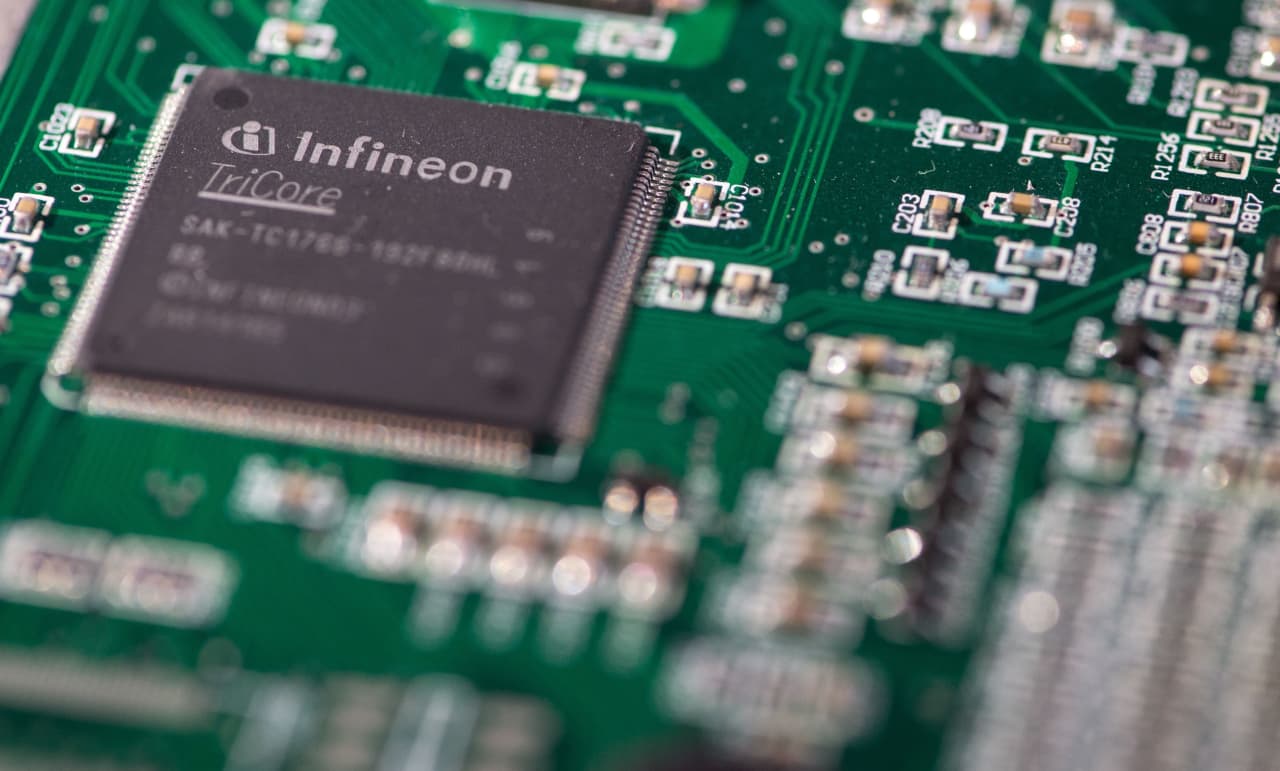

German semiconductor maker Infineon was one of the most downed on Friday when European tech stocks plummeted.

Matthias Balk / Agence France-Presse / Getty Images

European stocks fell sharply on Friday as tech stocks fell and investors were no longer able to avoid mounting tensions between the United States and China.

Pan-European Stoxx 600 SXXP,

fell 2.1% in early operations, with tech stocks falling 4.5% The German DAX DAX,

fell 2.2% and the French CAC PX1,

it was 2.1% lower. YM00 US Stock Futures,

ES00,

NQ00,

He also pointed down.

Asian markets fell overnight when Beijing retaliated against the United States after the Trump administration ordered the closure of the Chinese consulate in Houston. China ordered the United States to close its own consulate in Chengdu, as the dispute between the world’s two largest economies intensified.

Hang Seng HSI from Hong Kong,

the index fell 2.6%, while China’s SHCOMP comprised of China

3.9% plummeted. The negative sentiment, compounded by the drop in US tech stocks on Thursday, spread to the European opening.

“The fear is that this could be just the beginning of a escalation in tensions between the two superpowers,” Spreadex analyst Connor Campbell said as President Donald Trump seeks to “distract” himself from the domestic situation in the United States before presidential elections. .

After Intel warned that production problems could delay the next generation of its nanometer chips by at least six months, European microchip companies Infineon Technologies IFX,

and ASML ASML,

it collapsed in the first operations, along with the broader European technology sector.

Thursday’s slump on Wall Street was led by Apple and Microsoft, which account for more than half of the Dow’s DJIA,

losses, as weak employment data and concerns about another financial aid package from Congress appeared to trigger a sell-off in large-cap stocks. Tesla TSLA,

Amazon.com AMZN,

Netflix NFLX,

and Google Googl’s parent alphabet,

everything fell

There was some good news in Europe, but investors largely ignored it, given the broader mood early Friday.

French business activity exceeded expectations in July, rebounding more than expected after the closure measures were lifted, according to the closely watched Purchasing Managers Index. The German manufacturing sector also avoided a contraction for the first time in 19 months. In other positive signs, UK retail sales rose 13.9% in June, beating consensus estimates of an 8.3% increase, with sales now higher than before the crisis.

Actions in focus

Owner of British Gas Centrica CNA,

It shot up 22% after announcing a deal to sell its U.S. energy business to NRG Energy for $ 3.6 billion.

Vodafone VOD,

Shares fell 3.4% as the world’s second largest mobile operator confirmed plans to list its tower businesses in Frankfurt next year. The company’s revenue fell 1.4% to € 10.5 billion ($ 12.2 billion) in the first fiscal quarter.

.