Shares in the Asia Pacific rose during Thursday’s trading session, following positive news overnight about the development of a possible coronavirus vaccine.

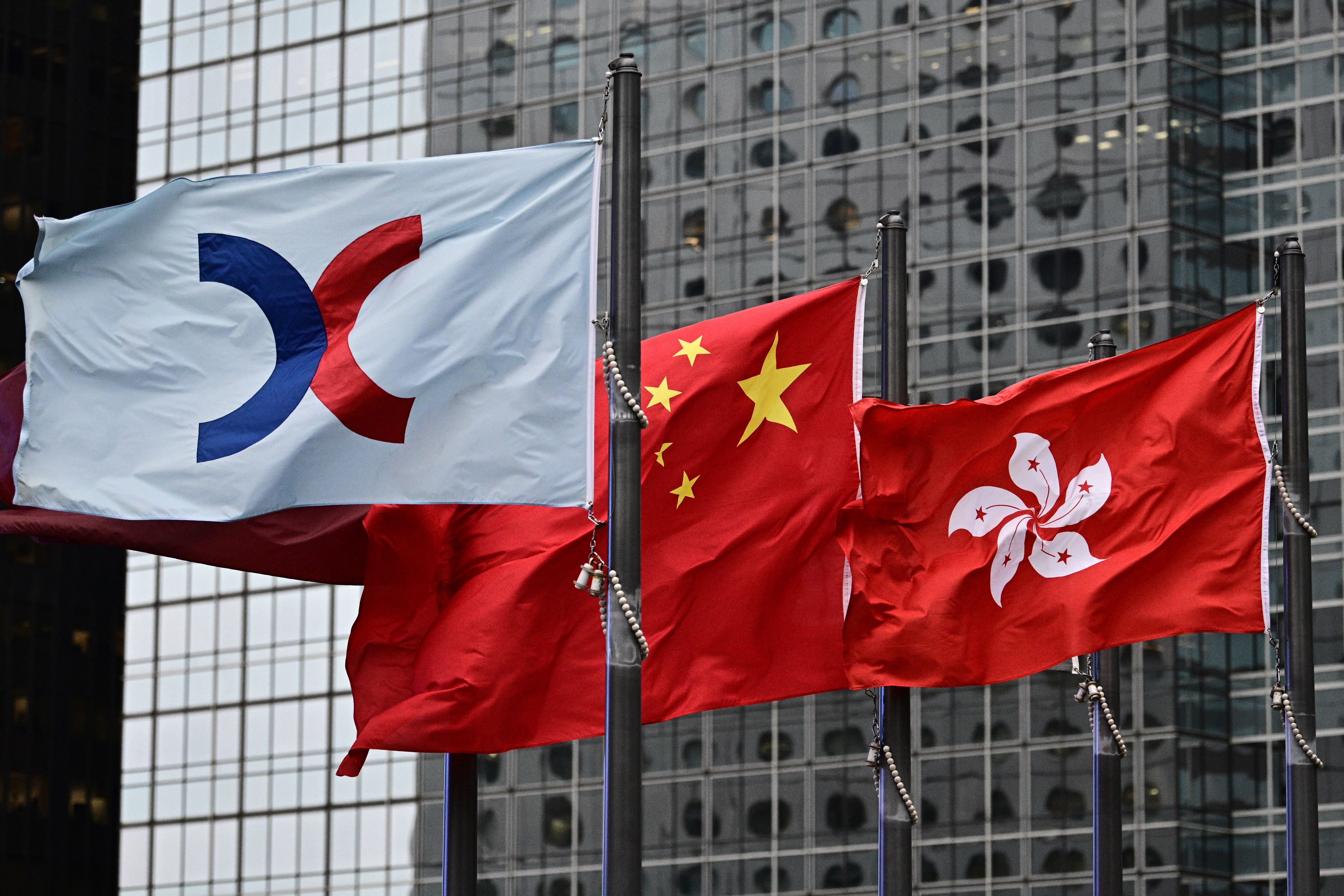

The Hong Kong Hang Seng Index led gains among the region’s major markets, rising 2.25%, from its last hour of trading. Shares of Chinese internet giant Tencent soared around 3%, while Hong Kong’s exchanges and clearing soared 4.85%.

The tensions were closely watched after China’s controversial national security law went into effect on Tuesday and Hong Kong police announced their first arrests under the measure on Wednesday. Police have so far arrested some 370 people, they said on Twitter.

Mainland Chinese stocks also posted strong gains on the day, with the Shanghai Composite rising 2.13% to around 3,090.57 and the Shenzhen component adding 1,292% to approximately 12,269.49.

South Korea’s Kospi rose 1.36% to close at 2,135.37. In Japan, the Nikkei 225 rose 0.11% to close at 22,145.96, while the Topix index advanced 0.27% to end its trading day at 1,542.76.

Meanwhile, Australia’s S & P / ASX 200 rose 1.66% to close at 6,032.70. May’s trade surplus reached 8.025 billion Australian dollars ($ 5.55 billion) on a seasonally-adjusted basis, according to the country’s statistics office. That was below expectations for an A $ 9 billion trade surplus in a Reuters poll.

Overall, the ex-Japan MSCI Asia Index gained 1.61%.

“I think it is very interesting that even with yesterday’s events, of course, the Hang Seng market performs relatively better today,” said Ben Powell, chief investment strategist for Asia Pacific at BlackRock Investment Institute, Thursday at Tomorrow to CNBC on “Street Signs”. Singapore time

Powell said the market movements are testimony to the global “political revolution”, referring to drastic measures taken by authorities around the world to keep financial markets afloat as the pandemic strikes global economies.

“Even with the complexities of domestic politics, geopolitics, the virus itself that is still with us … this political revolution is helping financial markets to heal … in March and now continue to function quite well” Powell said. “We believe that taking a moderately risk-friendly stance remains correct … both globally and here in the region.”

Investors noted the reaction to a recent study of a coronavirus candidate developed by Pfizer and BioNTech that showed that the drug created neutralizing antibodies. The results, which were published online, have not yet been reviewed by a medical journal.

“We are cautious,” wrote Joseph Capurso, head of international economics at the Commonwealth Bank of Australia, in a note. “We have received positive news about possible vaccines in the past, but all have not yet seen widespread production and distribution.”

A senior World Health Organization official warned on Wednesday that certain countries may need to reimplant blockages. In the U.S., more than 12 states have paused or reversed their reopens after a recent spike in cases. Globally, more than 10 million people have been infected with the coronavirus and have taken at least 511,000 lives, according to data from Johns Hopkins University.

Looking ahead, the US Nonfarm Payroll Report will be released Thursday morning in the United States.

The US Dollar Index, which tracks the dollar against its peers’ basket, was at 97,034 after a previous high of 97.19.

The Japanese yen was trading at 107.54 per dollar after strengthening yesterday from around the 108 mark against the dollar. The Australian dollar was at $ 0.6922 after recovering from levels below $ 0.69 yesterday.

Oil prices rose on Asian trading hours Thursday afternoon, and international benchmark Brent crude oil futures rose 0.86% to $ 42.39 a barrel. US crude oil futures were 0.78% higher at $ 40.13 per barrel.

– CNBC’s Fred Imbert contributed to this report.

.