CureVac AG Chief Executive Dr. Franz-Werner Haas is displayed on the facade of the NasdaqMarketSite in Times Square, sounding almost like the closing bell, marking the list of the Aug. 14.

United Press

Fund managers are the most bullshit they have been since the pandemic, according to the latest Bank of America survey released on Tuesday.

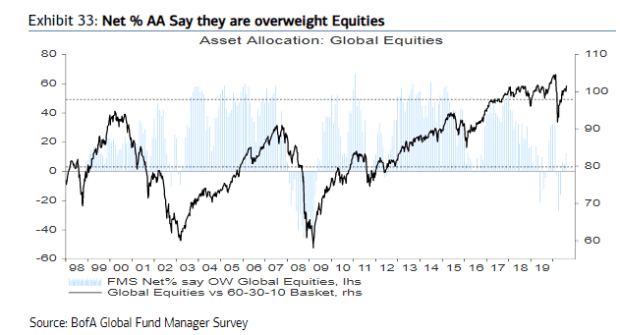

A net 12% were overweight stocks, an increase of seven percentage points since July, according to the latest survey. The S&P 500 SPX,

has climbed 51% since its lowest March, and the Nasdaq Composite COMP,

is 62% increased en route to 33 record highs.

Bank of America’s monthly survey finds a majority now that the stock market is accepting in a bull phase against a bear market rally with a margin of 46% to 35%. In July, 47% still thought it was a bear market rally against 40% believing shares in a bull market.

The net percentage of investors who expected global profits to improve over the next 12 months shot up 21 percentage points to 57%, the highest level since March 2017, because those who say companies are too bad, fell by 10 percentage points.

The fund managers, meanwhile, are not convinced by the rally in gold. A net 31% say gold is to be valued, the highest percentage since 2011, and the percentage that says an equivalent weight, bond and gold portfolio is to be valued is the highest since 2008. Gold on Tuesday was back above the $ 2,000 mark . It is up 31% this year.

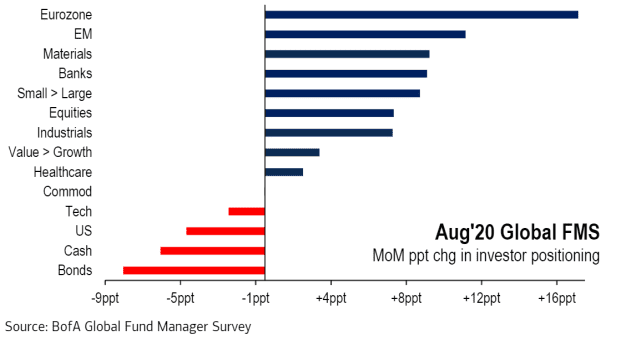

That was the beginning of a rotation to an inflation trading, as investors buy more and more eurozone and emerging markets as the dollar weakens. Materials, banks and small stocks were also more in demand as bonds, cash, US and technology fell somewhat to the advantage.

A total of 203 panelists with $ 518 billion in assets under management participated in the survey.

.