[ad_1]

Lenders make loans to borrowers on agreed terms or payment terms. As long as borrowers fail to repay the loan for a period of time, the loan is said to be non-current.

Therefore, a delinquent loan (NPL) is a loan in which the borrower does not meet interest and principal for a specified period. When borrowers are unable to meet interest and principal payments for a generally 90-day period of time in most cases, the loan is considered a delinquent loan.

In fact, according to the 2019 audited financial reports released by the 23 banks in Ghana and published in various print media, many of the banks’ NPLs were above the industry average.

The International Monetary Fund considers loans as delinquent when the borrower defaults on loan payments in at least 90 days or more and also when there are large uncertainties regarding future payments.

To assess the health of any banking system, the NPL percentage is used in the analysis. A bank with a higher delinquency percentage on its total loan portfolio suggests that they have difficulty recovering the interest and principal on their loans.

This has an adverse effect on the health and profitability of the institution. If this situation persists for a long time without established recovery strategies, it could have adverse effects on the Bank’s health, which could ultimately result in corporate bankruptcy or a possible Bank collapse. Reports of Ghana’s banking sector cleanup also revealed that most of the collapsed banks had very high NPLs, making them insolvent. This article looks in depth at why some banks have high delinquencies in Ghana and how that challenge can be curbed.

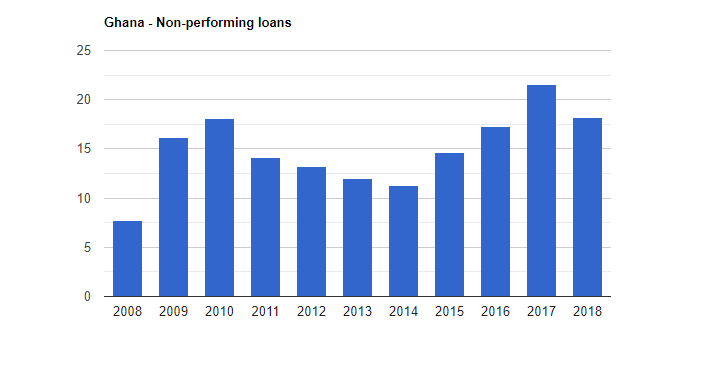

World Bank data on NPL for Ghana’s banking sector

World Bank data on Ghana’s banking sector NPL from 2008 to 2018 revealed that the average NPL ratio was 14.94 percent with a low of 7.68 percent in 2008 and a high of 21.59 percent in 2017.

What gives rise to the NPLs?

The incidence of nonperforming loans arises as a result of some factors over which the borrower has control, what is called internal and factors that are outside the control of the borrower known as external factors. Furthermore, default may be the result of the activities of the lender or the bank and this I have referred to as banking factors.

Internal factors leading to non-performing loans

Poorly managed loans

One of the key factors that can lead to a loan going bad is the diversion of funds loaned to other companies rather than the purpose for which the loan was granted or intended. Generally, before loans are made to a business or individual, the bank would establish the purpose of the loan or the intended use of the loan through its own in-depth analysis before finally approving the disbursement of loan facilities. .

When the borrower, upon receiving the approved credit, decides to divert the funds to other undisclosed businesses or personal businesses, the probability of the loan becoming bad is high. This can also happen with individual borrowers and corporate borrowers.

In recent times, the Ghana Fixed Income market recorded a default case from a quasi-governmental organization. The company issued a bond and it is alleged that the Board used the funds for some other commercial company that is not mentioned in the prospectus and this action led them to default on their coupons and principal payments.

Financing / lack of liquidity

The financial mismatch has contributed greatly to bad loans in Ghana. Most companies apply for short-term loans to finance long-term capital expenses. In most cases, entrepreneurs in the manufacturing, real estate, and even some contractors sectors are involved in such deals. They start paying off the loans when the business they got the loan for has not yet started to generate enough income to pay the interest and principal.

This type of agreement makes it difficult for them to even manage their working capital adequately and therefore fall into overdraft for their working capital, which further worsens their already strange financial position.

Choice of financing, mainly debt instead of equity

Some companies generally need to be capital-financed, but most companies prefer to use loans because they are unwilling to dilute their equity stake. In some cases, the Ghana Fixed Income Market provides a platform for companies to raise funds that can be traded and traded on the secondary market.

Some companies do not meet the listing requirement and others that meet the requirement may not be subject to scrutiny by securities industry regulators and would therefore opt for short-term loans. When raising long-term funds for long-term projects, be it equity or debt, businesses have time to generate enough income to pay their stakeholders.

Borrower Character

Although subjective, the character of the borrower is very important in managing credit risk. When the borrower is a delinquent volunteer, regardless of the conditions that exist, the loan would be in poor condition.

External factors causing delinquent loans

Change in government and government policies

Most of the time, when there is a change in government, some sectors are affected, especially if the manifestos of those governments are not in tandem with those sectors. The strategies of a particular government tend to be the main driving force in policy development.

For example, contractors who have executed government projects and have their funds locked with the government experience undue delays in paying contractual amounts, especially when there is a change in government. In some cases, payments are suspended due to government audits and reconciliation, and sometimes contracts are re-collected, leading to loan defaults.

This is a factor that is not under the borrower’s control and can lead to loan defaults when the borrower has no other means of financing to pay for their loans.

Exchange rate fluctuations.

Some companies take out loans to finance businesses whose key raw materials are imported. At the time of borrowing, they probably had a projection on the direction of exchange rate movements. So, when the cedi depreciates outside the band of its forecast, it affects the entire financial projection.

For example, when a company plans to import items worth USD200,000 to GHS5 / 1USD, an upward adjustment in the exchange rate to GHS5.5 / 1USD technically affects its projections. This is a clear case of exchange rate fluctuation over which the company has no control.

High interest rate regimes

In Ghana, the interest rates on loans are generally high. These high interest rates make it very difficult for a company to meet its credit obligations as they become due. A clear example is when a company borrows funds at a rate of 27 percent to finance a commercial company. If the company does not get enough returns above 27%, it would be very difficult for them to repay the loan. In the early stages, they may only be able to meet their obligations, but they would have difficulty staying afloat and meeting their medium and long-term obligations.

Natural disasters

Natural disasters create conditions that make it difficult for companies to repay their loans. Some common natural disasters in Ghana are floods and fires. In recent times, the Covid-19 pandemic has proven to be a force to be reckoned with to keep companies afloat. In most cases, this has paralyzed companies or even collapsed, resulting in loan defaults.

A clear case of the adverse effect of natural disasters is the consequences of the implementation of blockades and their disruptive effect on profitability in the airline industry.

This causes the need for insurance coverage for companies to deal with future uncertainties. According to studies, companies without adequate insurance coverage in their businesses tend to default when faced with natural disasters.

Cost of doing business and other macroeconomic indicators.

When the government creates an enabling business environment, the cost of doing business would be low. Conversely, when macroeconomic indicators are not fundamentally robust, it leads to a high cost of doing business.

The cost of doing business includes fuel prices, taxes, and labor fees. In general, when the cost of doing business is high, it has an adverse effect on the borrower’s ability to repay his loans.

Bank factors

These are factors that make it easier for a bank’s clients to default on their loans.

Inadequate credit risk management framework

Most loan officers are often concerned about their loan budgets and may be forced to ignore some red flags that can lead to future loan defaults when the loan is finally disbursed.

The credit risk analysis may not be carried out correctly. In some cases, the loan officer may not understand the client’s line of business, making it difficult to carry out proper due diligence to assess the health of the business. When poor due diligence is performed, the chances of default are high.

Poor loan monitoring

Loans must be managed on a case-by-case basis. For example, funds must be in tranches in the case of constructions for the various phases. When a contractor applies for a loan from the bank, the credit can be arranged in such a way that the funds are available in tranches.

There should be a follow-up after the loans have been credited to the customer’s account to ensure that the funds are actually being used. If poor monitoring is done, funds can be diverted. Monitoring involves inspection of the warranty, work in progress, etc. Monitoring helps you see the first warning signs so that corrective action can be taken.

Unethical bank staff colluding with the borrower to trick the bank

Some customers are unethical and the same can be said of some bank employees as well. Some bank staff members collude with clients to obtain loans that they know those clients could not repay. Once awarded, the chance of default is high, which would eventually lead to high NPLs.

conclusion

High-yield loans are not good for any bank, banking industry, and shareholders, even if the loans are inherited debts. When there is a large amount of bad loans in all banks, the health of the banking sector is unstable. The regulator has an allowable threshold for NPLs and some banks also have their internal NPL targets.

For banks to record low NPLs, they need to work with their clients and themselves to make this happen. Adequate due diligence, with an improved credit risk management framework must be done before loans are approved, there must be adequate monitoring of loans by loan officers and the recovery department so that they can be See and treat the first signs of default. Banks are expected to recruit and train their staff to be ethical, so that they do not collude with customers to trick the bank.

Companies must also learn to choose the appropriate funding sources for all projects and must not divert funds to other projects. The banking sector would be very strong and well equipped to carry out its financial intermediation role if all stakeholders carried out their respective roles.

A healthy financial services sector would help drive economic development due to its ability to support other sectors of the economy and provide good jobs for citizens.

Credit:https://www.myjoyonline.com/business/agribusiness/pbc-seeks-100m-amid-bond-default/, (https://www.theglobaleconomy.com/Ghana/nonperforming_loans/ )

Disclaimer: Disclaimer: The opinions expressed are personal opinions and do not represent those of the media house or institution for which the writers work.

About the authors

Carl Odame-Gyenti He is a senior PhD candidate (Financial Management), a financial and telecommunications enthusiast, who manages relationships with local and global investors, intermediaries, banks and non-bank financial institutions with an international bank in Ghana. Contact: [email protected], Cell: + 233-204-811-911

Sophia Kafui Teye (BSc, MBA, GSE Cert. AND CA Ghana (Student Member)

Author of the books listed below; Start Right: A Guide to Financial Investments in Ghana, Overcoming Infertility: What to Do When Delayed Labor, Contemporary Parenting, Intensifying Your Life Email Address: [email protected] Cell: + 233-242-913-562