An volatility returned to economic markets last week with volatility, hampering almost uninterrupted climbs in U.S. stock index records and raising questions about the roadmap for Wall Street, leading to a framework of challenges for investors.

Perhaps, the important question is, what happened to the hack in equity markets in the 48 hours after the S&P 500 index SPX,

And the Nasdaq Composite Index COMP,

On Wednesday, the 22nd 2020 recorded their 22nd and 43rd ranking, respectively, and the Dow made its first finish above 29,000 since February, closing it at an all-time low of 12% in February. “

Bull perspective

From the bull’s point of view, not much has changed.

Bullish investors have seen years of low interest rates and the Federal Reserve’s promise of money injections into various parts of the financial system, as well as other financial stimulus to the government, to keep the market afloat and lay the groundwork for the future. Dramatic damage.

Optimists see the decline experienced in the equity market this week as a bump in the road to further gains.

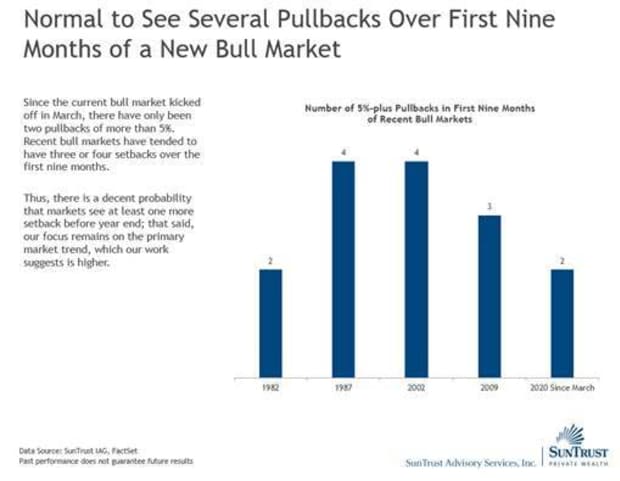

“Since the current bull market started in March, there have been only two pulls of more than %%. Keith Lerner, chief market strategist at Sunstrust Advisory, wrote in a research note on Thursday – see chart: Recent bull markets have had three or four shocks in the first nine months.

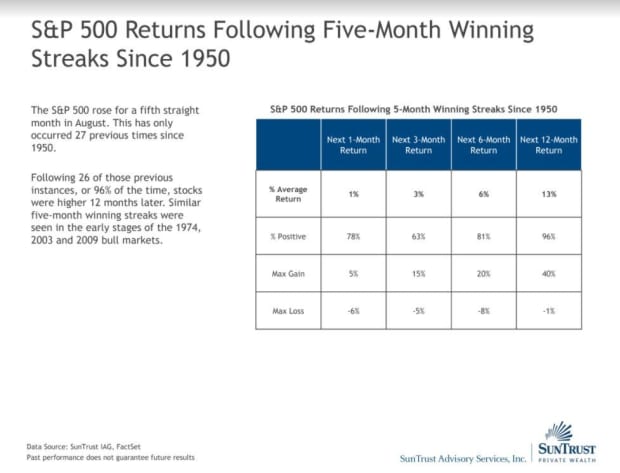

Lerner also notes that the five-month winning streak for the S&P 500, which has occurred only 27 times since 1950, is a good sign as it indicates that the return is ahead.

Therefore, investors may view this solitude as a natural corrective phase that removes some of the ornamental fruit from equity valuations that practical investors use to evaluate assets compared to its peers.

Marketwatch Chana William Watts last Thursday quoted Fischer Dan Suzuki, deputy chief investment officer at Richard Bernstein Advisors, as saying that Technol st G – a company that specifically includes Facebook FB,

Amazon.com AMZN,

Netflix NFLX,

Micros MS FT MSFT,

Apple Pal AAPL,

And Google Parent Alphabet Google,

Google,

(Or Phanum AG c) – Their valuation was based on many expansions or rapid price increases, while other segments of the market miscalculated earnings with their prices, distorting the “P” portion of commonly used prices. -To-earnings metric, or P / E, used to gauge the price of a stock.

“But these two groups of stocks have become more expensive for completely different reasons,” he noted. “The P / E of FAN names has risen because their ‘P’ (prices) have risen faster than their ‘E’ (earnings), while the P / E of the rest of the S&P 500 has expanded because ‘E’ has gone down a lot. Is. ‘P.’ More than that, ‘Suzuki wrote.

Indeed, during the period between the lows of March and the beginning of the last week, investors maintained a strong appetite for technology-related stocks and a group called “stay-at-home companies”, due to the belief that they were the only ones to receive. Promoted by the COVID-19 epidemic, but they are in the best position to benefit when the economy finally emerges from the recession.

Friday’s bottom rally, supported by moves in the financial sector, was also seen as constructive for the broader market, going into the three-day Labor Day weekend.

Peter Essel, head of portfolio management, wrote: “The move was largely led by Financial, which resulted in slightly higher interest rates at the end of the curve, especially the 10 basis point move in the 10-year Treasury,” Peter Essel wrote in the portfolio. Head of Management for the Commonwealth Financial Network, via email.

Yield in 10-year Treasury TMUBMUSD10Y,

Benchmark bonds rose 0.72%, the biggest single-day rise since Friday, May 18.

It is not uncommon for stocks to fall as soon as they meet on Friday, as yields rise as investors generally turn to the security of government debt, raising prices in times of uncertainty and yielding lower yields. That didn’t happen on Friday and could be interpreted by some as the least fixed-income investors seeing the move in stocks as an indicator of a temporary pullback rather than a more significant and permanent decline.

Mark Hefler, chief investment officer at UBS Global Wealth Management, said he saw this week’s market decline as a consolidated gain for investors. “We see the latest sell-off as a battle to make a profit after a strong run,” he wrote.

The S&P 500 enjoyed its strongest August in 34 years, growing by 7%, and added another 2.3% in the first two days of September to reach a new record high, he wrote. “Shares are still well supported by a combination of Fed liquidity, attractive equity risk premiums, and ongoing recovery as economists reopen from a lockdown.”

Bear perspective

From a bearish vantage point, the outlook for stocks seems more uncertain for investors. Some experts say it could work well for significant episodes of turmoil if gut-wrenching drops don’t come into the stock due to this uncertainty.

“Mini-tech sales on Thursday have left a lot of scars; Stephen Ines, Exicorp’s chief global markets strategist, wrote in a research note on Friday that it was not overly surprising that items in New York equity trading were relatively muted over a long week.

September is a notoriously weak month for investors, and even if that weakness moderates somewhat in an election year, October marks the start of the November 3 presidential election for Wall Street.

Chris Seneck, chief investment strategist at Wolfe Research, said the possibility of a resurgence of COVID-19 and winter is also a reason for the stock to weaken.

“We mean that this fall is likely to lead to a similar resurgence in infection rates in the United States, as children and college students return to school and the flu season begins,” analysts at Wolfe Research wrote on Friday.

Michael Kramer, founder of Mott Capital Markets, called the recent changes in the market “crazy” in a blog on Friday and said it is difficult for the market to determine what lies ahead, but he noted that an explosion in volumes could signal a change in selloff stocks.

He noted that for the first time since April 3, the S&P 500 has closed below its uptrend. “This is nothing in common; This indicates that the momentum is probably changing ifting, ”he wrote (see attached chart).

Regarding the losses that closed on Friday, Kramer said: “The uptrend was impressive nearby, but it could be as easy on the short covering heels as it was on the buy side.”

The downturn came as two popular companies saw their shares fall after splitting: Apple Paul AAPL,

And Tesla TSLA,

Tesla has ranked among the highest flyers in recent months and some have seen it as a gauge of sentiment in the overall markets. Its latest retreat is that the downturn has been pointed out by investors as a sign of market weakness.

On top of that, Tesla was not announced as a new entrant to the S&P 500 index late Friday night, which could put a pall on shares that lost about 20% from its top.

The way forward

Looking ahead, investors are turning to the Federal Reserve’s September 15-16 policy meeting, which could be important in clarifying when interest rates will be kept low, but if, if any, the central bank will implement a new quantitative easing.

In an interview with National Public Radio on Friday afternoon, Fed Chairman Jerome Powell said that as a good sign of economic growth, the labor market added 1.4 million jobs in August and the unemployment rate fell to 4% from 10.5%.

But he insisted progress was slowing: “We think it’s going to get harder from here,” Powell said.

Doubts that the government will soon provide a new round of monetary stimulus for jobless Americans have put little pressure on the Fed to reduce the impact on the economy from disruptions caused by the epidemic.

The role of the Fed may be the most important feature of whether it is able to continue to make stock market progress higher. It is now stable, there are many options for stocks, with long-running government bonds earning about 1% or less.

.