since the Hungarian economy is a particularly open economy with large foreign trade, fluctuations in the global market can greatly affect the country’s economic performance. In short, in a crisis situation, Hungarian investors, who are exposed to fluctuations in the world economy in extraordinary ways, may soon start to bail out their assets, which may result in the weakening of the forint. The process, of course, is not legal, and we saw many counterexamples during and after the 2008 crisis.

Finally, it is important to mention that the evolution of the forint exchange rate is significantly influenced by the expectations of international investors regarding the near future. Expectations can be largely determined by the way the central bank communicates and the monetary policy decisions it projects in its communications. The MNB communication reflects the fact that the central bank is committed to lax monetary conditions and, in the absence of an exchange rate target, will tolerate even further weakening of the forint. Communication from the central bank may have also contributed to the weakening of the forint in recent years and months.

Who hurts the weak florin?

The basic position related to the weakening of the forint is usually that it is a detrimental process, with the weakening of the forint, our compatriots who are on vacation abroad are doing it wrong as they have to spend more forint for one euro. The statement is correct, the vacationers are really bad with the devaluation of the forint, as are our importing companies of foreign products. Of course, the weaker the Hungarian currency, the more expensive a product priced in euros will be imported. The rise in prices in recent months can also be largely attributed to the fact that euro imports from abroad are becoming increasingly expensive due to the weakening forint. Thus, at first glance, we can say that the main “victims” of the weakening of the forint are Hungarian tourists and our compatriots who consume imported products. In 2020, there will be significantly more people in the latter group.

But the weakening of the forint also has winners. The first to be mentioned are Hungarian companies manufacturing abroad, which receive a significant part of their income in euros. They can benefit from the weakening of the forint as their forint-denominated income will increase. The matter is qualified by the fact that the goods sold abroad contain a significant amount of imported components, which can be measured by the share of imports. Almost 65% of the value added of the Hungarian economy has an import content. Thus, exporting companies lose part of the extra income they obtain on the income side due to the weakening of the forint due to more expensive imports. So give yourself the suggestion: let’s reduce the share of Hungarian exports! This requires that the added value of the national economy is increasing, even without imports, which leads us to a much more complex problem.

The winners of the weakening are also foreign companies whose revenues are denominated in euros, but which invest or employ their employees in Hungary. In his case, with the weakening of the forint, his euros are gaining more and more in the Hungarian market, the employment of Hungarian labor and investments here are becoming cheaper. This could be a significant competitive advantage for Hungary.

Finally, we must mention the Hungarian state as the big winner from the weakening of the forint. The budget receives subsidies from the European Union in euros, so with the devaluation of the forint, the amount received becomes more and more valuable after switching to the forint. Declining interest rates on foreign currency bonds owned by Magyar Nemzeti Bank, mostly denominated in euros and dollars, are also increasing in value after the switch to the forint. This is largely due to the fact that the MNB has proven profitable in recent years.

350? 360? How long does it weaken?

It is difficult to say a specific number when looking for the answer to the question of how long the Hungarian currency can weaken. Expert forecasts project a trajectory between HUF 350 and HUF 360, but a lot can happen during the rest of the year. Short-term, panic-like sales are very difficult to calculate, but perhaps all we can say is that without another drastic epidemiological tightening, the events of April are unlikely to repeat themselves.

All this, of course, does not change the structural phenomena that have existed for many years. If the central bank continues to refrain from tightening monetary policy, we can still expect the forint to weaken based on the aforementioned interest rate parity principle. It is also difficult to say with certainty how long-term inflation trends will develop, both in Hungary and in the eurozone countries. Of course, raising central bank interest rates could have serious consequences: tighter monetary conditions could easily delay the recovery of the Hungarian economy.

It is questionable whether central bank intervention is necessary to reverse the forint’s weakening trend. As we have seen previously, weakening has advantages and disadvantages. The central bank’s decision (whatever it is) will definitely put some players in an advantageous position, while others will fare badly. In economic policy, it is not uncommon for us to face value options. This is no different in the central bank’s response to the weakening of the forint.

Cover image: Currency exchange on Váci street on March 22, 2020. Photo: MTI / Márton Mónus

[ad_2]