Introduction

There is now little doubt that the precious metals sector of the market has entered a bull phase. A quick look at the charts for gold, silver and the producers clearly demonstrates the acceleration in value that has already taken place, and rewards those who were bold enough to establish a position in what was once a truly unloved area for investors used to be.

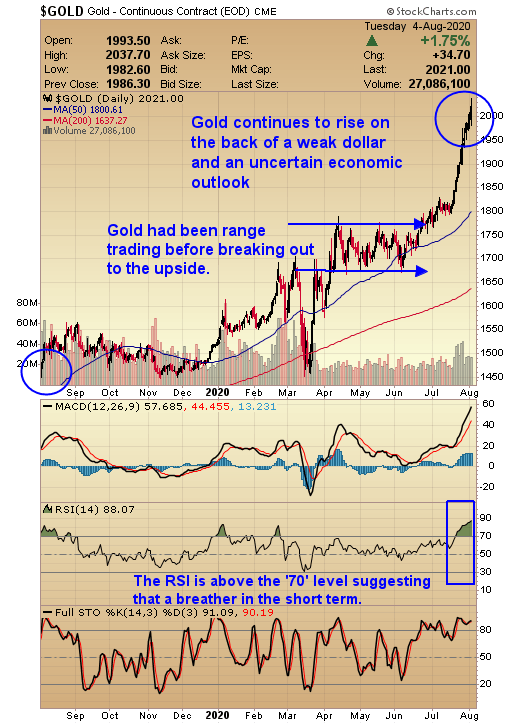

Gold

The two main drivers behind the demand for gold are the decline of fiat currencies such as the US Dollar and a gloomy economic outlook. The maniacal way in which central bankers try to print their way to prosperity is ignorant. If prosperity depended on printing money, then they could print a million dollars for each of us without any negative effect on the financial system. This is obviously an irreplaceable course of action to take; however, the money supply is inflated to record levels and thus investors are investing in hard assets to protect wealth.

The markets generally enjoyed an economic expansion for about 11 years, one of the longest in history. A recession was long overdue and now it’s here, and to make matters worse, is such a terrible pandemic that is also destroying many businesses.

A quick look at the map for gold shows how it has accelerated over the last twelve months from sub $ 1,500 / Oz to recently above $ 2,000 / Oz.

The demand, as evidenced by the funds flooding into the ETFs, will remove large amounts of the physical metal from the market. One such fund is the SPDR Gold Trust ETF (GLD) which provides an easy way to enter and exit the gold market. The net worth currently stands at $ 66.99B, which is 1,262 tons or 40.5B Ozs of gold. The flight from fiat currency to hard assets I can only see as pace of accumulation, especially since funds at a bank pay little or no interest. It should also be noted that this is a small sector of the market and it is very difficult to invest large amounts of money without forcing the price much higher. And so this suggests to me that gold will increase rapidly and can easily double to $ 4000 / Oz and then triple to take it to $ 12,000 / Oz as the mania gains momentum. Some would say that this call is scandalous and an impossibility. Gold, however, has registered a new hefty heel and could go anywhere from this point.

The supply and demand factors will play their part, but that is not the main reason for making this call.

I see this brand developing as follows:

Investors today are on top of changes and trends around the world and have 24/7 access to news stream so they know this sector is on fire. They can also sit on a beach and invest a $ 100k at the touch of a button on a mobile phone, gone are the days of waiting for a shareholder to carry out your instructions. Both the currency and the S&P 500 have had their day and there will be a rush for the exit. The precious metals sector has the momentum to attract at least some of those funds looking for a new home. This is a small sector of the market compared to, for example, the tech sector, so any increase in demand forces prices on higher ground and in turn gets even more coverage. Then comes the fever and there is nothing like a golden fever. It’s the perfect storm that has been in the making for a long time and is now unstoppable. And so we’ll lose the $ 2,000 / Oz price tag and it’s not hard to imagine gold going down the road to $ 12,000 / Oz. My goal has been $ 10,000 / Oz for a while, so at that point I will think about going out, hopefully still in one piece.

Charts with agreement of Stock Charts, TA by author

Silver

Poor man’s gold is in a similar position to that of gold, because it has been out of favor for a while and has finally jumped to life. The gold / silver ratio flirts at once with 130 levels; However, the demand for silver has dropped this ratio dramatically to around 78 and I think it will soon trade at the 60 level that would put silver at around $ 33.00 / oz. Silver also has the added attraction of being an industrial metal and will be required for electric cars, solar panels, medical applications along with a very different use.

As the chart below shows, silver prices fell out of bed when the coronavirus hit and hit the $ 12.00 / oz level; however, it has since more than doubled.

Charts with agreement of Stock Charts, TA by author

The Gold Bugs Index (HUI)

The producers finally enjoy their day in the sun, as the index of for the most part shows unheded supplies. The chart below shows that this index has risen from 220 to 360 over the past year, recording a gain of about 63%. As gold continues its pull to the north, any rise in price goes directly to the bottom line for many of these companies. Who knows, they might even start paying a decent dividend.

Charts with agreement of Stock Charts, TA by author

After such a dramatic increase in value, one would normally expect a bit of a pullback; however, these are not normal times because we are in uncharted waters, so expect the unexpected.

Conclusion

The demand for gold and silver is faster as investors buy the physical metal and / or stack in the ETFs.

Knowledge is freely available and accessible all over the world, so investors should be aware of the speed of change and be able to capitalize on it.

Most importantly, the shortfall achieved in the gold bull market is like no other and limits will be crossed time and time again as the panic to buy grips.

Take a position if you can in the physical metal if you can get it and also in some of the PM stocks that are the rising stars of the entire future.

If you have a comment, please send it in if you agree with us or not, because the more diverse comments we receive, the more balance we will have in this debate and hopefully our trade decisions will be better informed and more cost effective.

If you are not already a Follower and would like to see our posts about gold, silver and the related stocks, then press the follow button to not miss out as this is a fast moving market.

Announcement: I / we have no positions in named shares, and no plans to initiate positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I do not receive compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose supply is mentioned in this article.

Additional disclosure: gold-prices.biz makes no warranty or guarantee as to the accuracy or completeness of the data provided. Nothing contained herein is intended or will be construed as investment advice, implied or otherwise. This letter represents our views and replicates trades we make, but nothing more than that. Always consult your registered advisor to help you with your investments. We accept no liability for losses arising from the use of the data contained on this letter. Options involve a high level of risk that can result in the loss of a share if all invested capital and therefore are suitable for experienced and professional investors and traders. Past performance is neither a manual nor a guarantee of future success.