Fastly (FSLY) has been one of the biggest winners in the market since the COVID-19 hit the meltdown. The company came up above expectations in its latest recent earnings report, but the stock sold. Fear has been fueled by the company revealing that TikTok accounted for 12% of revenue in 1H2020.

Losing a 12% customer is never a good thing, but is not certain, because Microsoft (MSFT) and Twitter (TWTR) have emerged as potential suitors, despite Billflates’ unflattering remarks about the potential acquisition. If the reaction on the market’s knee is news to sell, it often seems as if investors selling the forest for the trees are missing out. Long-term investing is not an overly secure endeavor, but the risk of losing a large client is something for investors to keep in mind when qualitatively evaluating safety margin.

Despite the sell-off, investors who bought early this year have done well. What has been driving the rally since March? The simplified thesis is that Fastly benefits from increased internet usage during the pandemic, but this is not exactly why investors should be put off by Fastly in the long run. Increasing internet usage is far too simplistic, we should rather understand who Fastly’s customers are, why they use their services, how much they pay, and why they will continue to use their services in the future.

Customers of Fastly

Source

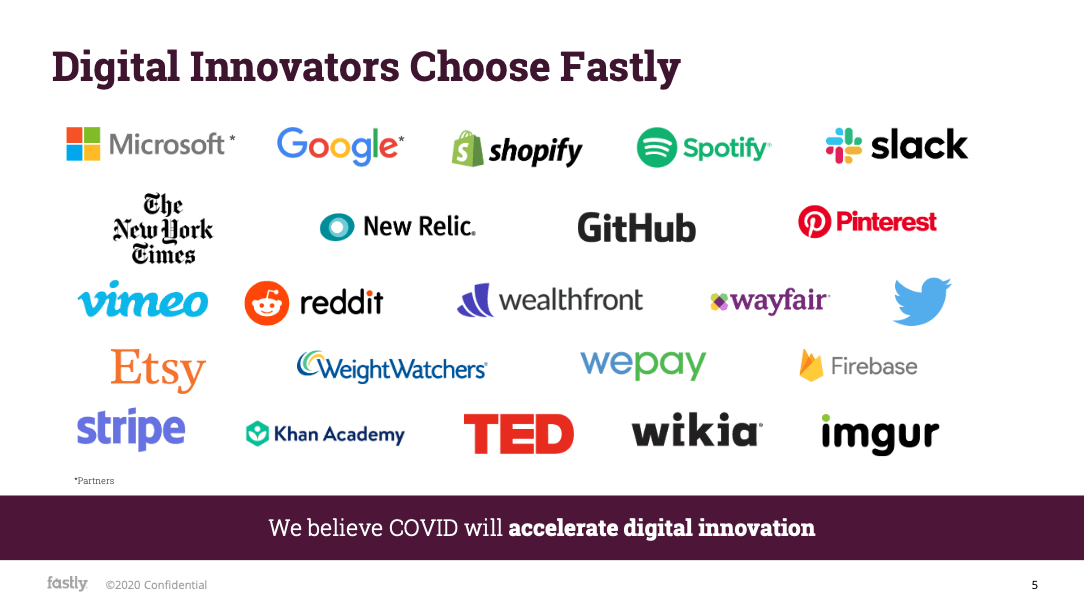

Fastly’s customer base is who’s digital innovators. Understanding how one of these companies uses Fastly’s services can give investors a clear idea of where Fastly’s growth is coming from.

Take Shopify (SHOP), for example. Shopify’s company offers digital solutions for businesses. Setting up an e-commerce storefront is one of these services, but Shopify also provides backend services needed to keep digital storefronts up to date on performance. Fast is one of those services. When customers order from a Shopify store, the traffic is routed through a Fastly CDN. Thus, as more shoppers join Shopify’s ecosystem, more traffic will flow quickly.

As Shopify’s traffic grows, so does Fastly’s topline. This is just one example, as shown above this also applies to numerous other customers. Some customers may use more than one CDN, but in general if other companies like Wayfair (W) drive more traffic, Fast benefits. While it is correct to assume that increased internet usage will benefit rapidly, this statement does not capture the essence of Fastly’s structural tailwind. Fast is a variable spending item for high-growth Internet businesses.

What does this tell investors? In general, as Fastly’s high-growth Internet businesses grow, so will it.

Understand CDN

Source

Source

Content Delivery Networks (CDNs) are nothing new. They are a bridge between the host server and the end user to improve performance. Akamai (AKAM), Cloudflare (NET), and Limelight (LLNW). In fact, Shopify is also listed as a Cloudflare customer. Reddit appears to be the only other crossover among the featured customers of each company. Some might argue that CDN is a relatively commoditized industry. While the service is commoditized, the way the service is deployed is differentiated between vendors. What makes Easy different can be traced back immediately to the founding of the company.

As the story goes, (Fastly founder) Artur (Bergman) became frustrated with the capabilities of CDNs around 2010. He complained about technical support needed to make adjustments to his CDN configuration and long delays as changes unfolded. Existing solutions lack programmability, a feature that was greatly appreciated by the engineering teams who were increasingly drawn into conversations about application performance and uptime through the DevOps movement. With a strong practical technical background, Artur decided he could build a better solution and he did.

The core release of other CDNs that do not lack configuration failure is one of the advantages that Fast has in winning the business of high-growth Internet companies. The other is the coding language Varnish in which Fastly was written.

At the heart of Fastly is Varnish, an open source web accelerator designed for delivering high-performance content. Update is the key to accelerating dynamic content, APIs and logic to the edge …

Tells hastily in the power of Varnish – our (author note: now former) CEO Artur Bergman and engineer Rogier Mulhuijzen have contributed parts of the basic code, and continue to contribute to the project to this day. Rogier tells a great story about the first time he ever wrote VCL, that will also give you an idea of what Varnish is capable of.

Source

With the speed of Fastly, stores can print information faster than ever before. Search Alpha or CNBC can run breaking news headlines on the edge (your device), allowing readers to receive breaking news headlines in real time. For companies that are not technology driven, it is not really necessary to complicate things with a configured CDN.

Finally, Fastly offers a differentiated CDN for developers, but the functionality of the core service has a lot of competition. This user describes the desirability of Fastly and Cloudflare can give investors some insight into the differences.

over-bifurcating to make a point: cloudflare is for macbook devs, rap is for types of Linux workstations.

they can both do about 80% of the same thing pretty easily, but cloudflare favors the web interface and “dumbed down” settings to keep the barrier to entry and learning curve low.

has almost an almost vertical learning curve (dns, tls, vcl, shielding, io / waf), but once you are comfortable you can think of it almost as part of your stack, like one of your services that just happens to be who speaks to the world.

i would test the decision what you are trying to do. if you want to “configure and forget” it by clicking once in the web and not touching it again until you might change hosting, and it’s okay with 80 – 90% cache hit ratio, you’ll probably have an easier time with cloudflare. If you want to use regex and modify headers and mess with cookies and active cache validation to get 99% cache hit rates then use fast.

Reason that Fastly’s services are purely commodity is not very fair, but is understandable. Users describe Fastly’s services as more technical in general, but that technical level is not necessary for every business. When customers compare and read the opinions of those who understand both services, it seems that Fastly has a greater potential in terms of taking the total customer volume. This means that investors can see rapid growth models that will continue in the foreseeable future.

Income is critical, but free cash flow is important for investors. To better understand the prospects of Fastly, we need to better understand the interest in the edge-to-edge computing platform, and take a closer look at cost structure.

Edge Computing

Edge Computing gets a lot of buzz, but this simple example from Cloudflare gives us a good idea of how edge computing is used in practice:

Imagine a building secured with dozens of high definition IoT camcorders. These are ‘dumb’ cameras that simply emit a raw video signal and that signal streams continuously to a cloud server. On the cloud server, the video output of all cameras is placed through a motion detection application to ensure that only activity clips are stored in the server’s database. This means that there is a constant and significant voltage on the internet infrastructure of the building, because significant bandwidth is consumed by the high volume of video images being transmitted. In addition, there is a very heavy load on the cloud server that have to process the video images from all the cameras at the same time.

Now imagine that the motion sensor calculation is moved to the network edge. What if each camera used its own internal computer to execute the motion detection application and then sent footage to the cloud server as needed? This would result in a significant reduction in bandwidth usage, as many of the camera recordings never have to travel to the cloud server. In addition, the cloud server would now be solely responsible for storing the important footage, which means that the server could communicate with a higher number of cameras without being overloaded. This looks like edge computing.

The advantage of Edge Computing is the reduction of pressure on the digital infrastructure. This is a net positive for end users because computing costs money. But, this leads to a monetization problem for Fastly.

Consider the above scenario in terms of Fastly’s business. Quickly generating revenue based on the volume of outputs, edge computing is set to dramatically reduce output.

Our commitment-based revenue is growing as our customers’ websites and applications deliver, process and protect more traffic as they adopt more features of our edge platform and as they adopt our platform broadly across their organizations.

Flight 10-K

Edge computing and Internet of Things devices are still in their infancy. Although the Flugger gives more top if the company is a winner in this segment, it is incredibly difficult to predict. Investors should not currently attribute tangible value to Fastly’s edge computing platform. Edge computing can provide a platform for businesses to reduce expenses, but Snel needs to navigate the monetization problem intelligently.

Why investors should tread carefully

So far, we have decided why we should expect Fastly to continue to grow, and why we should cautiously assign each value to its edge computing platform.

We need to know what free cash flow will look like. Unfortunately, Fastly does not enjoy the same operating charge as many of its customers. This is because of Fastly’s physical presence points (POPs).

Source

Source

Fast requires physical assets to run its business, which will naturally push margins compared to other technology companies. A software company, for example, will need very little extra expense to serve an additional customer, creating high operating charges. Fast will not have the same advantage. This shows in Fastly’s gross margin. In any case, what ultimately matters is what Fastly’s market expects. A simple 5-year look at free cashstream can give us an idea.

Source: author

Source: author

I used consensus number for revenue through 2022, and maintain a 35% growth over the next three years. As much as this article has discussed, this is due to Fastly’s structural tailwinds. But, when we look at margins, we see, even after the sell-off, the market expects a lot. This makes buying dangerous at the current level.

FCF margin going from -22.9% to + 15% in 2025 is no small task for a company to achieve. Operating costs should scale, but CapEx is unlikely to consider Fastly’s physical POPs. A multiple of 50x FCF is an estimate for ballpark, considering that Akamai is the only CDN on scale and trades closer to 30x with much slower growth. Akamai’s FCF margin is 21%, which is perhaps the best estimate in which Fastly’s margins will look on a scale, but is within range of what is modeled. This model results in implied marginal return of 0.4% over the next 5 years.

With such an uncertain margin profile, investors take a big risk to buy quickly at the current level. The capital intensity of Fastly will not be a clear apple for apples compared to a course of other companies. It is difficult to imagine a more profitable business than the one suggested above. Warren Buffett can refer to this scenario as buying a good business at a great price. With much uncertainty about levels of profitability, the risk of rewarding profile is skewed to the disadvantage.

Announcement: I / we have no positions in named shares, and no plans to initiate positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I do not receive compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose supply is mentioned in this article.