For the stock market it has been a rough September with the S&P 500 SPX.

Below 7% so far

In its broader view of the markets, Citi’s global asset allocation team doesn’t expect to find any easy facilities on the promenade, as it will be the next U.S. There is fear for the election. “A political process that cannot be sure of its leader, the parties refuse to accept the results and undermine the confidence of investors in the light of possible social unrest, the credibility of all losses and especially everything else that happens in the background. Strategists say the challenge to the rule of law will lead to a reassessment of temporary historical “safe” U.S. assets (including U.S. Treasury and U.S. Treasury), even if only temporarily, “says strategists.

The second phase of the Covid-19 related excitement is likely to be an accident of the Supreme Court vacancy, strategists (more on that below). As the Northern Hemisphere enters the cold autumn period, there is becoming increasingly clear an increase in cases that could change both human behavior as well as government reactions, both of which could weigh on economic activity.

The Citigroup acknowledges that “the central bank is internally bound in the put equity market,” and will buy more Treasury bonds and credit, and wants to keep inflation-adjusted interest rates below 1%.

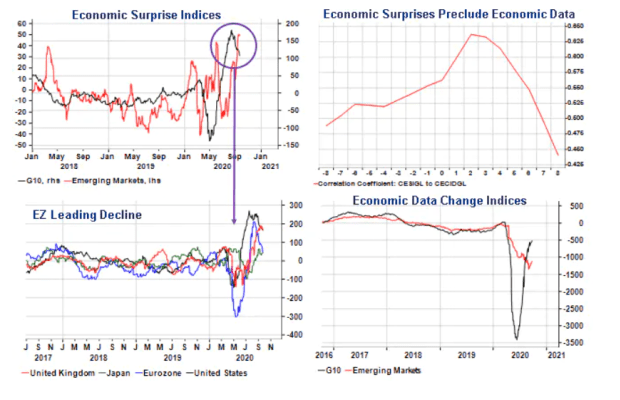

Against the backdrop of all this, the City team says, “It is worth trimming certain emerging market risks at a time when the near-term prospects are in some regional trend. [economic surprises] Negative reversal, led by Europe. “It advises moving from European to emerging-market equities EEM,

Where it is overweight for the first time since the COVID-19 crisis. Fundamentals of DXX DXY,

Strategists added that it will be unable to do so in the medium term, which will be another positive for emerging-market equities.

They are buying a dip in Gold GCZ20,

200 with a target of 2,200, due to extended macroeconomic uncertainty, which is likely to draw investors back into alternative cash savings assets.

Humming

After the House Democrats began drafting a new stimulus bill of 2. 2.4 trillion, from the previous tr 3 trillion, the new U.S. The stimulus package is being discussed. “We hope to come to the table with them soon,” said House Speaker Nancy Pelosi, while Treasury Secretary Steven Munuchin said the two sides had agreed to continue negotiations.

New York Federal Reserve President John Williams wrapped up a week of FedSpeak with a speech. On the economics front, too, durable goods orders data remained outstanding in August, with modest gains expected after a 11% jump in July.

COSTCO WHOLESALE COST,

Excluding gasoline and currency shifts late Thursday night, stores beat financial quarterly earnings forecasts on sales growth of 14%. Chief Financial Richard Richard Galanti has not committed to using the equivalent of about $ 30 per share of his shares in cash and dividends or dividends, except that the board will look into it during the next meeting. He also said the discount retailer would continue to pay workers an extra 2 2 an hour for at least the first eight weeks of the first quarter of the fiscal year.

The European Union (EU) has appealed a tax ruling in favor of Apple Paul AAPL.

Which adds up to about 17 billion dollars for the technology giant.

FTSE Russell has said that in another move to consolidate China into global financial markets, Chinese government bonds will be included in its world government bond index next year. Deutsche Bank analysts estimate that the move will bring in 120 120 billion by September 2022.

Bazaar

Thursday before and after the next session. U.S. Stock Futures ES00,

NQ00,

Fell once again. The dollar rose, and gold fell.

Chart

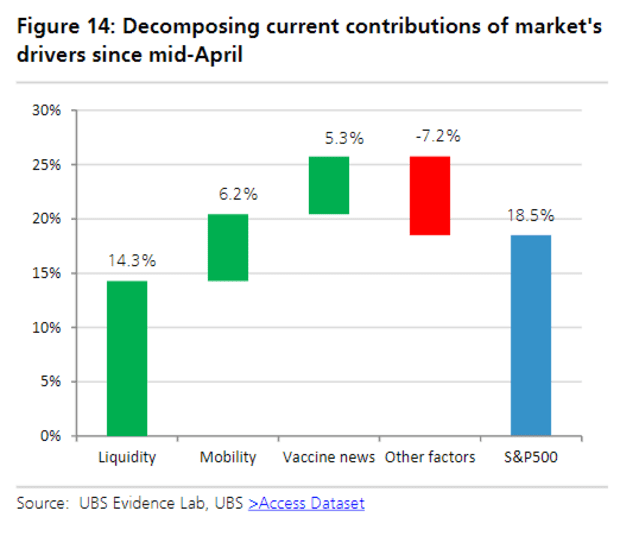

UBSA has withdrawn the S&P 500 since April 10 this year, cracking down on breaking the dynamics that bottoms up. Their analysts conclude that the biggest driver is an increase in liquidity, which they say has been in the plateau over the past month. Improving mobility and hoping for a vaccine have also helped, while elevated uncertainty has been a stretch. Their strategists recommend a one- to three-month spell away from the U.S., especially in emerging-market parity.

This tweet

Now this is a ceasefire letter.

Reads randomly

How the founders of special purpose acquisition companies pay – even when the stock is declining after the deal is closed.

The birds changed their song in response to the quiet streets

Crows, surprisingly to scientists, have consciousness.

Need to know the initial start and update to the initial bell, but sign up here to deliver it once to your email book. The emailed version will be sent out at about 7:30 p.m.

.