In the first letter received by CNN Business, V. Rene wrote that “numerous investors may have used this preliminary and insider information about the emerging epidemic, tragic economic and public health consequences, to make a profit for themselves.”

A report of those private concerns held by top US officials has been spread among selected investors by a hedge fund consultant, which will allow these traders to make bets that the stock will fall.

According to the Times, presidential aides were “giving rich party donors a warning of a potentially effective infection when wealthy Trump publicly insisted that the threat did not exist.”

The Times said a large investor’s response to the hedge fund consultant’s memo was “short of everything”.

It turned out to be a lucrative business.

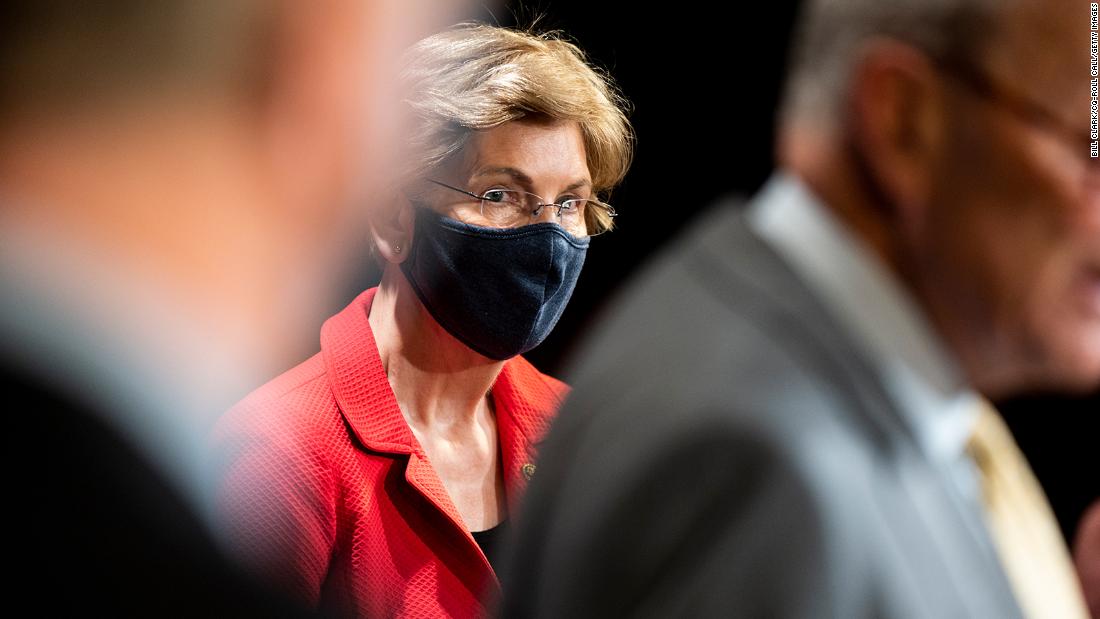

In the letter, Warren said the incident “seems to be a case of an internal trade textbook.”

‘Duty’

Treasury Secretary Steven Munuchi on Thursday called the Times report a “second exaggeration” by the paper.

“I can’t imagine this,” Munuchi told CNBC. “By the way, there were a lot of investors who had their own ideas of what was going on at the time and were rightly very concerned.”

And the Times has reported that legal experts say it is not clear that any communication about this briefing violates securities laws.

But at least one billionaire investor expressed concern about the incident.

Vernon requested the SEC and CFTC to review Republican information on the material provided to investors and any trade that may result from it.

In particular, the groom asked regulators to determine which officials in the Trump administration provided the information, how the information differed from public comments by the administration, who received the information, and whether those individuals traded securities, futures, exchanges or commodities. .

“If this report is accurate, it represents a horrific resignation by President Trump and the top brass of his administration,” Warren wrote.

.