[ad_1]

- For the first time in history, oil prices in the United States took a negative value on Monday.

- The direct reason for this is the coronavirus epidemic. Due to economic hibernation caused by games between major oil producers, shocks not seen since the 1930s affected the oil market.

- Demand has plummeted due to the crisis, but there are technical and political barriers to stopping production.

- Thus there was a big overproduction, the warehouses were full, it was worth paying for someone to take the oil from them.

- However, the negative price is a unique anomaly that results from the strange collusion of the coronavirus shock, certain characteristics of the US oil market. USA And unique events.

- However, market prices suggest that low oil prices will continue in the near future, but this could even have negative economic consequences.

Monday is likely to appear in several history and economics textbooks, when it was the first time that one of humanity’s most basic (so far) resources, oil, was priced at a negative price in the United States. As surprising as it has been, some analysts have been announcing it for a month.

It has figuratively happened that due to the coronavirus epidemic, the demand for oil has decreased dramatically after people, trucks, planes, etc. The producers, on the other hand, were not contained, so the warehouses were also full. Due to the brutal oversupply, in the end the producers had already paid the buyers, they only took the oil.

- Why did oil prices enter negative territory?

- Can you be happy with this?

- Will refueling be free?

Some people don’t have questions anymore, And there are those who read the Index.

However, this formulated explanation does not cover all elements of reality.

- On the one hand, it is not the price of “oil” that has turned negative, the anomaly has affected only a variety of US oil, while oil has sold and is selling at a positive (albeit low) price. across Europe and the Middle East.

- On the other hand, it was not the “price” of oil that turned negative, but the secondary market value of certain oil futures, which is also only in the last moments before the “monthly close”. What happened in Hungarian was that many traders realized later that they still didn’t need the oil they had bought before and couldn’t find it.

So it’s not like you can refuel for free soon – the negative price is a temporary anomaly born out of strange circumstances that has passed.

However, the episode also highlights the deeper problems of the oil market. These include Saudi Arabia’s desire for revenge, the ambitions of Russian President Vladimir Putin, the Siberian winter, and American innovation.

As a result, the oil market has been hit in recent weeks by a shock not seen since the 1930s, beyond the oil crises and the 2008 financial crisis. Because of this, oil is expected to remain Cheap in the near future, but it also has many potential negative effects that don’t necessarily make you happy about what happened.

What happened monday

Exactly what the negative price refers to and how it came about requires a little more explanation than the summary formula above. The starting point is that there are many crude oil products in the world and there are many oil markets with different regulations. Because of this, there is no “oil price”. The two indicative prices are Brent Oil and West Texas Intermediate (WTI) in the United States. The price of the first one, although it fell on Monday, remained around $ 26, the price of the WTI fell below zero.

The WTI market is concentrated in Cushing, Oklahoma, a city of just 8,000 people in the middle of nature, away from the seas and therefore from the world market. Its central role is due to the fact that at the beginning of the last century it was the site of a large oil field, so the American commercial infrastructure was built around it. Although the site has been developed since the beginning of the last century, the capacity of Cushing’s pipes and reservoirs is not something of steel (80 million barrels, or a week of production in the US), and even relatively small storage facilities. limited throughout the United States, which is one of the main problems of the current situation.

Another important note is that in the oil market, orders are typically future. Big corporations don’t buy oil by going to the well to refuel; rather, they agree in advance with the seller and commit to a specific quantity at a future date, at a previously agreed price. In addition to oil users in the market, of course, there are many traders and speculators who try to profit from price changes with futures, that is, they ideally buy an order for oil at a low price, which is transferred more expensive in case of an increase in prices.

The future nature of the market is a direct cause of Monday’s negative exchange rate. WTI futures contracts for acceptance in May close on Tuesday, which in practice means that anyone with a valid contract at that time must physically take over the oil ordered in Cushing in May. However, many of those with a valid agreement wanted to avoid this.

Not everything but

One reason for this, of course, is the decreased demand caused by the coronavirus. Because of this, refineries are not taking over crude oil, so storage capacities in Cushing and across the United States are saturated, and some traders have already been forced to it is good to rent expensive tankers for storage purposes only, and the charges have been recently thousand They escaped to $ 200,000. That is, it is not very possible to transmit the oil, but it is not even worth “maintaining” it, because with the saturation of the tanks, it can only be stored more and more expensive (and not at any time).

Photo: Nick Oxford / Reuters

The other reason is speculation. If customers don’t want to take over the oil (and speculators, of course, don’t want to take over), they will void their contracts or change the deadline to a later date. Because of this, the market always bounces back a lot in the lead up to closing, but things turned out particularly drastic on Monday. The main reason (in addition to the above) that most of the transactions in May in the past few weeks were purchased by private equity funds, the largest listed oil fund in the United States only bought a fifth of the transactions. However, the equity funds, feeling the problem, changed their positions from May to June in the days before closing.

Until now, the May prices have been maintained with money from the fund, the exit was as if the chair had been expelled from the market, which caused the panic of the remaining players. After that, there was no appreciable demand for May futures contracts even among the bloodiest speculators, even if they had, banks would be less willing to finance such reckless maneuvers in such dire times. Because of this, those who wanted to exceed their orders were also willing to pay in the final moments before Tuesday’s expiration for someone to take the oil from them because they don’t know what to do with it.

The end was that on Monday at the lowest point, WTI futures contracts were delivered for less than -40 dollars per barrel for their acquisition in May, the price at the end of the day Closed at $ -37.63. Meanwhile, Brent stood at $ 26, the average price of its fourteen major oil-producing cartels, the Organization of Petroleum Exporting Countries (OPEC), at $ 18, and a positive amount of $ 20 per barrel for the shipment of June. That’s largely the imprintthat the largest reservoir capacities are available globally and, unlike Cushing in the middle of nowhere, Brent and OPEC oil is much easier to dispose of in tankers or transport to remote reservoirs. Production outside the Americas will also help the slow recovery of the Chinese market.

However, despite being well above $ -37, they are also extremely low compared to recent prices, indicating that this is not just an isolated US affair. USA World oil production is currently 100 million barrels, but consumption is estimated at around 65-80 million barrels due to economic hibernation caused by the coronavirus. According to US analysts in the Wall Street Journal, the drop in demand in recent weeks has outpaced the drop in demand between 1979 and 1983 after the second oil crisis, both in terms of volume and percentage; more recently, it was in the 1930s that the balance between supply and demand shifted so abruptly and severely.

They can’t turn off the tap

According to industry analysts, 60 percent of the global storage capacity loaded at 6.8 billion barrels is already full, with deposits in the Caribbean, South Africa, Angola, Brazil, and Nigeria. Cushing could fill in May, according to current trends, the US strategic reserve. USA It can still hold 75 million barrels, but can only be replenished at the rate of half a million a day. The question arises whether they cannot sell or sell, why pump oil.

This is also hampered by technical and political barriers. The technical limitation is that oil production is not particularly flexible, at least for two of the three largest producers in the world. In Russia, most of the oil wells are located in western Siberia, where frost predominates for most of the year, and the ground becomes swampy in summer, making it even worse for oil drilling. Because of this, on the one hand, it is quite expensive to drill there; On the other hand, the well cannot be closed just because it freezes gently for most of the year, and the frozen well cannot be restarted, but a new one must be drilled. Therefore, for the Russians, a significant cessation of production is quite expensive.

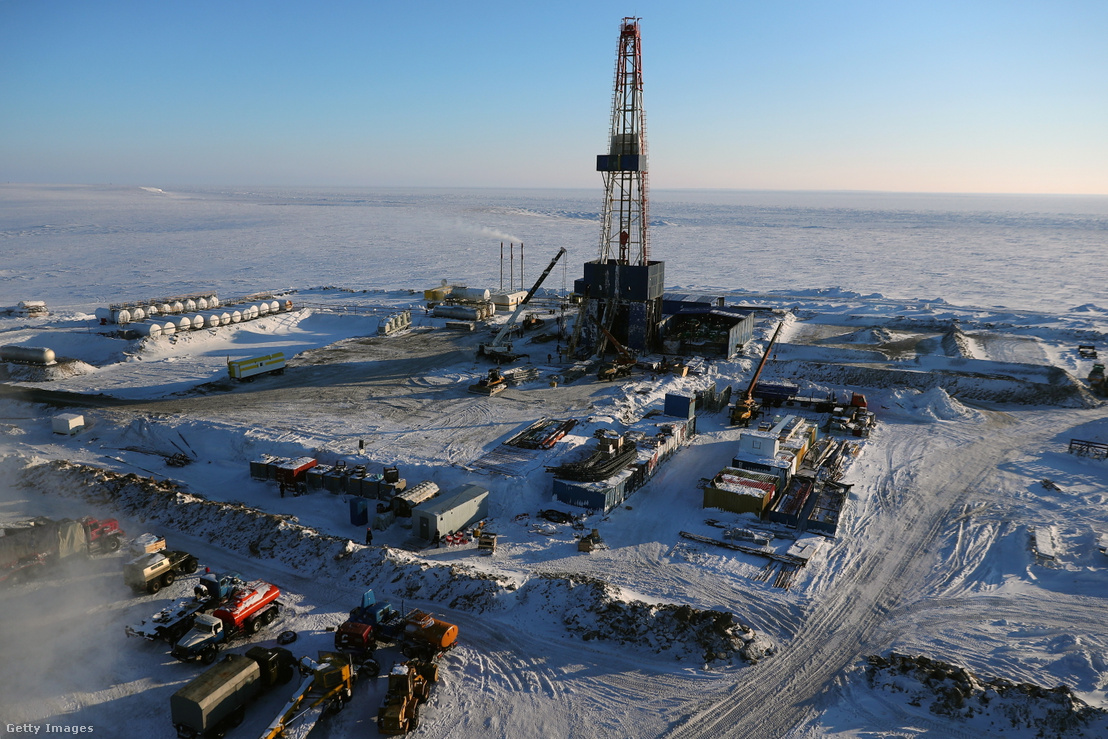

Photo: Vladimir Smirnov / Getty Images Hungary

The other protagonist in the story is the US oil shale industry, where the situation is similar. Oil shale is an extremely difficult-to-reach oil “grain” found in very small amounts in rocks with little permeability deep into the earth. They are drilled horizontally into the rock and then cracked with a mixture of water, sand, and chemicals, causing oil to drain out of the rock and out to the surface. Although such wells can be closed, it is also extremely complicated and expensive, and there is a risk that irreversible damage to the site will be caused if you make a mistake. Because of this, producers are reluctant to step on suffocation if they don’t have to, and in the short term they prefer to sell oil at a negative price because the cost of sealing may be higher.

The protagonist of the story, Saudi Arabia, is in a much easier position: oil is very easily and inexpensively available in Saudi fields, its wells can be closed relatively quickly and inexpensively and reopened if necessary, and they are also more flexible in terms of storage capacity. They, on the other hand, are only moderately willing to curb production.

prisoner’s dilemma

This is where the political implications of the thing come into play. Traditionally, the oil market has not been driven by market principles but by negotiation and the fight for interests between individual producers. The wars of interest continued with austerity between the turn of the millennium and the 2008 financial crisis, when the demand for oil steadily increased due to the Western credit-fueled uproar and the rapid development of China, causing a steady increase in prices, losing $ 160 a barrel before the crisis. Because of this, they all produced as they fit into the pipe, with no particular shocks.

Oil prices collapsed in 2008, when consumption plummeted during the crisis, as it does now. But then, after a good year, the market came back to life, the price retreated, bouncing between $ 90-120, until it broke again in 2014. This was due, on the one hand, to a decrease in the appetite of the developing world and China already a persistent weakness in western consumption. On the other hand, there has been a significant expansion in supply: High oil prices have triggered a revolution in innovation in the United States after making a range of technology solutions that previously would not have been worthwhile. This is how the aforementioned horizontal fracturing technology was created, thanks to which US production increased from five million barrels per day in 2009 to 9.5 million barrels in 2015, and then, after a small decrease, to 13 million barrels in February this year. With this, the United States became the largest oil producer in the world.

This greatly annoyed the Saudis, who feared their global market share of 12 to 13 percent. Therefore, despite the fall in prices, they not only did not restrict their production, but even increased it. Since oil shale oil extraction is much more expensive and cumbersome than desert drilling in Saudi Arabia, they wanted to bankrupt the Americans by flooding the oil market. This increased the loss of income for the other oil producers, so they were also forced to increase production, further exacerbating the drop in prices. So, in the end, the opposite of the pre-2008 process occurred: demand growth stopped, production grew feverishly, everyone was at war with everyone for the market.

Although the Saudis’ strategy didn’t come at the time, there still seems to be speculation that they may last longer among the bigger players, so others, especially Americans, throw in the towel earlier. In the midst of a global crisis with oil prices near zero, many smaller US producers will file for bankruptcy within near deadlines, or be forced to clamp down on their wells to avoid bankruptcy, just as Venezuela or Canada, which produce Low quality heavy oil will not be profitable.

I need the money

The situation is complicated by the fact that the depletion of oil money also does not benefit the Saudi regime, since it is practically its only income to support the people, and many purchases of American weapons and many wars in the Middle East. But the situation is similar in Russia, where oil remains the dominant export product, and where Putin also finances social spending, pensions, and various war adventures with oil revenues.

As a result, OPEC led by Saudi Arabia, the Russians and some smaller players have been forced to agree to a production cut of 9.7 million barrels per day that will take effect in May (which partly explains why the price of WTI June futures remained much higher than in May.)

The deal was also endorsed by the President of the United States, Donald Trump, a great admirer of the oil industry. Last week, 13 percent of US wells were closed, and the only U.S. regulator, the Texas Railways Committee, which oversees production in Texas, will discuss a 20 percent cut on Tuesday (the Railroad Committee oversees oil production, of course, for historical reasons, as in Cushing’s role). too).

Trump also promised state aid to small producers to close wells and weather the crisis. It is about whether the plan has the support of the lower house of the Democratic legislative majority: the left harshly criticizes the hydraulic fracture for environmental reasons, but in an election year, in the midst of a global economic crisis, it is more difficult to say no to the labor and commercial rescue. The industry estimates that for oil prices below $ 30, at least 70 US companies and less than $ 20, 140 companies may fall within a closed time frame.

Enough to?

The other more important question is what will it be enough for. With a drop in demand of 20-30 million per day, a production restriction of 10 million barrels is not enough. Meanwhile, the recovery of the economy is likely to take longer in the western world and is not complete: although speculation about future revolutionary changes may be premature at the moment, many analysts believe that a lasting decrease in air traffic is needed. and automotive. Was expected. Since the convergence sector accounts for 60 percent of oil demand, this poses long-term problems.

However, current industry forecasts suggest that the situation will soon reverse. The suffocation and bankruptcies of the smallest players will reduce production and, as consumption recovers, the shortage will develop and oil prices will increase again over time. The other possibility is that the crisis will continue and consumption will remain stably low. WTI offers in May 2021 are currently around $ 35 a barrel, so the market is currently appreciating that there won’t be a big increase for a year yet.

This, in turn, is not necessarily useful. Cheap oil is basically good for oil importers, since the price of energy is one of the most basic costs that is included in almost all products in some way. However, emergency birds have already said in previous price declines that deflation could have a detrimental side effect: if falling oil prices drive prices down and the price index begins to drop, people will postpone their purchases and companies will postpone their investments, hoping. that with the fall in prices, they can buy the same cheaper in the future. However, this is holding back economic activity: if people don’t consume and companies don’t invest, the economy won’t spin, leading to layoffs and wage cuts, further reducing consumption and investment, and so on.

The long-term effects of the coronavirus crisis can be guessed even in its many weeks, but one thing is for sure: wherever WTI and Brent prices go, gasoline will not be free in the wells and the average consumer will not feel the temporary drop in prices on Monday: since a significant portion of the price of gasoline (exactly $ 125 at an oil price of less than $ 50) is a consumption tax, and another significant portion is subject to VAT, which is not below 200 unless one makes a pilgrimage to Cushing with a can and a futures contract taken on Monday.

(Cover image: Oil flashes in an Iraqi oil field in the foreground of a man in a coronavirus epidemic due to a medical mask in March 2020 – Essam Al Sudani / Reuters)

[ad_2]