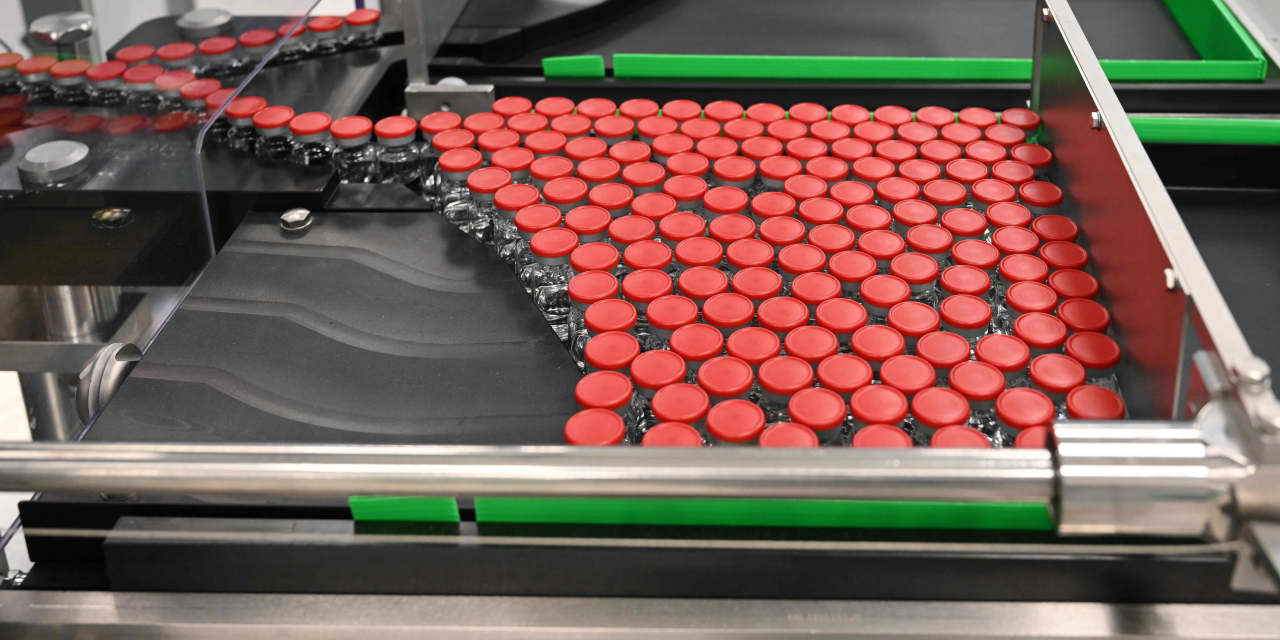

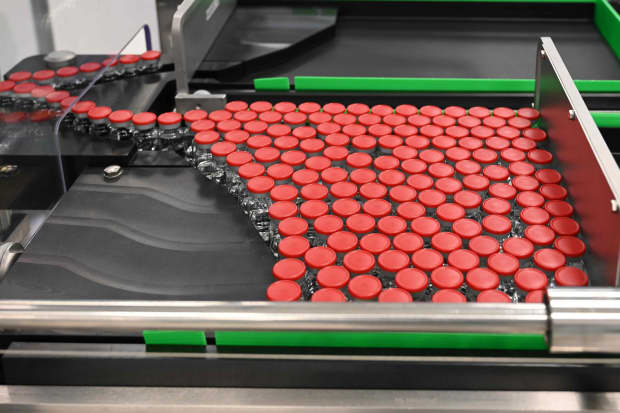

Capped vials of Oxford University’s COVID-19 vaccine candidate, who resumed trials after a break last week.

Vincenzo Pinto / Agence France-Presse / Getty Images

European stocks rallied on Monday, with US equity futures driven by news of vaccine hope, mergers and acquisitions.

Stoxx Europe 600 Index SXXXP,

The best weekly return since the week ended August 7, rising 0.3% to about 1.7% after the end of last week.

0.3%, French CAC 40 PX1,

0.4%, while the FTSE 100 Index UKX,

Was trading flat.

Investors will hear from the Federal Reserve, the Bank of England and the Bank of Japan in the coming days for a busy weekend for central bank meetings.

Wall Street, with the Nasdaq-100 futures NQ100, was also pointing to a stronger start.

145 points or 1.3%, while the S&P 500 futures ES00,

38.95 points or 1.2%, and the Dow Jones Industrial Average futures YM100,

278 points or 1%.

That gain came in the week of losing to the Dow DJIA for Gain Street.

1.7% drop, S&P 500 SPX,

Fell 2.5% and Nasdaq COP,

March.1%, its worst weekly loss since the week ended March 20.

New hopes on the coronavirus vaccine also helped in a sense of improvement earlier in the week.

Pfizer Inc. Of PFE,

Chief executive officer Albert Borla said in an interview on Sunday that the drug maker should be informed that its COVID-19 vaccine candidate will be operational by the end of October – and if approved, it could be distributed in the US by the end of the year. Pfizer is partnering with German drugmaker Bioentech BNTX,

On vaccine development.

Oxford University also announced on Saturday that it would resume hearings for a coronavirus candidate developing with AstraZeneca AZN.

The study was halted last week to review a “disorderly illness” in which a UK patient fell ill. Oxford University said it was considered safe to continue. Shares of AstraZeneca rose 0.5%.

U.S. Located Gilead Sciences Inc. GIDD on Sunday announced a 21 billion deal for Biotech Immunomedics Inc. IMMU has made a purchase of a key breast cancer drug maker.

Japanese technology company Softbank Group Corp. announced a 40 40 billion deal to sell chipmaker Nvidia NVDA to UK-based microprocessor designer Arm Holdings late Sunday evening.

For a mix of cash and stock.

Along with shares of German sector software group SAP SE SAP, the technology sector was also taken down by M&A,

0.3% rose and chip equipment manufacturer ASML Holding NV ASML,

ASML,

Above 0.3%.

And the race for tickets is getting excited. Software Software Group Racing Corp.

Microcorpt Corp., a technology giant, apparently by China’s BitDance. After MSFT’s offer was rejected, the US was instructed to handle the video sharing application.

But in a recent turn, Chinese state media say bitdance has also rejected Oracle.

Elsewhere, Euronext NV ENX,

On Monday it said it had submitted a non-binding offer to acquire Boris’ Italina from the London Stock Exchange Group plc LSE.

Pan-European exchange in partnership with Italian lender Casa Deposit e Precity Equity and Intesa Sanpolo Olo SPA ISP,

On offer. Shares of Euronext fell 0.2% and shares of the London Stock Exchange fell 0.5%.

.