[ad_1]

750 dollars, that is, 233 thousand guilders at the daily exchange rate. It’s a little less than the Hungarian median net salary, but in the US you need more than one and a half times as monthly income so that a person living alone is no longer below the poverty line.

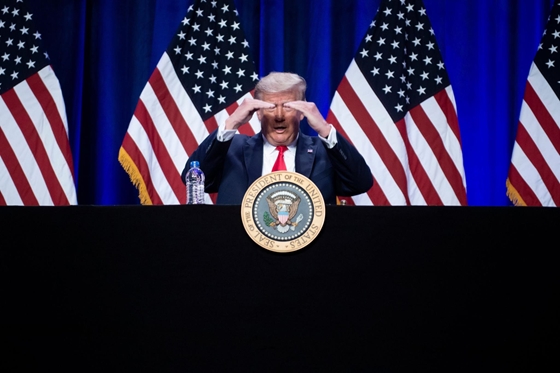

And that’s the amount of taxes Donald Trump paid in the first year he was president of the United States.

This is exactly the figures published by The New York Times: in 2016, when Trump became president, he paid $ 750 in taxes and another in 2017. In 10 of the previous 16 years, he did not tax a single dollar.

It’s worth knowing why all of this matters to Americans: Politicians aren’t required to publish their tax returns there, but since 1976, everyone who has become a major party presidential candidate has. Also, it is not possible to pretend in the same way as with Hungarian property returns, where tax returns have been made public, where there are consequences if they lie. So we know that both George W. Bush and Barack Obama paid more than $ 100,000 a year to the tax office as president, or that Democratic presidential candidate Joe Biden and his wife paid $ 1.5 million in 2018. After 44 years, in 2016, Trump was the first to not publish his data. Now, however, The New York Times has, so we can see how Trump’s finances played out before he became president and in the first year of his presidency. The long and complicated set will be discussed in depth, but to put it very simply, the point is:

Donald Trump’s accountants have been deciding for decades that the company’s empire is producing massive losses, so Trump has almost entirely avoided paying taxes.

© AFP / Brendan Smialowski

The beginnings

As early as 2018, the New York Times wrote that Donald Trump, at the current exchange rate, had received $ 200,000 a year in family businesses since 1949; You probably didn’t have to work too hard to get there since you turned three that year. He hadn’t been able to prove why since then, but it certainly had something to do with his father, Fred Trump, trying to cut his paper earnings after his real estate business. Beginning in the mid-1960s, the grown-up Donald became a paid employee of his father’s company, while his father also paid him as a consultant. According to the newspaper, Trump also helped his parents value their properties worth hundreds of millions of dollars. So when Fred Trump died in 1999 and his wife, Mary Trump, in 2000, their children inherited more than $ 1 billion by having to pay $ 52 million in taxes instead of $ 550 million. This is the point where the now published NYT article picks up the thread and examines what happened to the property after 2000.

By then, the Trump family, led by Donald, had already found the technique, which later became one of the keys to zero tax returns. The US tax system allows a business to suffer a large loss if it can be accounted for over several years under certain conditions, which means that it will have to pay less tax for a long time. Trump reported a loss of $ 916 million in 1995, allowing him to reduce his tax liability for 18 years, often to zero.

It was worth the loss

Donald Trump with his wife, Melania, and their son, Barron, in 2007

© AFP / Gabriel Bouys

For Trump, the real gold mine was the NBC reality show, The Apprentice. She had an unusual contract with the show’s producers, in which it was agreed that half of the profits would be her; That amount eventually turned into $ 197 million, which is more than the $ 178 million he made by investing in other companies. What was even more significant was that seeing the success of the program and Trump’s personal reputation, several companies, mostly moving into the real estate market, paid a total of $ 230 million to use the Trump brand.

But with that lost money, the tax documents said Trump had turned it all into an investment that did not benefit him. All in all, on paper, the business empire closed the years 2000-2018 with a loss of $ 174.5 million. His golf courses had a loss of $ 315 million, but his luxury hotel in Washington also fell by $ 55 million, and the Trump Corporation real estate company reported a loss of $ 134 million, at least on paper. In the meantime, though, he bought new golf courses in a row and built hotels, suggesting that for some reason it paid off for him.

According to the New York Times, the method was to transfer money from other stores to these investments and then remove the loss documents.

The apprentice was a financial success for Trump after 2005 who, for the first time in a long time, failed to bring his companies to a halt. In 2005-2007, he paid a total of more than $ 70 million in taxes. It couldn’t have stayed that way – it had a total loss of $ 1.4 billion in 2008 and 2009, largely due to its investments in casinos. And it wasn’t enough that he was tax-free again, even claiming $ 72.9 million in taxes already paid. Since then, the tax authority, the IRS, has begun to investigate your finances more closely; the investigation is still ongoing.

Other financial tricks also appear in the newspapers. Between 2010 and 2018, he paid approximately $ 26 million in Trump consulting fees, which can be written off from the tax liability. It is not necessary to reveal who receives these awards, but at one point the mystery was leaked. The Trump Organization paid someone $ 747,622 to advise it on a hotel project in Vancouver and Hawaii; The amount hit journalists because the president’s daughter, Ivanka Trump, received $ 747,622 for two consulting jobs that same year.

It is also common for Trump to describe his travel or meals as a business expense, but the $ 70,000 he paid for his haircuts was reserved that way, too. Looking at Trump’s hairstyle, it’s hard to imagine when the money went, yet it was still less than the nearly $ 100,000 paid on Ivanka Trump’s hairstyling bills.

I needed the presidency

The tax authority investigation and The Trainee’s increasingly modest earnings put Trump in a financially awkward position in the mid-2010s. His personal brand has sold off a bit of marketing; If it hadn’t been good for anyone to run for president, it definitely would be. When he realized that there are far more options in his campaign than playing a political reality show is unknown. It seems certain from the tax returns that, as president of the United States, he and his family were involved in many businesses that a politician would be more ethical to lose.

The Trump Organization operates several luxury hotels abroad where diplomatic events were held, with little revenue, and there are also many people in American hotels and golf courses who want to pressure the president in person. Trump’s club membership fee in Mar-a-lago, after 664,000 followers in 2014, already generated 12 million in revenue in 2017. Income from renting an office building on Wall Street nearly doubled at the time, and The NYT said that not only revenue but also the number of tenants increased after Trump became president.

Sea-to-lake

© AFP / Mandel Ngan

Debts are threatened

The tax investigation started after 2009 is nearing completion. If Trump is found to have wrongly raised $ 72.9 million, he will have to pay it back with interest and a penalty, so the final amount could exceed $ 100 million.

But that’s only a small part of the debt tower that could fall on Trump in the next few years. In 2012, he obtained a $ 100 million loan for Trump Tower ad space and withdrew almost the entire amount. Since then, it has paid $ 15 million in current interest installments, but in 2022 it will have to pay the total principal debt of $ 100 million.

And if all that wasn’t enough: according to his tax documents, his companies have taken out a total of $ 421 million in loans for him to be personally responsible for paying the money back, most of which he will have to pay back in 2022. If not. does, you can start the execution against him. We can’t say that this is any more difficult to do than a sitting president, but it sure would be unprecedented.

What can come now?

Alan Garten, a lawyer for the Trump Organization, told the New York Times that Donald Trump had “paid millions in personal taxes.” This statement is certainly true, but it is not what the NYT article was about. What the lawyer is talking about means that the president pays for health insurance or pays taxes right after his domestic employees. The NYT did not write about these, but about Trump companies that hide their income from the federal tax office.

| Nixon became an avid Trump supporter |

| It is no coincidence that American presidential candidates have been publishing their tax returns since 1976. In 1973, Richard Nixon also had more problems than his tax affairs, but as a side effect of the Watergate scandal, it turned out that in 1970, he paid only $ 792 81 cents in taxes. That’s a little more than what Trump paid 46-47 years later. |

Trump yells fake news and says he cannot publish his documents while the IRS investigation is ongoing, that is not true. The NYT dropped the charges less than 40 days before the election, two days before Trump and Biden stood for their first presidential candidate debate. By 2016, Trump had to answer such allegations, even if there were no detailed figures on tax evasion. It was then that he said that he was such a skillful businessman that he could keep the income, other times he replied that it was a lie, that he was paid taxes correctly; his enthusiastic supporters were not bothered by the fact that he was obviously lying.

It is also unlikely now that anyone who forgives Trump for the scandals of the past four years and calls coronavir insignificant will walk away from him over a complicated tax issue, with 38 to 40 percent of American voters voting for Trump, pass whatever happens. But with them alone, there is no choice. Joe Biden’s popularity in the states where the election will be decided is now measured at 50-52 percent, and Trump’s at 46-48, meaning that if Trump were to win over precarious voters on his own, it wouldn’t be enough. , even more of Biden’s current supporters. should be drawn into his own field, such scandals make it more difficult.

[ad_2]