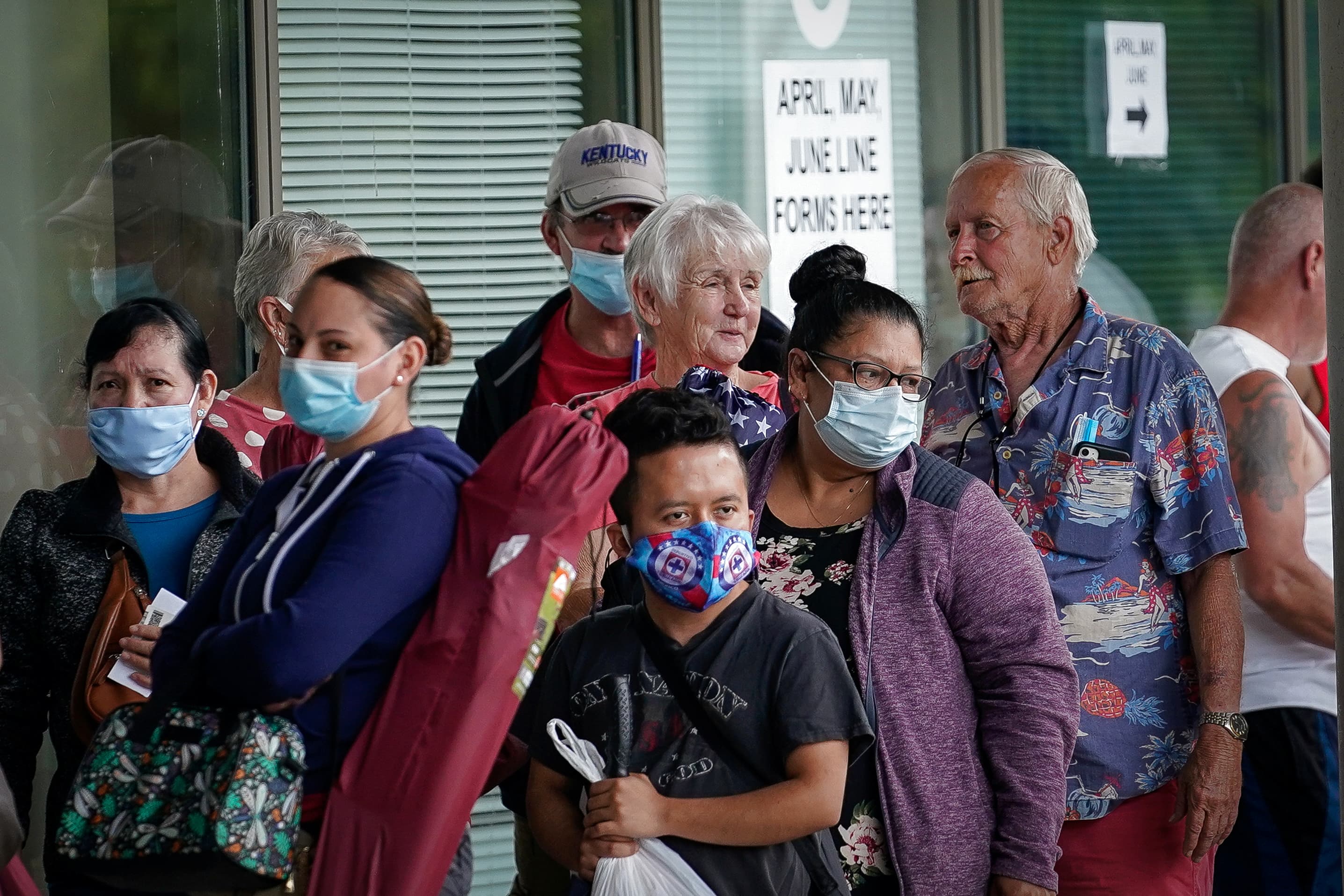

People stand outside a Kentucky Career Center hoping to find help with their unemployment claim in Frankfort, Kentucky, June 18, 2020.

Bryan Woolston | Reuters

There is a one in four chance that the economy could fall into a double recession, according to a majority of economists surveyed by the National Association for Business Economics.

Two-thirds of NABE members say the economy is not yet out of the recession that began in February. Eighty percent see a 25% chance of a second dip, once the economy recovers.

The 235 NABE members in the half-yearly survey gave good marks to the Fed’s stimulus efforts, but they were divided over the question of whether Congress has done an adequate job in response to the recession.

Three-quarters believe the Fed’s current monetary response is appropriate, the highest percentage of current monetary policy approvals since 2007. Nearly 60% expect federal fund rates to remain unchanged at 0-0.25%, or even lower go, at the end of 2021. Most expect the fund’s target to be higher by the end of 2022, but still within 100 basis points of where it is at present.

The survey was conducted between July 30 and August 10, just as Congress was struggling, but failed to reach agreement on the latest incentive package. Forty percent said the stimulus provided by Congress was not enough. Another 37% said it was adequate, and 11% saw it as excessive.

More than half, 52% say the optimal package for the next fiscal package would be at least $ 1.5 trillion, while another 20% think it should be between $ 1 trillion and $ 1.5 trillion . Seventeen percent thought a package smaller than $ 1 trillion would be optimal.

Sixty percent of panelists said Congress should extend both supplementary unemployment insurance and the Paycheck Protection Program for small businesses. Another 18% said they do not believe the extra wage for unemployment should be extended.

Twenty-five percent of respondents say fiscal policy is too tight or restrictive, while another 37 percent think it is “almost equal.”

Economists are concerned about the growing amount of U.S. debt, with 88% at least “somewhat” concerned by the fact that federal government debt is on track to exceed 100% of GDP, higher than any period since WWII. Twenty percent is very attentive and 34% is busy.

They also considered the best way for Congress to increase revenue. Fifty-five percent said a broad-based energy or carbon tax should be increased, and 51 percent said broad-based individual and / or corporate taxes should be broadened. Support for a wealth tax rose to 36% from 24% in the February survey in August.

NABE said a majority of 58% said the government should have done more when the economy was in good shape to develop better fiscal stabilizers.

Three key policy priorities that the next board must address in its first year are combating COVID-19, promoting economic recovery, and health policy. They were mentioned more often than a dozen other choices.

.