[ad_1]

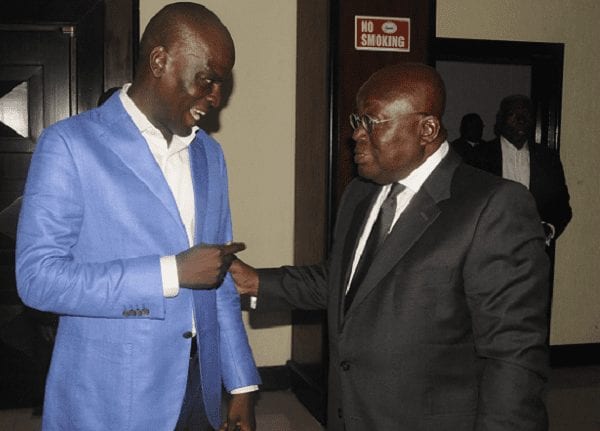

Minority leader Haruna Iddrisu has mocked President Akufo-Addo for his silence on the country’s public debt in his State of the Nation speech that was delivered in Parliament today, Tuesday, March 9, 2021.

According to the minority leader, while the president continued to refer to the debt left to him by the Mahama administration in his previous speeches, he has remained silent on the current state of the national debt.

“Interesting today is silent about the state of public debt. What is the national debt? We want to know, ”the minority leader scoffed as he seconded the motion to postpone the proceedings in the chamber after the president finished reading the speech.

Ghana debt stock

The balance of public debt peaked in December last year after a greater accumulation of debt to cover income deficits and finance a larger fiscal deficit expanded the amount the country owes to internal and external creditors.

Bank of Ghana (BoG) data released on January 29 showed that the debt balance ended the year at GH ¢ 286.9 billion, the highest since the bank began publishing data on how much the country owes.

The December 2020 stock was equivalent to 74.4% of total economic production, measured in terms of gross domestic product (GDP).

It is the first time in more than 15 years that the debt / GDP ratio has reached 74%. The closest was in 2016 when it was reported at 72.5 percent of GDP.

High debts displace fiscal space by ensuring that more income is used to finance interest and pay off principal, a situation that limits spending in productive sectors and also creates a cycle of indebtedness.

Cleaning exercise

Of the debt balance, the data showed that GH ¢ 15.4 billion, equivalent to four percent of GDP, was spent in the financial sector clean-up exercise.

The data on the economy was released ahead of the central bank’s Monetary Policy Committee (MPC) press conference on February 1, where a policy decision on the BoG’s policy rate and the direction of monetary policy would be announced. for the next three months.

The data also showed that debts acquired in the country had exceeded those acquired from foreign sources, the first in years.

Hard times

The latest development preceded a warning from BoG Governor Dr. Ernest Addison that the country required tough decisions to reorganize public finances after the COVID-19 pandemic hit them hard.

While asserting that the deficit target of 11.4 percent of GDP was understandably high, the governor, who also chairs the MPC, said in late December that the debt-to-GDP ratio of 71 percent at the time was “pretty good. above the maximum early warning sustainability threshold of 70% for countries with market access (MAC) ”.

“The country’s debt service indicators and gross financing needs have exceeded sustainability thresholds. Non-resident public debt holdings, although declining, is still high at 59.9 percent of GDP, above the 45 percent threshold for the MAC, ”he said at a conference that explored the state of the economy.

“Gross public funding needs are also above the MAC threshold of 10 percent due to increased tax liabilities, suggesting restricted fiscal space for growth spending,” he said at the Legon Alumni Conference. from the University of Ghana.

Composition

The data showed that the debt stock was ¢ 218.2 billion GH (62.4 percent of GDP) in December 2019, but increased by 35.6 percent to ¢ 286.9 billion GH in December 2019.

It indicated that around GH ¢ 68.7 billion were added to the debt stock within the 12-month period.

The data also showed that the share of debt in external and internal debt was almost on par, although those contracted locally were slightly above those owed to foreign creditors.

The external component was GH ¢ 139.6 billion, which represents 36.2 percent of GDP, while the internal component was GH ¢ 147.3 billion, equivalent to 38.2 percent of GDP.

The country remains a country with high risk debt problems according to the rankings of the International Monetary Fund (IMF) and the World Bank Group after reaching the list in 2015.

— starrfm