[ad_1]

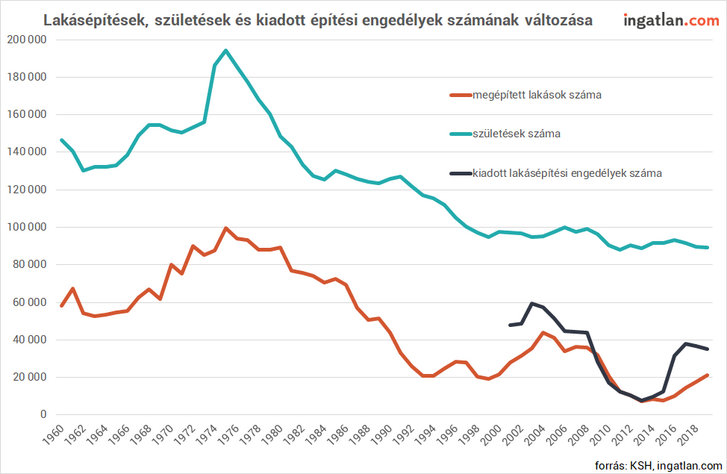

Although in Hungary at least 30,000 new houses are needed to maintain the state of the housing stock and even more to renovate it, the market has not reached this level in a long time. The number of new homes has increased in recent years, but late last year, with the farewell to the discounted housing tax, the mood to build became more restrained. This is evidenced in the latest analysis by ingatlan.com, which examines the market based on more than four thousand new home listings.

When how much?

According to this, during the last two decades, an average of almost 24,000 new homes have been built each year, but the picture is somewhat misleading because there was a really serious boom in the 2000s. In 2004 and 2005, the stock expanded by more than 40,000 new homes, and the last time there was an example of a level above 30,000 was in 2009.

However, the current credit and economic crisis deepened the real estate market, including the new real estate market.

– said László Balogh, the main economic expert of ingatlan.com.

The lowest point was in 2013, when slightly more than 7,000 apartments were delivered, but in 2019 more than 21,000 have already been delivered. So even so, the market is far from the 30,000 level needed to maintain stock quality. On the other hand, in recent years, investors have renovated a large number of apartments, which is a positive factor.

Ideas, plans: what is a 0 percent loan like?

The situation in the new home market may change in the future through planned new home construction programs. The rust zone housing program is imminent, under which thousands of new homes can be built in large cities with reduced VAT. Recent statements from government and economic decision makers suggest that the government or possibly the central bank may take more steps to encourage construction. According to the idea presented by the Governor of the Central Bank György Matolcsy with the participation of the Magyar Nemzeti Bank

New builders and buyers of green homes could get a 10-year 0 percent loan.

The central bank governor urges a change in housing policy. I would give a 0 percent loan to build green homes.

The program, which currently exists only at the plan level, could also stimulate supply and demand, as home developers could be involved in this as well. According to the calculations of money.hu belonging to the ingatlan.com group, in the case of a 10-year fixed-term mortgage loan of 10 million HUF with an interest rate of 3.62%, the monthly payment is currently 99,000 HUF and the total amount to be reimbursed is HUF 11.9 million. In the case of zero interest, the monthly fee would change to approximately HUF 83,000, provided that no commission is charged for loans to the facility.

In addition to the plan outlined by the governor of the central bank, Katalin Novák, who was appointed minister responsible for family affairs from October, also indicated that in the future a broader housing construction program could be launched.

Katalin Novák, who was nominated for the position of Minister without Portfolio for Families, presented her ideas on Friday.

László Balogh said that the increase in housing construction is also extremely important to strengthen the supply side of the new housing market. Without it, the additional subsidies would only drive up prices. Encouraging housing construction, on the other hand, can also promote economic expansion through construction performance and the jobs created.

Country price summary

We must wait for the details and the launch of the different state programs, so that for the moment their impact can be predicted. However, analysis by ingatlan.com shows that transition programs are becoming more and more timely as supply in the new housing market shrinks. About 3,000 new flats and single-family houses were put up for sale in the capital, worth 871,000 HUF per square meter in mid-September. Most of the new flats and single-family houses in the capital are in III., XI. and XIII. district.

- Although the market for new flooring has increased in recent years, fewer than the 30,000 needed to maintain and renew the quality of the stock have been built.

- At the lowest point in 2013, just over 7,000 new homes were delivered, up from more than 21,000 last year, but it is still below the 24,000 average of the past two decades.

- In the market for apartments and new houses, almost 3,000 properties are waiting for sale in Budapest and almost 800 in large rural cities.

- The average price per square meter of new homes in the capital is 871 thousand HUF. The same is 612 thousand florins in Debrecen, 683 thousand in Kecskemét and less than 500 thousand florins in Győr.

Almost 800 new houses and flats await owners in large rural cities. Debrecen, Győr and Kecskemét have the largest offer. The average square meter of new homes in Debrecen is 612 thousand HUF, that of its peers in Győr is less than 500 thousand HUF and that of Kecskemét is 683 thousand HUF. According to the expert from ingatlan.com, the data shows that the market for new apartments has started to close between Budapest and other large cities.

(Cover image: Construction on Taksony Street in 2019. Photo: László Róka / MTI)

[ad_2]