[ad_1]

02:20 a. M.

Friday 18 September 2020

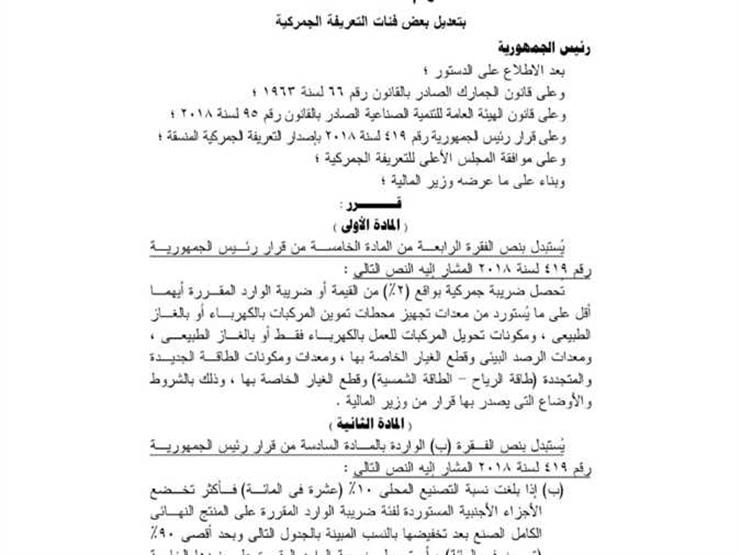

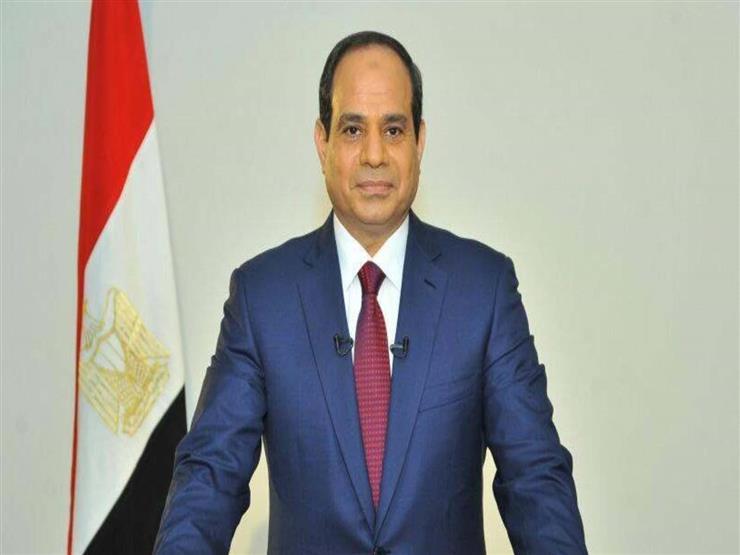

President Abdel Fattah El-Sisi issued a decision to amend some articles and categories of the customs tariff contained in Presidential Decree No. 419 of 2018 that issues the harmonized tariff.

Resolution No. 459 of 2020 includes the modification of the fourth paragraph of Article 5 of Presidential Decree No. 419 of 2018 referring to the following text: A customs tax of 2% of the value or the entry tax, whichever is less, will be charged. on imported equipment for supplying electrical energy to vehicles. Or with natural gas, the components of conversion of vehicles so that they work only with electricity or with natural gas, environmental monitoring equipment and its spare parts, equipment and components of new and renewable energy “wind energy – solar energy” and its spare parts, according to the terms and conditions issued by a decision of the Ministry of Finance.

The second article stipulated that the text of subsection “b” contained in article 6 of Presidential Decree No. 419 of 2018 on the percentage of local industrialization, referred to as the following text should be replaced:

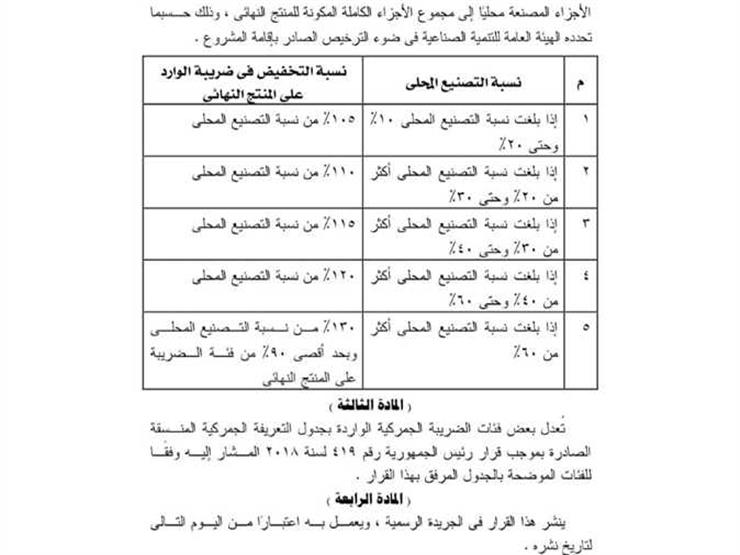

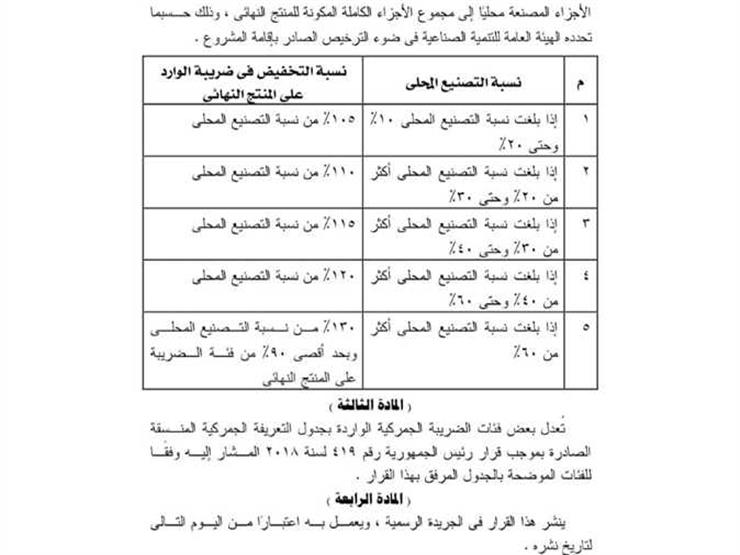

(B) If the percentage of local manufacturing reaches 10% or more, the imported foreign parts will be subject to the kind of import tax that applies to the finished product after reducing it at the rates indicated in the following table and up to maximum of 90%, or the import tax will be charged on its own articles, whichever is less, for each Party of them separately when the percentage of local manufacture reaches 60%, and these percentages may be reduced to 40% by decision of the Minister of Commerce and Industry.

The last article stipulated that this law will be in force from the date of its issuance and its publication in the Official Gazette.

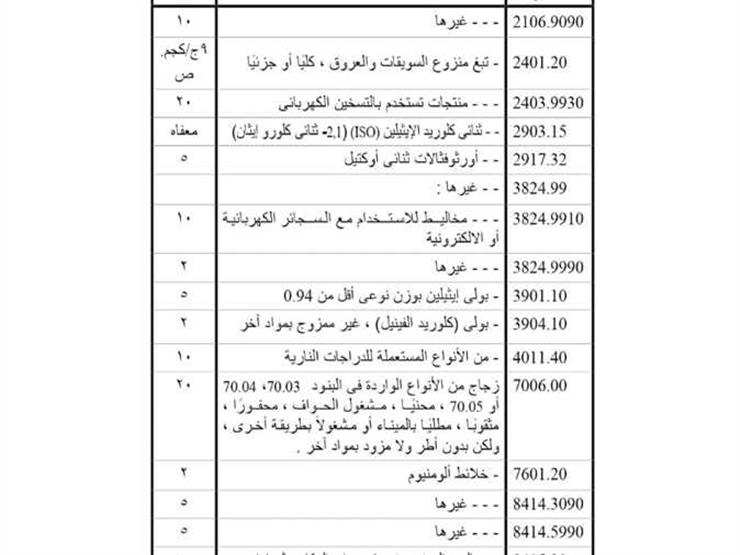

The Official Gazette published in Number 38 continued on September 17, 2020, Presidential Decision No. 549 of 2020 that modifies some categories of customs duties.