[ad_1]

Prudential Life Insurance Ghana and Fidelity Bank Ghana Limited, in collaboration with the UK Ghana Chamber of Commerce (UKGCC), Petra Trust and the National Insurance Commission, have conducted a webinar to educate the public on the best ways to create financial security.

The webinar follows the renewal of the partnership between Prudential Life Insurance Ghana and Fidelity Bank Ghana Limited.

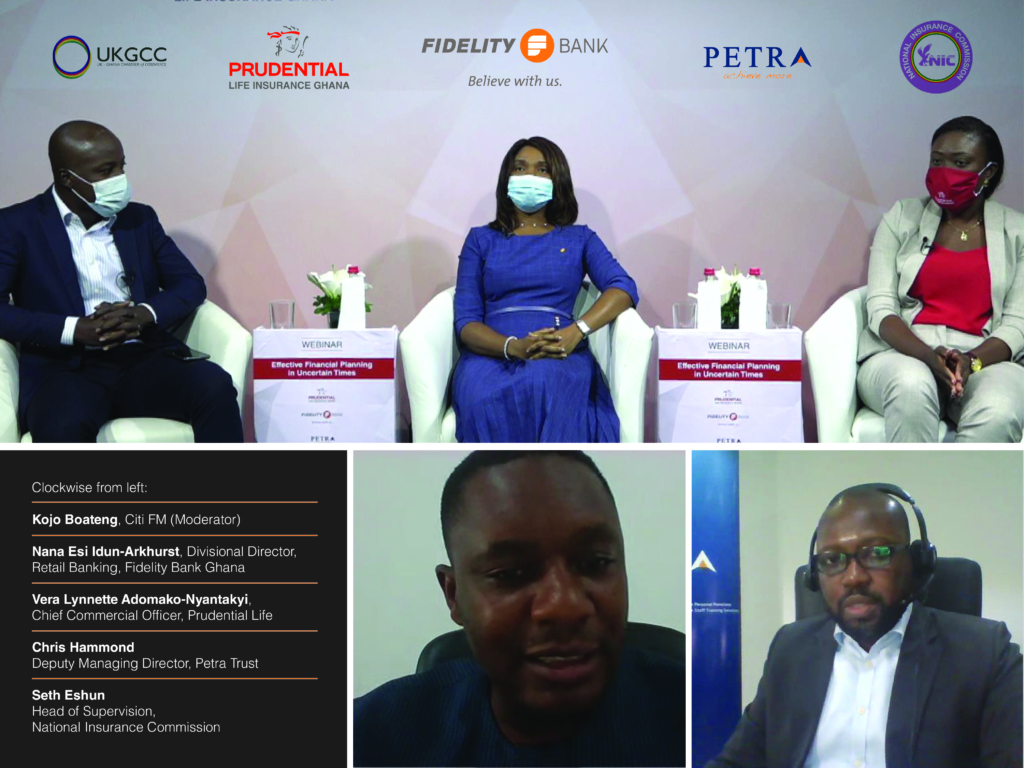

The webinar, which was streamed live on Facebook, had as its theme Effective financial planning in uncertain times, brought together seasoned industry professionals to discuss innovative ways people can take charge of their finances for a better future.

The webinar, which was moderated by Kojo Akoto Boateng of Citi FM / Citi TV, featured panelists including Vera Lynnette Adomako-Nyantakyi, Business Director of Prudential Life Ghana; Nana Esi Idun-Arkhurst, Division Manager, Retail Banking, Fidelity Bank Ghana Limited; Chris Hammond, Deputy Executive Director of the Petra Trust; and Seth Eshun, Head of Supervision, National Insurance Commission (NIC).

As the discussions began, Nana Esi Idun-Arkhurst noted that everyone needs a financial plan to address the uncertainties in life.

“Regardless of how much you earn, you need to create a culture of saving and deliberately saving to help in times of uncertainty. Fidelity Bank has the right mix of transactional, savings and investment accounts to help with effective financial planning, ”he said.

Highlighting the need to invest in insurance products, Vera Lynnette Adomako-Nyantakyi commented: “How long can you operate and maintain your lifestyle in times of uncertainty? If you can’t boldly answer this question, I advise you to save more, spend less, and sign up for a good insurance policy at Prudential Life Insurance. “

Chris Hammond said, “You can’t have a complete financial plan without a retirement plan. Up to 16.5% of income can be saved in a level 3 long-term personal savings pension plan for a solid retirement plan. “

Seth Eshun advised employees to check with the Social Security and National Security Trust (SSNIT) if their Tier 1 pension is being paid and to confirm which institution is their Tier 2 trustee.

He added that the NIC will ensure that insurance companies treat their clients fairly in all their transactions.

In his closing remarks, moderator Kojo Akoto Boateng added that Ghanaians should save not only for a rainy day but also to enjoy some of life’s joys, like taking a family vacation.

The thought-provoking webinar saw seasoned panelists share ideas, tools, values, and habits to guide Ghanaians on their path to effective financial planning.

Some participants who joined the webinar expressed satisfaction in gaining financial literacy to be in a better position to provide security for their families and to choose the right type of insurance to secure their future, even in uncertain times.