The American economy

President Donald Trump has inherited a strong economy, and during his first three years in office he is growing at a healthy rate. Then the Covid-19 epidemic changed everything.

The economy was healthy at the start of Donald Trump’s presidency in January 2017.

Employers added jobs directly in the months straight – the longest hired work on record at the time – and unemployment was only 7.7%, a 10-year low. Corporate profits were close to all-time highs, and so were stocks. Overall, GDP grew by 2.5% per year – a modest rate for the world’s largest economy. Not everything was bright: federal debt was at an all-time high since the 1950s. But by most metrics, it was hard to deny: the economy was on solid footing. And fortunately for Trump, growth continued from there.

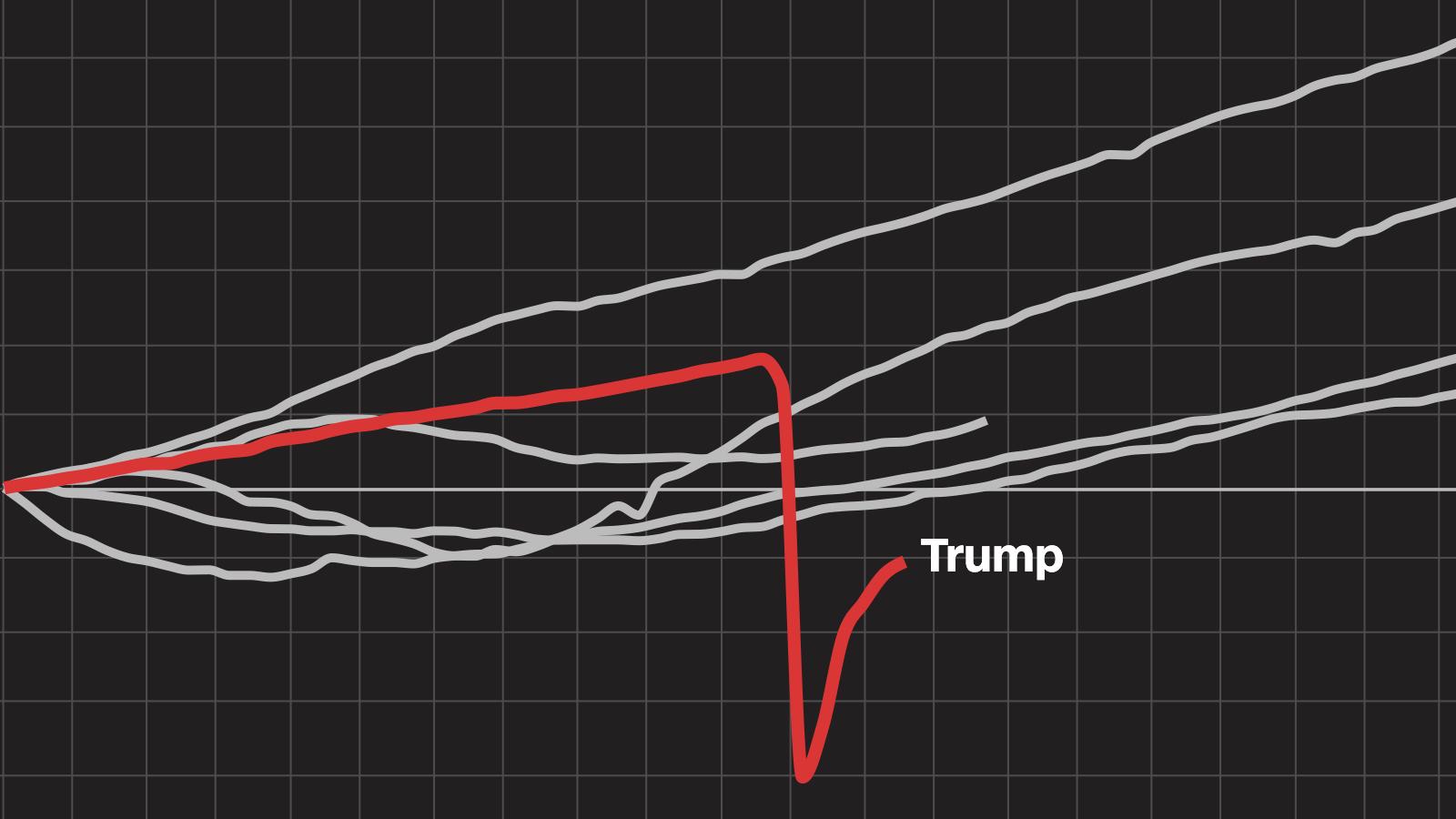

Below we have found 10 indicators to show how the economy has grown under every president from Ronald Reagan to Trump. Keep in mind, every president started in different circumstances. George W. in George Fees. Bush’s first year was plagued by dot-com busts and the September 11 attacks. Following the catastrophic housing crash and the global financial crisis, Barack Obama began with the Great Depression. Despite this crisis, most recent presidents have presided over the developing economy during their tenure. The Trump presidency will be characterized by the country’s response to the Kovid-1p epidemic, which is still playing out both as a health crisis and as an economic one.

Take a look at the charts to see how the economy under Trump has evolved like its predecessor.

By 2020, President Trump’s first term was characterized by solid job growth, but then the epidemic destroyed nearly 15% of American jobs in just two months. Since May, the economy has lost almost half of those jobs, and Trump is heading for the election losing the worst job under any presidential registration.

In contrast, at this stage of Obama’s presidency, the job market grew 0.4%. He took office at a time when employers were cutting hundreds of thousands of jobs a month. Hiring kicked in higher gear in the post of president.

Entering Trump’s office fees, he inherited the strongest job market in American history from Obama. But Covid-19 quickly put an end to it. The unemployment rate has risen to 14.7%, a 10 percent increase since Trump took office. Although it has improved slightly, unemployment has risen in September. No other president has seen such a sudden increase in employment.

Trump likes to talk about how middle-class incomes have increased during his presidency – and that was true in his first three years. In September, the Census Bureau released figures showing that people in the Central American household earned, after adjusting for inflation, to earn Rs. A stronger job helped increase revenue in the market, as more people worked all year. And more than 20 states also raised their minimum wages, raising incomes for low-income workers.

We don’t have data for 2020 yet, but the epidemic will certainly have a big impact on that number. For some families, the 1,200 weekly stimulus checks and the temporary ોમાં 600 increase in weekly unemployment benefits have actually lifted income during the epidemic. But many others, especially those who have lost a business or are struggling with long-term unemployment, are struggling to make ends meet.

The longest bull market in history began shortly after entering Obama’s office and continued well into Trump’s presidency. Investors welcomed Trump’s corporate tax cuts in 2017, and yet the trade war with China gave him a record-breaking run by 2020. In about a month, before receiving re-ing later in the summer. As of October 27, the overall Trump presidential index had risen 49%. While a quick bounce-back is a bright spot for them, it also contrasts with the 76% stock gain under Obama and the 64% gain at the same stage of the presidency under Clinton.

The housing market is one of the few parts of the economy that has not declined dramatically during the epidemic. This is in part because the record-low interest rates and the domestic trend from business have led city dwellers to buy houses in suburban and rural areas, leading to rising house prices in many areas. That’s also because comprehensive measures, including dismissal and tolerance programs for mortgages, have helped struggling families weather the crisis so far. That unpaid bill could eventually catch millions of families, causing a crisis in the housing market. But so far, house prices have risen 21% since Trump’s inauguration.

Food pricesSmall increase

If it seems like your grocery bill is going up right now, because there has been a sudden increase in foodstuffs during the epidemic. However, long walks have been relatively stable. At this very stage of the presidency of Reagan, George HW Bush, Clinton, and George W. Bush, food was already 9% or more. They are just under .1.1% under Trump, and up.9% under Obama, marking an era of low inflation.

Consumer costsAbove, but vague

American consumers in the U.S. Is the backbone of the economy and does not get bogged down easily. However, consumers quickly cut costs at the onset of the epidemic, once stimulus checks and unemployment benefits came to their aid, and in May and June they were quick to reopen their wallets. Retail spending on goods, especially by ret online retailers, quickly rebounded. (In the meantime, spending on services such as haircuts, travel and meals in restaurants falls below the pre-covid-1ms standard.) However, despite the rapid recovery, consumer spending has risen less under Trump than in any of the previous five presidents.

Manufacturing jobsBarely changed

American manufacturing jobs peaked in 1979, and since then no president other than Clinton has presided over the gains in factory jobs. So it was a tall order when Trump promised to bring back the factory job. In Trump’s first three years, some jobs were added in the manufacturing sector, but in 2020, the epidemic spoiled the little progress those workers had made. As of September, the sector had 164,000 fewer jobs, or 1.3% since Trump took office. That said, the scattered presidents in the factories were even more intense under Reagan, Obama and Bush, as globalization and technological advances led to a decline in America’s manufacturing workforce.

The federal government’s debt burden has not been as high compared to the size of the post-World War II economy, but it has not only been met during Trump’s presidency. Debt rose under Reagan, who slashed taxes massively, and it grew under Obama’s leadership, which used federal stimulus funds to help the economy during the Great Recession.

By the time Trump took office, debt was about 76% of GDP. But by mid-2020, it was 105% – a growth of 29 percent during his presidency. Economists have always argued for paying off debt when the economy is strong, and spending more when the economy is weak. But despite his promises to ‘get rid’ of debt, Trump has grown it both in good times and bad. While most of the increase has come from coronavirus relief funds, earlier policies such as corporate tax cuts and defense spending increases have also fueled the boom.

Gross domestic productA deep recession

Extensive measures of economic activity – gross domestic product – measure the value of goods and services produced in the country. It usually rises between 2% and 3% per year after adjusting for inflation. The first three years of Trump were all in that category, but 2020 saw a sharp decline. We don’t have full year data yet, but the second quarter had the worst result on record going back to 1947. Third-quarter data is due out Thursday, and is expected to show some improvement – but not a full recovery.

Many economists predict that businesses and workers will not fully recover from this severe economic downturn for years.

Additional development by Byron Manley

Notes

Total national production lines are calculated as a percentage change in the fourth quarter prior to the inauguration of each president, the most recent data before he took office. Lines for average income are calculated as a percentage change from the last calendar lender year before each president’s inauguration. Lines showing unemployment and federal debt are treated as percentage changes, as they begin as a two-metric ratio. All other lines are treated as a percentage change from January when each president was inaugurated. President Reagan is not shown in the house price data because the data is only available in 1987 and does not include his entire presidency.