Nick Woodman, founder and CEO of GoPro, from the company’s IPO in 2014

Getty Images

GoPro Inc. after third-quarter profit growth. Shares of No advanced to a three-year high on Friday, beating Wall Street expectations by a huge margin.

Andrew Yurkwitz, an analyst at Oppenheimer, raised its share price target by 25% to $ 8 to ડ 10, saying it implemented GoPro’s strategic shift to a more direct-customer (DTC) and subscription model, announced just two quarters ago. , Has been “significant”. He reiterated the outperformance rating he has received on the stock over the past two years.

“As implementation continues and confidence grows over the years of sustainable cash flow, we believe there is more to come.”

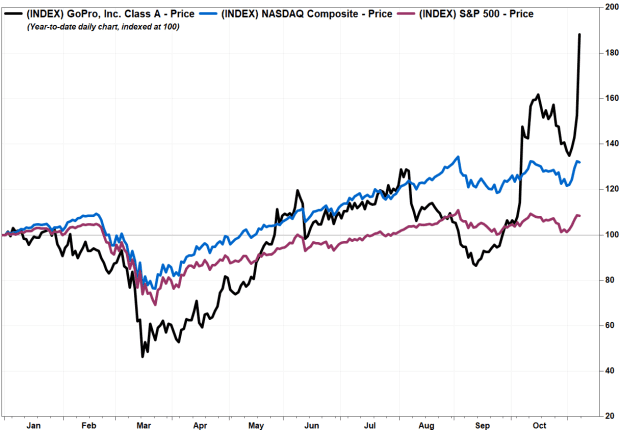

Stock GPRO,

Rocketed 24.2% in morning trading, trading above 8 8 for the first time since December 2017. Now it has increased its market capitalization by 89.4% to date to increase GoPro’s market capitalization to 1.30 billion.

In comparison, the Nasdaq Composite COMP,

32.0% this year and the S&P 500 Index SPX,

8.5%.

Factset, Marketwatch

The company reported earnings of 3. 3.2 million, or two cents a share, late Thursday night in the same period a year ago. Excluding the recurring item, GoPro made adjusted earnings by losing 20 cents per share of the stock at a loss of 8 cents per share, beating the fact cents EPS consent.

“In Q20 2020, our direct-to-customer and subscription-centric strategy increased margins, increased subscribers and significantly reduced our operating costs, resulting in GAAP and non-GAP profitability,” said Chief Financial Bfiser Brian McGee. Financial B Fisher Brian McCaggie said. “As we operate, this approach enables efficient working capital management [days sales outstanding] Down 25%, respectively, reduced channel inventories and reduced our own investments in inventory. “(GAAP refers to generally accepted accounting principles and non-GAAP refers to adjusted earnings.)

Revenue rose 113.9% to 28 280.5 million, well above the factset consensus of 4 234.5 million. Subscribers rose 65% to 501,000.

Gross margin improved to 35.4% from 21.7%, with the average selling price rising from 11% to 4 304.

“The proproch was strong for GoPro from completion, ending with the successful launch of our stunning new flagship, the Hero 9 Black,” said founder and chief executive Nicholas Woodman, founder and chief executive Nicholas Woodman.

GoPro Inc.

Wedbush analyst Michael Patcher raised his share price target from 6 to $ 8, the results showed that the company’s strategic shift is going smoothly. He reiterated the neutral rating on the stock, citing valuations after the January, 2018 period.

JPMorgan’s Paul Belden reiterated his neutral rating and set his stock price target at $ 8, but was also excited about GoPro’s strategic shift.

“The shift to the subscription service provides more visibility to the customer base, more consistent cash flow, and provides a great way for future accessories and driving camera upgrades,” Belden wrote.

.