[ad_1]

General news for Wednesday, December 23, 2020

Source: www.ghanaweb.com

2020-12-23

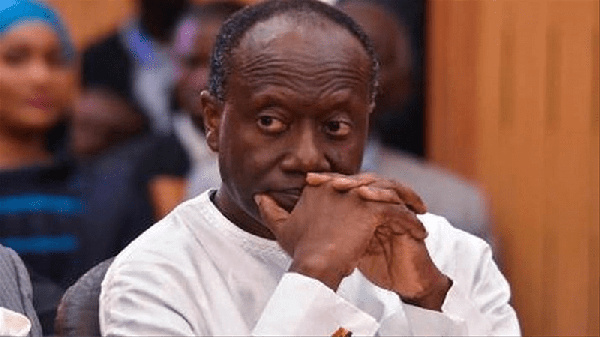

Ken Ofori-Atta, Minister of Finance

Ken Ofori-Atta, Minister of Finance

Transparency International has urged the UK Financial Conduct Authority (FCA) to review the Government of Ghana’s request to list Agyapa Royalties Limited on the London Stock Exchange and to decline listing if corruption issues are not satisfactorily addressed. .

According to a message quoted by GhanaWeb on Transparency International’s website dated December 22, 2020, the organization also asked the banks and lawyers involved in the deal to withdraw their commitment.

Agyapa Royalties Limited is a Jersey-based special purpose vehicle that will own nearly 76 percent of the royalties generated by 16 large gold mines in Ghana under a scheme that has caused controversy and political fallout in Ghana.

Forty-nine percent of Agyapa Royalties shares will be sold through a listing on the London Stock Exchange.

Martin Amidu, the former special counsel, raised red flags about the money laundering risks in the deal and possible bid rigging by hiring the transaction advisers.

Amidu, who publicly shared his corruption risk assessment report in November, gave further impetus to promoting a review of Agyapa’s royalty agreement.

Transparency International in a presentation to the FCA, and sent to JP Morgan, Bank of America, Merrill Lynch and the international law firm White and Case, details the concerns shared by a coalition of nearly 30 local and international civil society organizations that the deal smells of corruption.

Linda Ofori-Kwafo, Executive Director of the Ghana Integrity Initiative, the Transparency International chapter in Ghana, said:

“There are serious red flags about how this agreement was established. Civil society actors have expressed concern about inadequate stakeholder consultation, transparency, and valuation of the agreement. Other concerns are the way the transaction advisers got involved in the process and the lack of public oversight over the company at the center of the deal. For Ghana it is crucial that Western financial institutions and regulators involved in this deal take these concerns seriously. They should not facilitate schemes that could end up looting Ghana’s mineral resources in the name of investment.

President Akufo-Addo asked Ken Ofori-Atta, the Finance Minister, to send the relevant documents to the Ghanaian Parliament for review, but the matter is unlikely to be discussed before the term of the current Parliament expires on January 6, 2021. at 11:59 pm.

Send your news to

and features for

. Chat with us through WhatsApp at +233 55 2699 625.