[ad_1]

However, the situation in the media market is constantly changing: if you want to support quality business journalism and want to be part of the Portfolio community, subscribe to Portfolio Signature articles. Know more

Despite only a few weeks left until the British government concluded a free trade agreement with the European Union, Boris Johnson engaged in a risky game to improve his negotiating position, threatening the nightmare of exiting the agreement. This is, of course, terribly bad news for the auto industry on both sides of the English Channel, a scenario that was long considered unthinkable and then sought to draw the attention of decision makers to its risks.

It’s no coincidence that the biggest headache for automakers and their advocacy organizations has been and continues to be caused by unconventional Brexit. The worst case scenario would be a real disaster for the automotive industry, for two fundamental reasons:

- Just-In-Time Manufacturing Principle and Strategy Used by Automotive Manufacturers

- And the duties payable on the products

A significant part of the parts needed for production are sourced from abroad, mainly from Europe, by British car manufacturers, who can then use them to assemble their finished vehicles. However, in the spirit of the Just-In-Time production organization and inventory management strategy, they only stock enough parts in their factories for a short period of time to save significant costs. This system is sustainable, since the customs union of the European Union guarantees the smooth and continuous flow of goods. However, in the event that the British leave the European Union without an agreement and, as a result, each element has to be liquidated, the system that has just been introduced will immediately collapse.

Without a deal, it would also be a real disaster for car manufacturers if trade between the UK and the European Union was automatically governed by the rules of the World Trade Organization. Under the general rules of the WTO, the EU would treat the UK as a foreign country after the end of British membership in the EU, in the absence of a bilateral free trade agreement with London, in which case 4.5% for vehicle parts and 10% for UK car imports. and impose a 22 percent tariff on commercial vehicles. Of course, the British would be forced to take the same step for EU products.

THE DEPARTURE WITHOUT AN AGREEMENT COULD BE AFFECTED BY THE SUPPLY CHAIN FISHERIES AND THE SIGNIFICANT INCREASE IN PRODUCTION COSTS IN THE UNITED KINGDOM, IN THEIR PRICES

Tariffs on European Union vehicles would also lead to significant price increases, as several automakers have previously stated that they will pass the resulting cost increase on to customers. And for the nightmare to be complete, it would also imply greater administrative burdens for those involved.

We can talk about significant exposures in both directions.

This is also a big risk because the UK car market is extremely important, as is car production for the European Union and vice versa. About 2.2 million of the new vehicles sold came from the European Union, which accounted for 81% of total UK car imports in 2019. And the British have produced nearly 807,000 vehicles that have been sold in the Union European Union, accounting for 18 percent of EU vehicle imports, according to a recent analysis by the Association of European Automobile Manufacturers (ACEA).

Similarly, there were large volumes of auto parts trade between the two parties: around 80 per cent of the auto parts imported by the UK came from the EU, while 16 per cent of the auto parts imports in the European Union came of the island country. To all this, it is important to add that in the UK, various manufacturers operate around 33 motor and car factories, and that a serious network of suppliers has been established in the country. Thus, the British car industry employed some 823,000 people last year, of which it is estimated that at least 10 percent were workers from other EU countries.

It is also worth summarizing the above figures, the figure below shows the UK’s most important partners in the auto and auto parts trade. Germany, of course, leads by towers, followed by Belgium, Spain and France. These four players alone exported € 39.3 billion worth of cars and parts to the island nation, while goods worth € 11.1 billion came from there.

A $ 110 billion defection could be the end of the political game

Looking at all of this, it’s easy to understand why industry players are desperately trying to get hold of all existing tools and use renewed vigor to warn decision makers about the harm they can do with their irresponsible behavior.

The Association of European Automobile Manufacturers (ACEA), the Association of European Automobile Suppliers (CLEPA) and 21 other automotive organizations have issued another statement stating that if the British withdraw from the European Union without an agreement and as of January 1 from 2021 the WTO introduced by the general rules come into force, the increase in prices, the decrease in demand will lead to

WITH 3 MILLION VEHICLES, THEY COULD BUILD LESS IN THE NEXT 5 YEARS.

All of this is calculated by advocacy organizations

110 BILLION EUROS (COURSE 39 380 BILLION HUF) WILL CAUSE A DECREASE IN TRAFFIC BETWEEN THE UNITED KINGDOM AND THE EUROPEAN UNION.

The uncertainty surrounding the exit has caused enormous damage thus far, and the coronavirus put a shovel on it

We have written in detail several times before that Britain’s exit from the EU and the uncertainty about the final outcome of the subsequent series of negotiations will cause significant damage to the island nation’s economy, especially the legendary British auto industry, which is practically collapsing before Brexit. .

The emergence and rapid spread of the coronavirus further exacerbated the situation, with big bad news coming from the island’s auto market for months. This is why many became optimistic when looking at car sales in July, as it turned out that for the first time in a long time, the UK car market had expanded by more than 11 per cent. Looking at the sales figures, there was hope that perhaps the deep flight would end and car sales would start to pick up again.

August sales figures released by the British Automobile Manufacturers and Dealers Association (SMMT) quickly disproved all of this, with just 87,226 passenger cars registered last month, down 5.8 percent from August 2019.

Taking into account the entire year so far this year, it can be said that a little more than 915 thousand cars were sold, which represented a decrease of almost 40 percent compared to the same period last year.

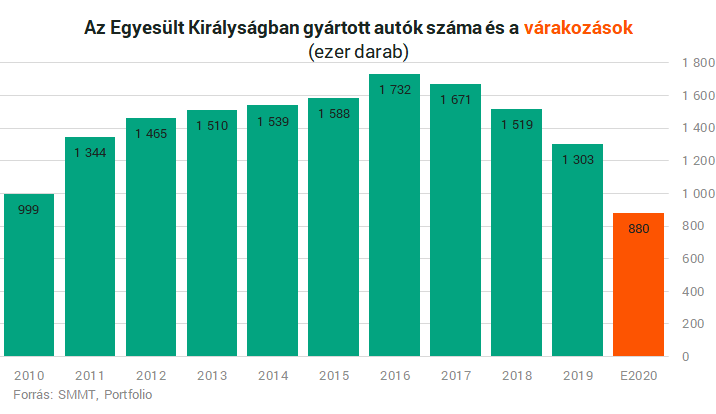

It’s also worth noting that SMMT has significantly cut its forecast for this year ahead of the March sales figures – they believe 1.73 million cars could be sold, a contraction of about 23 percent in the second car market. largest in Europe.

The British car industry has also found itself in a very difficult situation, with the latest statistics showing that 85,000 696 cars were manufactured in the country in July, 51% more than in June but 21% less than in July last year. . It’s also worth remembering that only 197 cars were produced in Britain in April due to the coronavirus epidemic, the lowest since World War II.

In the first seven months to the end of July, 39.7 percent fewer cars were manufactured than the previous year. The decline slowed somewhat compared to a six-month decline of 43 percent in the island nation.

The slowdown in the global car market, the uncertain outcome of negotiations with the EU and the coronavirus epidemic combined have meant that British carmakers are not expected to use half their production capacity this year.

It should also be noted that not only is the British car industry in a difficult situation, European manufacturers are also going through a very difficult period. The strict measures taken to prevent the unexpected outbreak of the coronavirus epidemic and the spread of the epidemic have really shocked the sector in the past. While the recovery is well under way and the production figures and backlog for the second half of this year may generate confidence in the future, this does not change the fact that 3.6 million fewer cars are expected to be produced. in Britain and the European Union combined by 2020 than a year earlier.

The dramatic decline in demand for automobiles has also resulted in significant overcapacity in the automotive industry, in response to which many players have embarked on a degree of transformation that will lead to factory closures and job losses.

The responsibility of politicians is therefore enormous, as it could reinforce the aforementioned unfavorable processes by unrequited Brexit, causing further serious damage to one of the most important sectors in Europe.

Cover Image Source: Peter Byrne / PA Images via Getty Images

[ad_2]