[ad_1]

Shortly after opening, the price of OTP fell sharply and the price of bank securities fell more than 6 percent.

The business volume is outstanding, so far OTP was traded in the first minutes of trading for an amount of HUF 2.2 billion, such business volume usually develops in the OTP market until the afternoon.

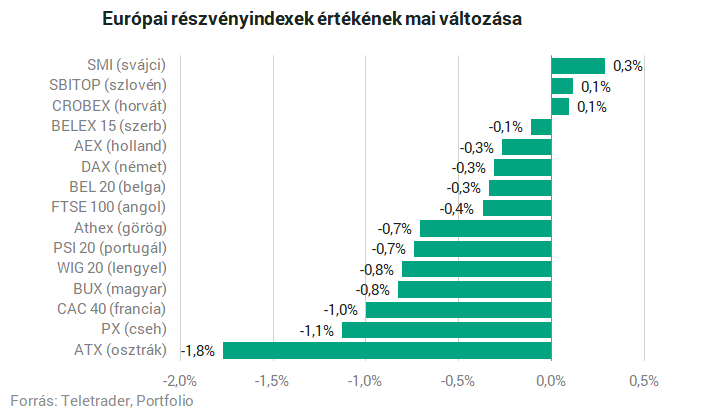

The fact that trading on the European stock exchanges started pessimistically only partly influences the fall.

The fact that the technically and psychologically important level of HUF 10,000 has dropped is also behind the drop.

By the way, the OTP exchange rate has been in a downtrend for months, the top of the downtrend channel was last touched early last week, that’s where the change came from, the decline has accelerated today .

New information was received over the weekend about the extension of the loan repayment moratorium: For parents raising children, retirees, unemployed, public employees and businesses experiencing a drop of at least 25% in income, the The government will extend the loan repayment moratorium for another six months until mid-2021 and imposes a ban on the termination of credit contracts for half a year, Prime Minister Viktor Orbán announced on Facebook.

The mood in the banking sector is also well illustrated by the results of last week’s 2020 public lending conference, where 6 out of 10 voted that annual earnings will be lower than in the first half, meaning that credit institutions will have losses in the second semester. This may be primarily due to an increase in loan impairment.

Regarding the issue of lifting or extending the payment moratorium, the figure below is interesting as it shows that in mid-2021, as a result of the crisis, the relative majority of conference voters expect a moderate increase in the default rates of 4-8%. in loans to the banking sector.

Cover Image: Akos Stiller / Bloomberg via Getty Images

[ad_2]