[ad_1]

The House of Representatives approved the latest income tax amendments last Saturday, after a Republican draft resolution was passed by law, and the House of Representatives approved it. These latest amendments include raising the tax exemption limit for some segments, and the personal tax exemption limit has been raised, and these amendments will apply. As of July 1, 2020, these amendments aim to increase wages for workers in the country.

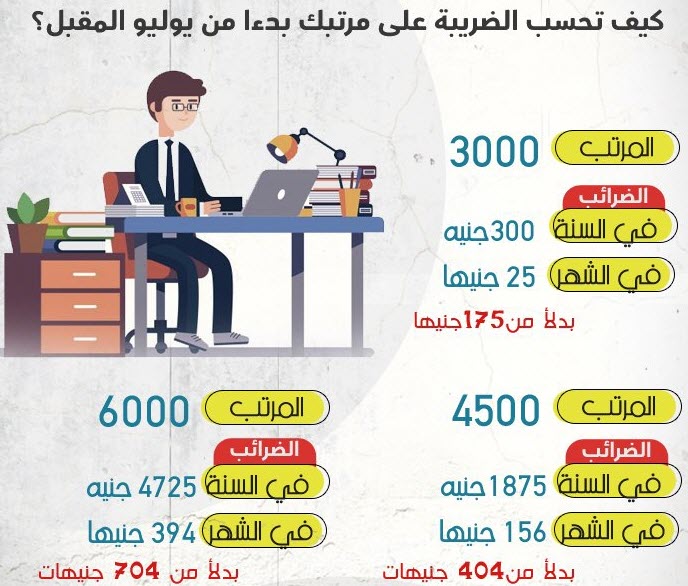

The employee can calculate the income tax that will be calculated on his salary if this employee works in the government or the private sector. If the employee’s salary is £ 3,000, the annual tax amount will be £ 300 per year, and the tax amount will be £ 25 per month instead of £ 175 per month AND the annual total is 25 x 12 = 300 annual pounds.

If the employee’s salary is £ 4,500, then the value of the income tax will be 1,875 pounds, equivalent to £ 156 per month instead of £ 404 per month, and if the employee’s salary is £ 6,000 per month, Then the value of this employee’s annual income tax will be £ 4725, and the amount of the tax will be £ 394 per month. Pounds instead of 704 pounds.

How to calculate the income tax of your salary

Dr. Mohamed Moait, Minister of Finance, stated that personal income tax in light of the new amendments is progressive and achieved savings for the lower wage classes and that the new amendments have addressed the current distortions that They focus on tax deduction and the new amendments include increasing the tax exemption limit by 60% and increasing the base limit for each taxpayer from £ 8,000 a year to £ 15,000, which is the first exempt tranche.

The tax amendments also included an increase in the personal exemption limit for owners of wages from £ 7,000 to £ 9,000, so the annual income from wages reaching £ 24,000 will be fully tax exempt, and a 2.5% tax value for those with annual income ranging between 15 and 30 thousand Pounds that are not the personal exemption limit.