[ad_1]

As employers plan to increase or reopen, some are realizing that low-to-middle-wage workers may not want to be called back because they are making more unemployment money than they worked, thanks to the additional $ 600 per week that everyone is unemployed. You are receiving from April through the end of July from the federal government under the Care Act.

A handful of Republican senators, including Lindsey Graham of South Carolina, threatened to suspend the Care Act, saying that giving people more than 100% of their wages could create “a strong incentive for employees to be fired instead of go to work”. They all ended up voting for the bill.

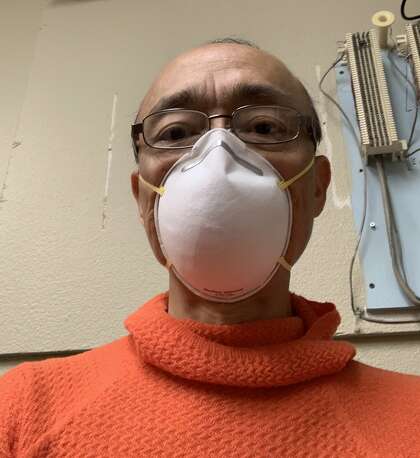

Dr. S. William Chang has an ophthalmology practice at Modesto. Because he stopped seeing patients, except in emergencies, his business fell by about 60%. A couple of technicians left earlier this year, but I still had to cut two technicians from 35 to 20 hours a week. He said one of them raises $ 80 a week from regular unemployment, plus $ 600 in federal benefits, totaling $ 680. His regular salary is about $ 22 an hour.

Before the pandemic, she earned about $ 770 a week, but now with her 20 hours of work plus unemployment, she makes $ 1,120, or 45% more. The other technician, who earns roughly the same salary, has also applied for benefits.

A technician who left at the end of March applied for unemployment. He was making $ 18 an hour for 30 hours a week or about $ 540. Chang is not sure how much unemployment he could get, if any, but if it’s around $ 250 a week plus $ 600, he would get $ 850 a week than would not work until July 31.

Now his business is coming back and “in two to three weeks I will probably need more help,” he said. But the “bailout package is so generous that I’m afraid it will be in the interest of my employees to remain unemployed,” at least until July.

Many small businesses that received loans from the Federal Paycheck Protection Program, including Chang, need to hire staff within eight weeks of financing to obtain loan forgiveness. But there are so many employees who are reluctant to return that the US Treasury Department. USA He added this question to his frequently asked questions on Wednesday:

“Will a borrower’s PPP loan forgiveness amount be reduced if the borrower fired an employee, offered to rehire the same employee, but the employee rejected the offer?” The answer is no. He said he will issue a rule that excludes laid-off employees whom the borrower has offered to rehire (for the same salary and number of hours) from calculating the reduction in loan forgiveness under the Cares Act. “To qualify for this exception, the borrower must have made a written rehire offer in good faith, and the borrower must document the employee’s rejection of that offer. Employees and employers should be aware that employees who reject reemployment offers may lose eligibility for continued unemployment compensation. ”

Paying $ 600 equals $ 15 an hour for a 40-hour week. Self-employed individuals who lost their jobs as a result of the coronavirus also receive $ 600 in addition to their pandemic unemployment benefits, which in California range from $ 167 to $ 450 per week. Unemployment benefits, including $ 600, are subject to federal taxes but not California income taxes.

When added to the nationwide average unemployment benefit, $ 600 was intended to replace 100% of the worker’s average salary. But that means that people who earn more than the average salary could get more than they previously earned, and those who are below the average salary get less.

Whether it should spread has become a hot topic in Washington. On April 29, Graham said that he and Republican Senator Tim Scott would allow an extension “on our bodies.”

Josh Bivens and Heidi Shierholz of the Institute for Economic Policy wrote that the additional $ 600 “has been by far the most effective part of our economic policy response to the coronavirus crash.” It would have been better to limit the benefit to 100% of pre-crisis wages “up to a fairly generous maximum benefit,” but “decades of disinvestment in administrative capacity” by state unemployment offices left them unable to calculate a flexible amount with 100% replacement rate.

The $ 600 is “direct relief precisely to the people who need it most,” Shierholz said in an interview. And because they need it most, “it will be channeled back into the economy.” It is where “the economy and humanity totally intersect.”

Maurice Emsellem of the National Labor Law Project said the $ 600 is especially important in California. The state’s maximum unemployment benefit, $ 450 per week, has not changed since 2005. The average benefit, $ 338 per week, is below the national average of $ 378.

To give unemployed people enough to buy necessities without discouraging work, unemployment must replace at least half the average weekly wage, with a maximum benefit equal to two-thirds of the average wage, according to a report by the Federal Advisory Council.

“Our average benefit of $ 338 replaces only 25% of the average weekly salary,” which was $ 1,340 in the second quarter of last year, Emsellem said. The average weekly benefit plus $ 600 is $ 938, or 70% of the average. “That’s just where the federal commission says it should be in normal times,” says Emsellem. “Now we are in a crisis situation. The $ 600 is critically important to keeping the economy going and keeping low-income people afloat. ”

To maintain benefits, unemployed people must complete a certification every two weeks asking if they looked for work, were able to work, and rejected any job. The Employment Development Department temporarily suspended the certification requirement from March 14 to Saturday to ease the strain on its computer system. He suspended the job search requirement indefinitely due to the coronavirus.

Unemployed people who reject “proper” work lose their unemployment benefits. However, a job might be inappropriate if there are health and safety issues. “We would say, and I hope EDD would agree,” that older workers with immune problems “should not be denied unemployment” if they refuse a job for valid health reasons.

EDD said it is developing guidance on this issue.

Shierholz said he expects Congress to extend the $ 600 last July. With the national unemployment rate reaching nearly 15% in April, “the contest that some people get more than they should is surprising,” Shierholz said. Your best guess is that Congress extends it, but for less than $ 600.

To help employers and employees, Congress might say, “Get back to work and you can take some of your unemployment,” said Jim Paulsen, chief investment strategist at the Leuthold Group.

Sung Won Sohn, a professor of economics at Loyola Marymount University, said he would phase it out after July 31, but that he would award state funds to increase unemployment benefits in a way that meets his individual needs.

Kathleen Pender is a columnist for the San Francisco Chronicle. Email: [email protected] Twitter: @kathpender

[ad_2]