[ad_1]

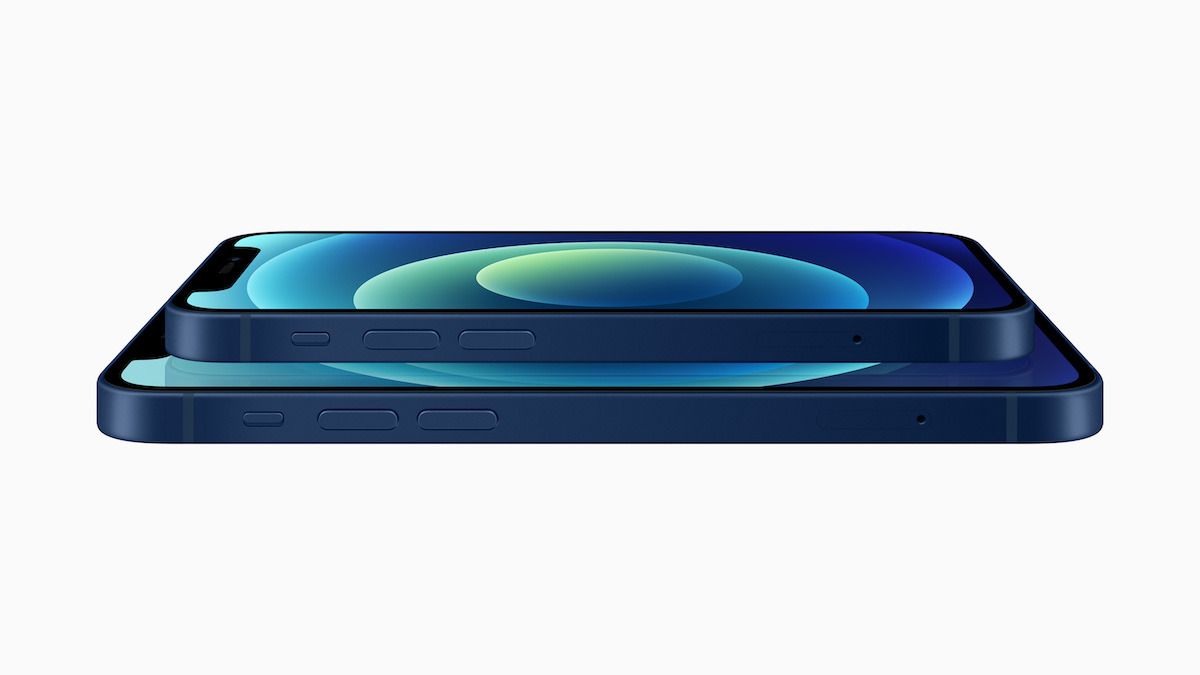

Morgan Stanley is warning investors of a possible loss of revenue from the iPhone for the September quarter, but continues to believe that the iPhone 12 will drive growth going forward.

In a note to investors seen by AppleInsider, principal analyst Katy Huberty believes that the current aggressive expectations of the iPhone “do not fully explain the lack of new products” in the September quarter. He adds that the current iPhone consensus for the period of 40.4 million shipments is “too high.”

That’s because the iPhone 12 and iPhone 12 Pro models were released too late to impact the quarter. Despite that, the performance of the iPhone SE and iPhone 11 bodes well for Apple, and Huberty has increased his estimates of revenue and earnings per share for the September quarter by 2% and 4%, respectively.

Based on the performance of Apple’s older iPhone models, Huberty has raised his September iPhone revenue forecast to $ 22.9 billion on 33 million shipments. That’s below the iPhone revenue consensus of $ 28.5 billion and the shipping consensus of 40.4 million units for the quarter.

Huberty adds that investors are likely to “ignore” the iPhone results for the September quarter, given the focus on the new iPhone 12 models. And while he notes that it is too early to place bets, initial delivery time indicators are promising for the lineup.

As of October 20, delivery times for the iPhone 12 and iPhone 12 Pro are 18.5 days for the iPhone 12 Pro and 10.1 days for the iPhone 12, from the delay in the anticipated delivery date . That puts the lineup in third place behind the iPhone X and iPhone 11 Pro and iPhone 11 Pro Max at this point in their respective cycles.

The analyst notes that anecdotal reports from Apple’s supply chain indicate that demand for the iPhone 12 is much higher than past generations.

Huberty has also raised Morgan Stanley’s Apple Services estimates to $ 14.5 billion, up 2%. Overall, the bank predicts Apple’s September quarter revenue of $ 60 billion and earnings-per-share estimates of $ 0.62.

The investment bank maintains its 12-month AAPL price target of $ 136, based on a 5.9x enterprise sales value multiple in the Apple Products business and an EV / Sales multiple of 10.5x in the Services business. from Apple. That results in a sales / EV multiple of 6.7x for 2021 and a target price-earnings multiple of 33.3x for that year.

Shares of AAPL were trading at $ 115.13 Thursday morning, down 1.49% in intraday trading.