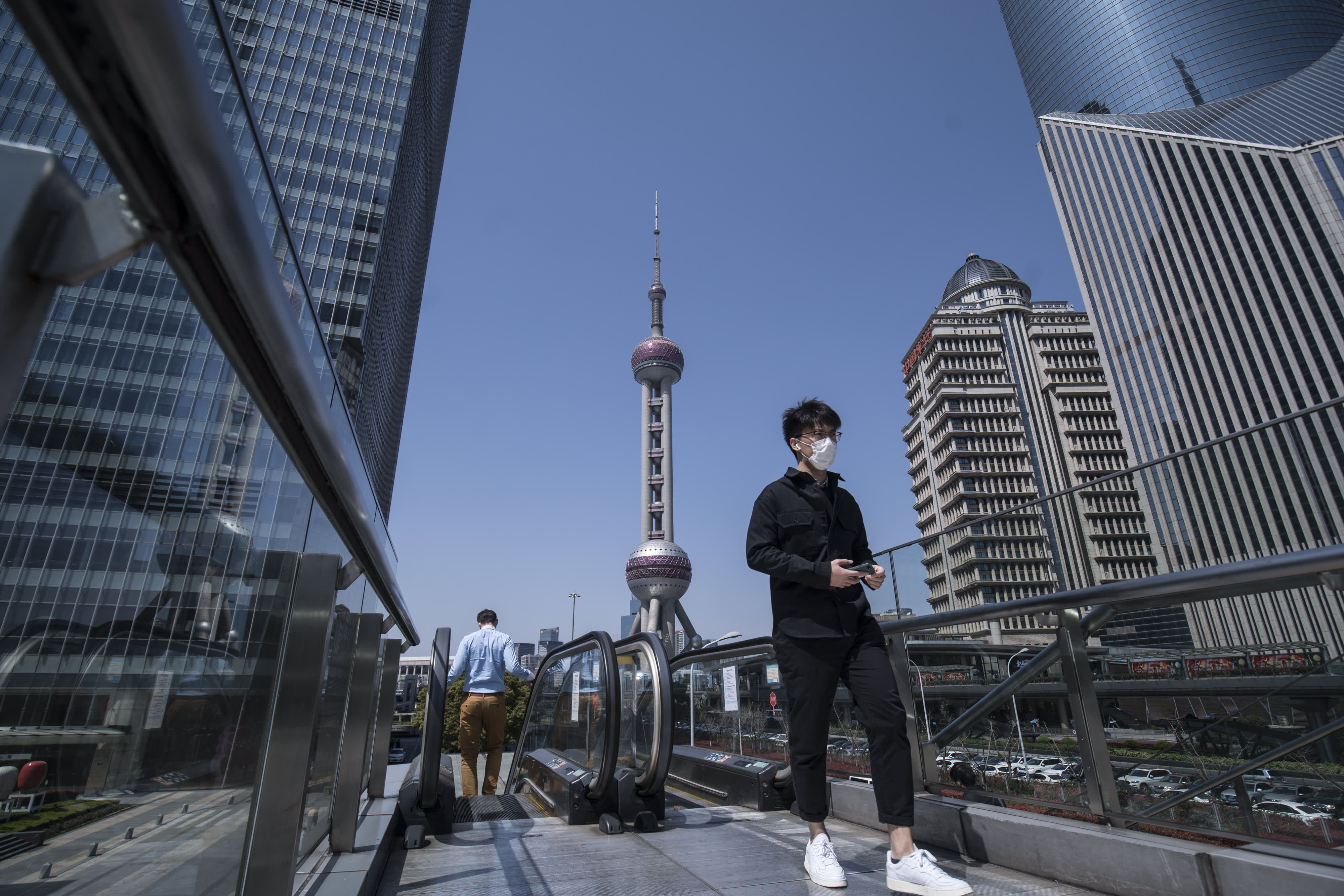

A pedestrian with a protective mask walks through the Lujiazui financial district in Shanghai, China on Friday March 20, 2020.

Qilai Shen | Bloomberg | fake pictures

As global uncertainty increases, more foreign companies are buying into China, including deals in the most sensitive finance and technology industries.

“In the past 18 months, we have recorded levels of foreign mergers and acquisitions (mergers and acquisitions) in China that were not seen in the previous decade,” wrote research partner Rhodium partner Thilo Hanemann and founding partner Daniel H. Rosen in a published online report. Thursday.

“Most of that activity has been driven by American and European companies that take advantage of the more flexible limits of foreign ownership or bet on Chinese consumer demand,” the report said.

Over the years, the Chinese government has gradually increased the industries in which foreign businesses can operate, and has also removed restrictions on wholly owned foreign operations.

Many foreign financial institutions in particular are buying majority stakes in their Chinese joint ventures and applying for licenses to manage more local money.

At a high-level annual financial conference in Shanghai that concluded on Friday, China’s top regulators emphasized that the world’s second-largest economy would continue to open its local capital markets to foreigners.

“The market in China is very large and many of these foreign (corporate) investors are studying long-term business development in China,” Martin Wong, managing partner of the insurance sector for the financial services industry at Deloitte China, said in a phone interview earlier last week. “They are not looking at the short and medium term.”

The growing commercial interest in China contrasts with an increasingly tense geopolitical environment.

Since the administration of US President Donald Trump began to increase pressure on China with tariffs about two years ago, the political campaign has extended to technology and finance. The appearance of Covid-19 late last year in the Chinese city of Wuhan and the resulting global pandemic have only further strained relations between the United States and China.

The economic shock of coronavirus-induced restrictions on trade caused gross domestic product in both the US and the US. USA As in China, it contracted in the first quarter. Many economists expect that the US GDP. USA It falls more than 40% in the second quarter, and China sees some growth, before a rebound later this year.

Amid economic and geopolitical pressures, Chinese companies are investing less abroad, according to data released Thursday by China’s Ministry of Commerce. But foreign investment increased 7.5% from a year earlier in May to 68.63 trillion yuan ($ 9.87 trillion).

The Rhodium report noted that another factor behind the investment trend is that in some industries, Chinese companies have become leaders, in part through the growth of startups and the support of government policies.

“For the first time, therefore, it is attractive for foreigners to buy technology and industrial assets rather than build from scratch,” the authors wrote.

What are the companies buying?

Here are some deals this year that Rhodium highlighted:

China has kept its markets closed long enough to develop its own giants in many industries. But other sectors are still in the early stages of development. At the intersection of a growing middle class and more flexible financial ownership restrictions is the insurance industry.

In December, France-based insurer AXA announced that it completed the purchase of its domestic shareholders for approximately 4.6 billion yuan, claiming to be the largest 100% foreign-owned property and accident insurance company in the Chinese market. .

Looking ahead, AXA China CEO Xavier Veyry said the company is seeking to take advantage of the increased demand for Chinese consumers’ health insurance.

“It is important that foreign companies, first of all, take root in the Chinese market, serving Chinese customers with the support of the parent company because China is not a single market and customer needs are very diverse and demand of advanced digital applications will drive the future, “Veyry said in a statement to CNBC earlier this month.

Government concerns

China may present a unique opportunity for companies looking for growth right now. But concerns about fraud have escalated after Nasdaq-listed Luckin Coffee, which touts itself as Starbucks’ local rival, revealed in April that it was manufacturing about 2.2 billion yuan in sales last year.

The United States Senate unanimously and quickly passed legislation in late May that could ultimately compel Chinese companies to withdraw their shares from US exchanges. The House of Representatives is expected to vote later this summer.

The problem right now is that (US regulators) need to sit down with us with the problem-solving attitude to find a plan.

Fang Xinghai

vice chairman, China Securities Regulatory Commission

Chinese regulators have tried to signal that they are taking steps to prevent fraud in light of the Luckin scandal.

“We are ready to solve problems,” Fang Xinghai, vice chairman of the China Securities Regulatory Commission, said Thursday at the Lujiazui Forum in Shanghai, according to a CNBC translation of his Mandarin-language comments shared through media backed by the state.

“The problem right now is that (US regulators) need to sit down with us with the problem-solving attitude to find a plan,” Fang said.

Across Asia, fraud will only escalate as the coronavirus crash puts increased pressure on business units to make a profit, and remote work setups may be more vulnerable to cyber attacks, some analysts said.

That is giving rise to some regional business opportunities.

Chris Fordham, managing director of the Alvarez & Marsal disputes and investigations team in Hong Kong and China, told CNBC last week that the company plans to double its workforce from about 50 people right now in Greater China, to about 100 in about two years.

But despite everything China talks about openness, foreign companies, including financial ones, still complain about burdensome local requirements, not to mention a state-dominated local market.

Peter Ling-Vannerus, chairman of the banking and securities working group of the EU Chamber of Commerce in China, noted that China’s financial institutions are some of the world’s largest companies with significant state support and 20% of global deposits. “They are giants that you cannot easily compete with,” he said in a statement.

Within China, “European bank executives highlighted the staggering number of periodic reports that must be filed with various regulators, about 100 every month,” said Ling-Vannerus. She noted that at this time, financial institutions are cautiously moving forward in China, as she said is the case for all European companies in the country.

.